Author

Author

|

Topic: We're Fucked - The Coming Economic Crisis (Read 164975 times) |

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #120 on: 2009-08-13 01:18:42 » |

|

[MoEnzyme] I appreciate that we in the Church of the Virus noticed this collapse months or even a year or so before it happened depending on how you measure these things. Just to be honest, I don't really count myself in the "we" forecaster class except that I had nasty feelings of foreboding and I happened to be reading other people who had already focussed on such a probability. However like all economic issues, past realities are no gaurantee of future performance.

[Hermit]

Actually I predicted this on the CoV in 1999, repeated the warning in 2001 and pointed to this specific crash and the underlying reasons in December 2005 in the article, "Is the economy on a pharmaceutical that starts with a V and ends with a smile." I repeated the warning a number of times after that in multiple threads as the Cheney-Bush maladministration dismantled the American economy, especially on the demise of the M3 in an attempt to hide their excesses (e.g. [ Church of Virus, BBS, Mailing List, Virus 2006, Iran, Hermit, Reply #12 on: 2006-02-26] ).

As the Crash of 2008 is regarded as having happened on September 16, and this article was dated 2005-12-29, I think that we can claim a bit more than a year's lead. In fact, taking the 2005 date into account (the earliest easily accessible via the BBS), the lead time was 2 years, 8 months, 18 days.

When the US comes to a new accommodation with the reality that having sold its raw materials to China, that it will have to pay China prices set by the Chinese for access to raw materials, that by 2014 China will be a greater oil importer than the US, and that it makes very little the rest of the world would like to buy, and begins arranging its economics accordingly, I may begin to see some hope for a turnaround. Should it begin to invest in viable space energy systems - which like a national grid will require massive government backing - before it is too late, the transformation of its suburbs into something approaching sustainability and the management of its population in the recognition that the sustainable population of the US is around 200 million, I will see some grounds for optimism. Without these things there is no reason to forsee a technological singularity, only our eventual extinction, probably in a self inflicted or at least self assisted immolation.

Here is what I said in 2005-12-29 in an article read nearly 1600 times via the BBS.

[ Church of Virus BBS, Mailing List, Virus 2005, Is the economy on a pharmaceutical that starts with a V and ends with a smile ]

Did I evade your spam filters*? Good. Hopefully the rest will too.

I went to buy some electrical cable that at this time last year cost $109. This year the identical length of the identical product on an identical reel at the identical store costs $238. The cost of copper is responsible for only a small fraction of this difference. This is a "temporary aberration" and so is not included in the PPI or CPI. Of course, if you use copper cable in your products, you would do better to produce them outside the USA. And this is happening. Just ask GE or any transformer producer (and they might answer you honestly if not blaming medical or pension costs for forcing them to move offshore).

Steel, which doubled in price when Bush added illegally added protective tariffs to imports has increased in price now that the tariffs are gone - because the producers are now owned by the Chinese who apparently comprehend capitalist economics rather better than does Washington. This is a "temporary aberration" and so is not included in the PPI or CPI. Of course, if you use steel in your products, you would do better to produce them outside the USA. And this is happening. Just ask a vehicle or machinery producer (and they might answer you honestly if not blaming medical or pension costs for forcing them to move offshore).

Transport makes up 15% of the cost of all goods available in the US. Oil which makes up 70% or more of transport costs is up by a dollar a gallon. This is a "temporary aberration" and so is not included in the PPI or CPI. Of course, if you use oil - or transport to produce your goods, you have to buy the oil anyway - at any price. Which is perhaps why the oil companies are being congratulated by Washington on their record profits.

Roofing (which shares an oleaceous component with transport) which pre Katrina went for $170 a square is now running over $380 a square. Timber too (protected by Bush's present to the timber industry - anti-dumping tariffs levied on Canadian softwoods) is going through the roof as the US timber industry profits in the absence of effective competition. Of course, if you use roofing or timber in your products, as the building industry does, your prices will soar - as they are. Which is why nobody is talking about the value of new housing starts these days. But this is a "temporary aberration" and so is not included in the CPI any longer.

The cost of milk is moving faster than anything less than a Republican in search of illegal campaign contributions. I bought milk in Iowa at $2.70 three months ago. Now the same gallon bottle costs $3.80. In New Orleans it cost a dollar more. But this is a "temporary aberration" and so is not included in the CPI.

House House sales took an unexpected 2.7% dive in November. US 2 and 10 year yield curves are currently inverted. Meanwhile, AFP in a" story about what is described as the movie industry's "most disappointing year in nearly two decades" asserts that Hollywood is "in a deep existential crisis." "Is it the movies? Is it the ticket prices? Is it because home theater and DVD? I think because all this is happening at the same time, it is a combination of facts" whined Paul Dergarabedian of Exhibitor Relations Co's. The article makes it clear that the decline is apparent not only in box-office receipts, but also in the sale and rental of DVDs. Apparently many of the people who have invested large sums in home theater systems prefer to cocoon themselves at home, watching movies in the company of friends, but even this cohort is buying and renting fewer movies. It is probably only a matter of time before this is blamed on emule, limewire, bittorrent and friends (anything to avoid acknowledging that the films on offer were largely pretty crappy), although I notice that had my 1998 suggestion of a "tax" of a few dollars per 64k of broadband connection been adopted (along with "free" public distribution of media by the Library of Congress), that the amount raised by such a tax at the proposed rates in the USA alone, assuming no significant change in broadband adoption, would have exceeded all other income made by the entire entertainment industry this year. But while related, this is a side issue. More centrally, the story claims, "Hollywood [also] faces a major external threat: runaway production costs and the growing trend of movie producers to shoot in places such as Canada, Australia and New Zealand to cash in on much lower staff and production charges." Poor Hollywood! No, not really. Those moving have powerful economic and artistic reasons for the move. Or they once had. Moving abroad isn't as low-a-cost-option as it once was either. While profligate investors, irresponsible producers, and squandering directors all have played a part in ensuring rising production costs, I suggest that the other important variable here is the relentless decline in the purchasing power of the inflated dollar. After all, many directors who have taken production abroad to Canada, Mexico, New Zealand, and other more frugal locations to make their movies still roll up production costs in excess of $100 million (US). Given such up-front costs, a box-office yield of $200 million or more, achieved by only a handful of films, isn't particularly impressive.

I suggest that far from the issues raised by the article, box office takings merely foreshadowed this year's rather sad retail experience. Having had their expectations of strong Thanksgiving sales squished into the slush, having been forced to acknowledge that the pre christmas sales were "below expectations", and now having realised that the "tween" sales postulated by breathless pundits are simply not going to happen, retailers are pinning their hopes on the anticipation of "strong post-Christmas clearance sales" to "salvage" a "very disappointing Holiday".

I think they are in for yet more disappointment. I suspect all the above reflects a perfectly understandable and long predicted development. People are spending less on entertainment simply because, except for those southerners randomly blessed by the insurance industry, people have less money to spend – or to express exactly the same thought in a much scarier way, they've used up all the credit that even the crazy American credit system is prepared to offer. This is evidently seen as good news in some quarters. As reported in the New York Times, those who hurried to file bankruptcy before the new law went into effect in mid-October are already being barraged with new credit card offers - for humanitarian reasons of course. Ellen Schloemer of the Center for Responsible Lending explained how it works, "The whole business model of the credit card industry is built around outstanding debt. This is the only industry that calls people deadbeats when they pay all their bills every month." Unfortunately, this is getting much harder to achieve. As the Economic Policy Institute notes, contrary to the consumptive song of Washington, inflation-adjusted wages are down, living expenses continue to rise, and American households are mired in ever-deepening debt.

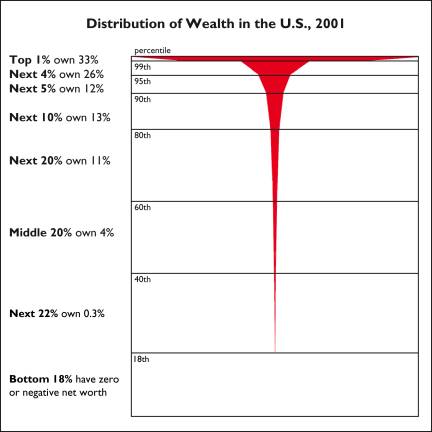

Did I mention "inflation"? Officially annual US inflation at 2.5% is right on target in our booming economy full of record profits. Of course, the inflation rate calculations, like those for the M2 ,have been changed on a moment by moment basis this year (and next year the M2 is to be removed from public view), such that it is impossible to draw any meaningful comparisons of published inflation data with previous numbers - but where we at least know that changes in the price of food and fuel are no longer included in the indices - as they are suffering from "temporary aberrations" in values (which might perhaps more properly be ascribed to the American people that voted for Bush** as they shared their minuscule slice of paradise*** in the graph that deserves a place in prominence in every place where mathematically literate people still comprehend such a presentation).

Source: Inequality.org, Edward N. Wolff, "Changes in Household Wealth in the 1980s and 1990s in the U.S.", Jerome Levy Economics Institute, May, 2004.

Anyway, the critical point I meant to make in all this (inflation data, retail sales, consumer credit crunch, property down turn, US yield curve inversion, etc) is that if you have any market or dollar denominated values that you can move into anything else, the half-day trading on Friday would, I suggest, be a really good time to be moving in to hard assets and currency hedges. Should the indicators prove to be only a market glitch, you might take a cold at worst. Should it be a precursor to worse; as it may well be; you will hopefully avoid pneumonia.

Hermit

*Consider the alluded word which is not a part of the topic or content in order to avoid the beyeing of filters everywhere :-)

**"The larger the mob, the harder the test. In small areas, before small electorates, a first-rate man occasionally fights his way through, carrying even the mob with him by force of his personality. But when the field is nationwide, and the fight must be waged chiefly at second and third hand, and the force of personality cannot so readily make itself felt, then all the odds are on the man who is, intrinsically, the most devious and mediocre — the man who can most easily adeptly disperse the notion that his mind is a virtual vacuum."

"The Presidency tends, year by year, to go to such men. As democracy is perfected, the office represents, more and more closely, the inner soul of the people. We move toward a lofty ideal. On some great and glorious day the plain folks of the land will reach their heart's desire at last, and the White House will be adorned by a downright moron."

HL Mencken originally in "Bayard vs. Lionheart" in the Baltimore Evening Sun, 1920-07-26, reprinted in "On Politics: A Carnival of Buncombe"

***In 2001, according to NYU economist Edward Wolff, the richest five percent of American households controlled over 59 percent of the country’s wealth; the richest 20 percent held 83 percent of the wealth; the bottom 80 percent had 17 percent; and the bottom 40 percent just 0.3 percent.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.06

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #121 on: 2009-08-15 01:47:36 » |

|

[Blunderov] Umm. Just for clarity, I did not mean to imply (when I said " ...all that is left to us") that anyone here was/is an 'economist' per se. The accurate prediction of future events which were made by Hermit, Mo et al in this thread are more accurately to be ascribed to philosophical sophistication rather than economic training in my view. Of course the two fields do overlap sometimes...

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #122 on: 2009-08-21 15:02:17 » |

|

Recovery… What Recovery?

Source: Gains, Pains & Capital

Authors: Graham Summers

Dated: 2009-08-21

Long time readers know that I don’t buy the claims of economic “recovery” in the slightest. Often times I see folks on CNBC asking, “when will things get back to how they were?” The simple answer is…

NEVER.

The US has entered a New Normal… a new economic climate… and it is one dominated by:- Higher consumer savings

- Lower consumer spending

- Rising unemployment

- Lower corporate profits

- Increased Government spending/ transfer

- Reduced private sector growth

- Excess capacity

- Reduced production

- Excess bank reserves

- Reduced lending

This is, in a nutshell, a bleak economic picture. It is, however, reality. I know the media is now rife with folks predicting the end of the Recession. I even know “smart” analysts who are saying the same at independent research firms.

In terms of the REAL economic picture, these folks are completely misguided and wrong. The US is facing the worst economic contraction since the Great Depression. This is NOT a plain vanilla recession. And while stocks may (and I emphasize that word) have staged their major bottoms in March, the US economy has yet to remotely turn around.

Consider that:- 34 million Americans are on food stamps

- 18% of incomes coming from an already broke government

- Seven million people will run out of unemployment insurance by Christmas (add their families and you have 13 million folks becoming destitute)

- Tax receipts are at their lowest levels since 1932

- 32 states have budget problems ($121 billion in total deficits) and the Federal Government is running a $2 trillion deficit

- Civil unrest growing: National Guard May Be Called to Alabama

- Industrial capacity for May ’09 was 68%: an ALL TIME low (roughly 1/3 of our plants and production facilities are doing nothing at all).

- Rail carload volume for 1H09 is down 19% from the already plunging level of 1H08.

- Even after laying off people and cutting costs, Quarter over Quarter Corporate Revenues and Profits fell 17% and 33% respectively in 2Q09.

Hard to get the word “recovery” out of the above. However, economics is a dark art, and in the hands of a deft accountant, you can dream up all kinds of nonsense, including a positive GDP… which we are likely to get in 3Q09.

However, with the Feds even openly acknowledging that their GDP findings are wrong (see the numerous revisions to the downside over the last year), this will be largely meaningless to anyone outside of the DC beltway.

On that note, the next time you see or hear anyone proclaiming that the recession is over, feel free to forward them the above list of data points and ask for their explanation as to how those items spell recovery.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #123 on: 2009-08-26 16:04:05 » |

|

New Study Exposes 2007 as the Year of the Super-Rich

Too Much: A Commentary on Excess and Inequality.

Source: Alternet.org

Authors: Sam Pizzigati

Dated: 2009-08-18 | It's a Mugging: Our National Wealth Is Getting Handed Over to the Bloated Rich

Inequality expert Chuck Collins argues we're in America's second Gilded Age.

Source: Alternet.org

Authors: Mark Karlin

Dated: 2009-04-16 |

In 2007, the year before the Great Recession began, America's super rich partied — as never before. The evidence? We look at the year's freshly crunched income numbers.

Emmanuel Saez, the Berkeley economist who many now consider the world’s top authority on the incomes of the super rich, has never been one for sweeping statements. He tends to let his data do the talking. But his latest data — from the crunching of just-released IRS tax records for 2007 — have wowed even Saez.

America’s most affluent, those data show, have never grabbed a greater share of the nation’s income than they did in 2007. The nation’s top .01 percent of income-earners in 2007 — taxpayers who made over $11.5 million — pulled in 6.04 percent of all income, the highest top .01 percent share of the nation’s income since the IRS started keeping records back in 1913.

The year 2007, a rather awestruck Saez noted earlier this month, “was an incredibly good year for the super rich.”

The 14,588 families who made up 2007’s top .01 percent averaged $35,042,705 in income, 1,080 times the $32,421 average income of America’s bottom 90 percent. The gap between the top .01 percent and the bottom 90 percent, before 2007, had never stretched over 1,000 times.

Was 2007 the most unequal, top-heavy year in American history? That depends on how you define the top. If you’re looking at only the tippy-top of the income distribution — families in the richest tenth or hundredth of 1 percent — 2007 “wins” the inequality honors hands down.

But if you define rich a bit more broadly, as the top 1 percent, the rich of 2007 don’t quite match the sticky fingers of their awesomely affluent counterparts back in the late 1920s. [ Hermit : What the author does not say is that the wealthy of today have far more opportunities to avoid taxes and especially to offshore income completely skewing the picture. Bear in mind that income distribution is only one part of the puzzle, and is far less biased than wealth distribution. For perspective, even as the United States agricultural, industrial and manufacturing base has been eviscerated, and its financial system collapsed, 90% of the world's wealth has migrated to the United States and 80% of that wealth has ended up in the hands of 10% of the population of the USA. Refer http://extremeinequality.org ]

In 1928, the last full year before the Great Depression, America’s most affluent 1 percent took in 23.94 percent of the nation’s income. The comparable figure for 2007's top 1 percent: 23.5 percent.

Those 1928 wealthy would see their share of the nation’s income drop sharply as the Depression deepened. Economic shocks to the system, as Berkeley's Emmanuel Saez notes, almost always cost the rich income share, since profits from businesses and stock market wheeling and dealing tend to “fall faster than average income” during economic downturns.

But what happens next can vary enormously. After the Great Depression, the super rich share of America’s income stayed down — for over a generation. The quarter of the nation’s income that the top 1 percent collected in 1928 actually shrank all the way down to 10 percent in the early 1950s and didn’t start rising appreciably again until after Ronald Reagan’s 1980 election.

After the recession early in the 1990s and the downturn in the early 2000s, a totally different story. The super rich income share did dip after each of these recessions, but only momentarily.

Why did the super rich share of the nation's income go down and stay down after the Great Depression and come right back up after the recessions of recent years?

No mystery here. During the 1930s and early 1940s, as Saez points out, the New Deal put in place financial regulations and progressive tax rates that prevented “income concentration from bouncing back.” In the 1990s, by contrast, Congress and the White House deregulated financial markets. In the 2000s, the two joined to cut taxes on the rich.

So what will happen after our current Great Recession ends? That remains the $64,000 question of our time. In the 1980s, we let market fundamentalists dismantle a huge chunk of the New Deal legacy. The institutions that had kept America's super rich less than super — most notably, progressive taxation and strong trade unions — begin to go by the wayside.

In their place came the record inequality that the new Saez figures so dramatically document — and, over the last year, the worst economic times that Americans under 70 have ever seen.

“We need to decide as a society whether this increase in income inequality is efficient and acceptable,” says Emmanuel Saez, reverting back to his customary eminently sober academic tone, “and, if not, what mix of institutional reforms should be developed to counter it.”

The rest of us can’t afford to be so understated. Those reforms, starting with higher progressive tax rates on high incomes, can’t begin too soon.

|

Tax responsibilities have shifted off of large wealth holders and onto wage earners, off corporations and onto individuals, off the progressive federal tax system and onto state and local tax systems, which tend to be more regressive. Tax cuts for the rich have shrunk federal services -- and shifted responsibilities to states for health, anti-poverty, transportation and more. That's the shaft part. Chuck Collins, senior scholar at the Institute for Policy Studies and director of the Program on Inequality and the Common Good.

* * *

On April 15, the Mad Hatters of the Teabagging Party protested that the extreme income redistribution over the last 30 years continue unabated so that the super-rich become even richer as America's middle class sinks into oblivion.

There's been a class war going on since Ronald Reagan was elected, and it's been a war on the working class as the average wage earner got mugged by the largest shift of wealth to the rich in American history. BuzzFlash interviewed Chuck Collins on the income redistribution scam that has been pulled off in full view of the American public, fattening the wallets of the already financially engorged fat cats.

* * *

Mark Karlin: Can you explain what the Working Group on Extreme Inequality is and its relationship to the Institute for Policy Studies?

Chuck Collins: The Working Group was formed by a group of labor, religious and civic leaders with the goal of advancing the discussion about the dangers of extreme inequality to our economy, health, democracy and civic life. The institute helps staff the Working Group through the Program on Inequality and the Common Good. Our original work was to dramatize that "inequality matters" -- that these inequalities have undermined the quality of life for everyone.

With the economic meltdown, we've all gotten a "crash course" in how extreme inequality is bad for the economy. With wages stagnant for three decades, most working families have survived by working more hours and borrowing on credit cards and against home values, if they are fortunate enough to own one. The consumption of the bottom 70 percent of U.S. households has been based on debt -- not on real wage growth.

Meanwhile, wealth has dramatically concentrated at the top of the pyramid. The super rich in the top 1 percent put massive amounts of this wealth into the speculative casino economy -- which helped wreck the economy. In our view, extreme inequalities contributed to the economic collapse.

MK: You have a section on your Web site Extreme Inequality titled "How Unequal are We?" Well, how economically unequal have we become?

CC: We've become dangerously unequal as wealth has concentrated in very few hands. The top 1 percent has over 34 percent of all private wealth -- more than the bottom 95 percent of the population combined. In the mid-1970s, this wealthiest 1 percent had less than 20 percent of private wealth. This is a dramatic shift in a short time. We're in America's "Second Gilded Age."

This matters because wealth is power -- the power to shape the culture, to distort elections and shape government policy. A plutocracy is a rule by wealth -- and more and more, the priorities of the society are shaped by the interests of organized wealth.

We have a downloadable chart pack that has very up-to-date materials on income, wage and wealth inequality.

Better yet, we did a short video called The Sound of Inequality, which is an audio illustration of the wealth gap using black beans in a soup pot.

MK: Does your blood boil when the right-wing corporatists use "redistribution of income" as a pejorative associated with "socialism" when they have been redistributing income to the wealthy for decades?

CC: It is boiling, especially around April 15 tax day. It is a fantastic deflection. For 30 years, right-wingers have pushed for policy rule changes in the economy (trade, taxes, government spending, deregulation) that have fueled a radical redistribution of wealth from the bottom and middle of society -- to the tippy top. It's been a Robin Hood in reverse.

When President [Barack] Obama proposes to raise the top income tax rate from 35 percent to 39.6 percent, they call him a "socialist." Imagine, a 4.6 percent hike in taxes could tip us into a totalitarian socialist state.

What would these right-wing extremists call Republican President Dwight Eisenhower, who presided over a top tax rate of 91 percent on the ultra rich?

The forces of organized selfishness will reflexively object to any tax, but most of the population recognizes that the price of a healthy and good society is a fair tax system and healthy communities without grotesque inequality.

MK: Your Web site discusses some of the racial dimensions of economic inequality. Can you give us a summary?

CC: If we examine these wealth disparities through the lens of race, we get another important part of the story. The legacy of racial discrimination is imprinted on today's wealth and assets ownership patterns. This historical legacy is different for each racial group, but the basic story is about systematic barriers to homeownership and wealth accumulation for people of color.

How else can we explain that the percentage of blacks, Latinos and whites who own their home is 47, 49.7 and 75 percent, respectively? And that the median net worth for an African American household ($20,600) is only 14.6 percent of the median wealth for a white household ($140,700)?

Racial discrimination in housing loans after World War II means that, two generations later, we still have very uneven wealth and asset ownership. Even before the economic crisis blew open in September 2008, tens of billions of wealth owned by people of color had vanished in the subprime [mortgage] scam.

My co-worker Dedrick Muhammad is an expert on this. You can learn a lot from being a fan of his "Bridging the Racial Wealth Divide" work on Facebook.

MK: What about hidden taxes for people who aren't rich? When we cut taxes for the rich, all of us end up paying higher fees for what were formerly free public services. For example, in Chicago, the parking meters were just privatized, and the costs for drivers skyrocketed. While we keep reducing taxes for the wealthy, the public services are still needed, so we end up paying for them through privatization and increased fees.

CC: Great example of the parking meters. I recently was asked to pitch in to buy a new chair for my daughter's public school. And here I thought that's what my taxes were for!

When you get nickel-and-dimed for services that used to be public -- or watch public services get slashed -- or have to wait longer in line or on telephone hold -- I want you to repeat this mantra: "Stop the Shrink, Shift and Shaft."

It is important to step back and see the dramatic tax shifts that have taken place over the last several decades. The neo-cons worked to shrink certain parts of government -- the parts that help non-wealthy people have decent lives and economic opportunity.

Remember anti-tax activist Grover Norquist's stated goal: "I want to shrink government to the size where we can drown it in a bathtub."

Tax responsibilities have shifted off of large wealth holders and onto wage earners, off corporations and onto individuals, off the progressive federal tax system and onto state and local tax systems, which tend to be more regressive.

Tax cuts for the rich have shrunk federal services -- and shifted responsibilities to states for health, anti-poverty, transportation and more. That's the shaft part.

The result is a weakened regulatory state -- which, by the way, was the goal of the neo-con anti-tax, anti-government activists. So speculators boost up housing or oil prices -- and we all pay more. It's a form of taxation -- although the money goes to speculators. With the lack of strong government oversight, we all end up paying more to private corporations and speculators.

One challenge is this happens in slow motion, and we adjust our expectations. But there was a time when working-class students used to get grants to help with college expenses. There was a time when there were homebuyer assistance programs that didn't require you to work through a predatory lender.

MK: Your group just released a report, "Reversing the Great Tax Shift: Seven Steps to Finance Our Economic Recovery Fairly." Can you share some of the highlights?

CC: We offer some very concrete examples of the tax shifts I just mentioned. For instance:

In 1955, when the U.S. first instituted tax day, America's top 400 taxpayers paid three times more of their income in taxes than the top 400 of 2006, the most recent year with IRS data available. If these 400 ultra-rich folks had paid 1955 tax rates, the federal treasury would have collected $35.9 billion more in revenue in 2006. [ Hermit : As the next column shows, 2007 data has just become available. It is important to note that it is not only the much lower tax rates but the vast number of tax avoidance strategies available to the wealthy that have distorted this picture. ]

Our report found that the 139,000 U.S. taxpayers who made over $2 million in 2006 averaged $5.9 million in income. They paid an effective tax rate of 23.21 percent, compared to 49 percent effective rate that those of equivalent income paid in 1955.

If these individuals had paid taxes at the same rate as their 1955 counterparts, the federal treasury would have collected, in 2006, an additional $202 billion. That's enough money to send massive aid to the states and make more overdue investments in transforming our economy to be more sustainable.

The main part of our report identifies seven tax proposals to reverse the tax shift and raise $450 billion in revenue from the wealthy and global corporations that are playing games with the tax system.

For instance, we propose that income from wealth (capital gains and dividends) should be taxed the same as income from work and wages. That reform would generate $80 billion in revenue. [ Hermit : My proposed Transaction Tax with an Alternative Minimum Capital Tax would address this more effectively and a lot less painfully. ]

When someone asks "where will the money come from," this is our answer.

MK: Can you compare the U.S. tax policy toward the rich to some other nations?

CC: The U.S. has among the lowest tax rates for an advanced industrial economy.

MK: How come so many salaries and bonuses for CEOs have grown to such enormous amounts, regardless -- in many cases -- of their performance on the job?

CC: The problem of runaway CEO pay has been alarming for 20 years. In 1980, the gap between highest and average paid workers in a company was about 42 to 1. Today, it is over 300 to 1.

Excessive pay to top managers promotes a very short-term outlook, encouraging CEOs to do whatever it takes to boost their share price for the next quarter. It provides a disincentive for long-term company health and growth.

Wall Street's culture of greed has wrecked our economy. Most ordinary taxpayers don't know we subsidize excessive pay by allowing corporations to deduct bloated pay packages.

Our group supports legislation to limit the deductibility of excessive CEO pay, such as the Income Equity Act introduced by Rep. Barbara Lee, D-Calif.

MK: How can individual Americans concerned about economic justice take action?

CC: In the next two years, there will be many opportunities to push back against the economic policies that worsened inequality. We have a president who understands the corrosive impact of inequality on people and communities.

Folks should sign up for action alerts at extremeinequality.org. We send out a monthly roundup of timely actions and activities.

MK: Are you optimistic that we will be moving toward economic justice in the coming years?

CC: Yes. There is a growing mobilized sector of society that wants a healthy and fair economy. We've seen the disaster of an economy organized around funneling wealth to the top. We all have a stake in an economy that works for everyone, not just the wealthy.

Some positive signs of the times: Some wealthy folks and business leaders agree that things are out of balance. Business for Shared Prosperity was formed to mobilize business leaders to support increases in the minimum wage.

The newly formed Wealth for the Common Good brings together wealthy individuals and business leaders to support rebalancing the tax system.

Also, please visit Chuck's tremendous site, Extreme Inequality.The truth about economic injustice will set you free from propaganda, bought and paid for by the wealthy, on taxes. |

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #124 on: 2009-08-31 12:05:09 » |

|

The Fed's Big Banking Risk

Source: thebigmoney.com

Authors: Bernhard Warner, Matthew Yeomans

Dated: 2009-08-31

Last week's headlines were dominated by talk of better economic times, but this morning's Wall Street Journal highlights just how big a risk the federal government is taking to shore up the U.S. financial sector. It reports that the FDIC is assuming most of the risk on nearly $80 billion in loans and other assets as it encourages a handful of healthy banks to help clean up the toxic banking environment through a series of takeovers and consolidations. As the FDIC moves into an aggressive "clean up mode," the agency's total exposure "is about six times the amount remaining in its fund that guarantees consumers' deposits," a huge potential risk for taxpayers. But with high risk comes the opportunity of high rewards. The New York Times reports that the federal government has made a $4 billion profit in interest payments from just eight of the biggest banks that have fully repaid their obligations under the emergency Troubled Assets Relief Program. So far, the government has taken profits of about $1.4 billion on its investment in Goldman Sachs (GS), $1.3 billion on Morgan Stanley (MS), $414 million on American Express (AXP) , and some $334 million from five other bailout investments. According to the Financial Times, the Federal Reserve has made a $14 billion profit on its various loan and bailout deals since the start of the crisis two years ago. "The central bank earned about $19bn in income from charging interest and fees to financial institutions and investors that tapped the new facilities to obtain much-needed funds during the turmoil. The interest the Fed would have earned by investing the same amount in T-bills was an estimated $5bn, leaving a $14bn gain since August 2007," it writes. [ Hermit : This needs to be put in perspective. The Fed has assumed an estimated 24 T$ (before interest) of risk to obtain this "return" and the banks and other organizations mentioned here have paid out ten times more or about 32.6 G$ in bonuses (infra) as they paid a little under 3.5 G$ to the Federal Reserve - and lent almost nothing to anyone else which was supposed to be the point of the exercise. Can you spell Gigafail? ]

It may just be one of the wackiest political alliances of the year. House Financial Services Committee chairman Barney Frank and the Libertarian-leaning, outspoken, small-government crusader and Texas Republican Ron Paul appear to be teaming up on a plan to limit the powers of the Federal Reserve. Paul, the notorious Fed-basher, told the WSJ he has Frank's word "to advance the Texas Republican's legislation opening the Federal Reserve to broader federal audits." The way the bill is now written up, the Government Accountability Office, the investigative arm of Congress, would audit the Fed's monetary-policy operations. Paul, of course, ran a dark-horse campaign for president last year, advocating the eventual elimination of the central bank. It took a financial crisis of this kind to get more support for his ideas. "Barney told me, 'It's going to come. You're going to get what you want,'" Mr. Paul told the Journal. "We're going to have some hearings and we'll get a vote." According to Reuters, the Fed audit proposal would be incorporated "in broader legislation to revamp U.S. financial regulation that would likely pass the House in October."

The stock market's summer party may be over, according to a NYT story saying that some analysts are predicting a "sharp pullback" in stocks. Shares are up more than 15 percent since mid-July, part a prolonged rally following the market's historic slump this winter, but September is a notoriously bad month for Wall Street, and now the smart money may be voting with its feet. “The people who know are getting out early,” Art Cashin, the director of floor operations at UBS, tells the NYT. “This rally’s a little long in the tooth.”

<snip section on ebooks>

Banks Paid $32.6 Billion in Bonuses Amid U.S. Bailout (Update4)

Source: bloomberg.com

Authors: Karen Freifeld

Dated: 2009-07-30

Citigroup Inc., Merrill Lynch & Co. and seven other U.S. banks paid $32.6 billion in bonuses in 2008 while receiving $175 billion in taxpayer funds, according to a report by New York Attorney General Andrew Cuomo.

Cuomo analyzed 2008 bonuses at nine banks that received Trouble Asset Relief Program financing from the U.S. government. New York-based Citigroup and Merrill, which has since been taken over by Bank of America Corp., received TARP funding totaling $55 billion, Cuomo said.

“When the banks did well, their employees were paid well. When the banks did poorly, their employees were paid well,” Cuomo’s office said in the 22-page report. “When the banks did very poorly, they were bailed out by taxpayers and their employees were still paid well. Bonuses and overall compensation did not vary significantly as profits diminished.”

The study, called “No Rhyme or Reason: The ‘Heads I Win, Tails You Lose’ Bank Bonus Culture,” comes as Congress and the Securities and Exchange Commission examine whether to limit the compensation paid to top corporate executives.

“One senior bank executive noted recently that individual compensation should not be set without taking into strong consideration the performance of the business unit and the overall firm,” according to the Cuomo report.

Upside, Downside

“As this executive put it, ‘employees should share in the upside when overall performance is strong and they should all share in the downside when overall performance is weak.” But despite such claims, one thing is clear from this investigation to date: there is no clear rhyme or reason to the way banks compensate and reward their employees,” the report said.

Wall Street firms’ pay has traditionally been tied closely to performance of the companies, which is why employees receive most of their compensation at the end of the year after final results are known. Depending on seniority and performance, bonuses for traders, bankers and executives can be a multiple of their salaries, which range from about $80,000 to $600,000.

Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co. paid out a total of $18 billion in bonuses in 2008 while receiving a combined total of $45 billion in taxpayer dollars through TARP. Together, the three firms earned $9.6 billion last year, Cuomo said. [ Hermit : Note that the tax payer funded bonuses were about double the profits. This is perfectly in line with the limits where players determine it is not worth investing as determined game theory. ]

Top Recipients

The top 200 bonus recipients at JPMorgan Chase & Co. received $1.12 billion last year, while the top 200 at Goldman received $995 million. At Merrill the top 149 received $858 million and at Morgan Stanley, the top 101 received $577 million. Those 650 people received a combined $3.55 billion, or an average of $5.46 million.

JPMorgan Chase had 1,626 employees who received a bonus of least $1 million last year, more than any other Wall Street firm, according to the report. Goldman Sachs had 953 employees who received $1 million or more in bonuses, while Citigroup Inc. had 738, Merrill Lynch & Co., 696, and Morgan Stanley, 428. Bank of America Corp. had 172, while Wells Fargo & Co. had 62. [ Hermit : It is lovely when most of the regulators are drawn from amidst your ranks. ]

Kristin Lemkau, a spokeswoman for JPMorgan Chase, Mark Lake, a spokesman at Morgan Stanley, Jeep Bryant, a spokesman for Bank of New York Mellon, and Michael DuVally, a spokesman at Goldman Sachs, all in New York, declined to comment. Carolyn Cichon, a spokeswoman for State Street, and Citigroup spokesman Stephen Cohen didn’t immediately return a call for comment.

Pay for Performance

Melissa Murray, a spokeswoman for Wells Fargo, declined comment on the report itself. She said the company has a “pay- for-performance” culture where staff are compensated on individual and business performance. “We implemented a say on pay policy this year and our shareholders approved the compensation of the Company’s named executives,” she said.

Citigroup and Merrill Lynch suffered losses of more than $27 billion at each firm, the report said. Yet Citigroup paid out $5.33 billion and Merrill $3.6 billion in bonuses.

“We have put forth guidelines to better link pay to long term performance and effective risk management,” said Travis Larson, a spokesman for the Washington-based Securities Industry and Financial Markets Association. “That includes the ability to recover bonuses from employees if those bonuses turn out later to be improper.” The industry association put out its guidelines in June and member firms are working to incorporate them, he said.

Wall Street Pay

The report shows the more bonus-laden compensation styles of the four major Wall Street banks compared with retail banks such as Wells Fargo & Co. and Bank of America that employ far more people whose main compensation is typically salaries.

Bonuses averaged $160,420 for Goldman Sachs’s 30,067 employees, compared with $13,580 at Bank of America, employer of 243,000 people, the report said. Bonuses averaged $95,286 per employee at Morgan Stanley, $61,017 at Merrill Lynch and $38,642 at JPMorgan Chase & Co., which operates large retail and investment banking units.

At Wells Fargo, the fourth largest bank holding company after acquiring Wachovia Corp. last year, bonuses averaged $3,479 for the company’s 281,000 workers, according to the report.

Goldman produced the most in earnings per employee -- $77,228. In contrast, Merrill had the worst revenue performance, losing $467,797 per employee in 2008 while handing out an average bonus of $61,017, the third highest payout, the report said.

“The data that the attorney general has extracted is far more granular and detailed than anything that we might get from financial filings from these firms, so it’s extremely interesting in that respect,” said Paul Hodgson, a senior research associate for executive compensation at The Corporate Library in Portland, Maine. “The SEC may have a stronger platform to argue for disclosure of compensation for employees that earn in excess of a certain amount.”

TARP Pay-Back

Goldman and Morgan Stanley, credit-card lender American Express and custody banks State Street Corp., Bank of New York Mellon Corp. and Northern Trust Corp. paid back a combined $30 billion in TARP funds on June 17, in a step toward eliminating government restrictions on lending and compensation. JPMorgan Chase paid back $25 billion. [ Hermit : Or why these amounts were paid back so rapidly even though the banks were not and are not lending money to anyone that needs it and while foreclosures continue apace but mortgage adjustments remain below 1% of of those at risk even where their mortgagees are still paying substantially above prime. ]

The U.S. House Financial Services Committee, led by Massachusetts Democrat Barney Frank, approved legislation two days ago that would let regulators ban incentive pay at banks and give shareholders a vote on bonuses in response to public outrage over Wall Street pay.

Egregious Behavior

The bill, which needs approval from the House and Senate, would allow banking agencies and the Securities and Exchange Commission to bar compensation practices that push financial companies to take “inappropriate risks.”

Frank said today in a telephone interview that the House tomorrow will consider his legislation to allow shareholders to hold an annual, non-binding vote on executive pay and require regulators to set pay restrictions that prevent excessive risk taking.

“Attorney General Cuomo’s report on executive pay at companies receiving taxpayer bailouts is shocking and appalling,” said House Committee on Oversight and Government Reform Chairman Edolphus Towns, a Democrat from New York. “Companies that only months ago were facing bankruptcy and sought the help of the Federal government are now paying out billions in compensation -- and in some cases without reimbursing taxpayers. This egregious behavior proves that Wall Street still doesn’t get that times have changed and the old way of paying executives is long gone.”

Part of Their Lives

Towns said in a letter to Cuomo that he would hold a hearing after the August recess to examine the Obama administration’s reforms in pay practices at companies that received TARP funds.

In October, industry veterans including John Gutfreund, president of New York-based Gutfreund & Co. and the former chief executive officer of Salomon Brothers Inc., said Wall Street would insist on paying bonuses in the face of the worst financial crisis since the Great Depression, a taxpayer bailout and mounting political outcry.

Odds that Wall Street will forgo the payouts are “slim to none,” Gutfreund said in October. “They’re going to have to be a little bit sensitive because politicians, whether they like it or not, are part of their lives now.”

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #125 on: 2009-09-04 13:23:10 » |

|

Unemployment Rate Hits 9.7 Percent As Economy Sheds 216,000 Jobs In August

Source: Huffingtonpost.com

Authors: Arthur Delaney

Dated: 2009-09-04

The national unemployment rate rose to 9.7 percent -- the highest level since June 1983 -- as the U.S. economy shed 216,000 jobs in August, the government announced on Friday morning. That's up from 9.4 percent in July.

By a broader measure that includes forced part-timers and people who'd like to work but aren't looking, the national unemployment rate reached 16.8 percent -- up a staggering 6 percent from this time last year.

The pace of job cuts has steadily slowed since the beginning of the year, when monthly losses exceeded 700,000 in January.

The total number of unemployed is 14.9 million, roughly double the number at the start of the recession in December 2007. [ Hermit : At about 2.3 people per wage earner, this represents in excess of 30 million people. ]

The number of long-term unemployed, those out of work 27 weeks or longer, edged up only slightly in August, from 4.96 million to 4.98 million. At the end of the year, nearly 1.5 million of those people will exhaust their extended unemployment insurance unless the government takes action to further extend their benefits.

And the picture isn't so great for people who are working, either. A report released this morning by the Economic Policy Institute concludes that many workers who have not lost their jobs during the recession have nevertheless taken a hit as a result of sluggish wage growth, reduced hours and involuntary furloughs. Private sector wages have grown at a rate of 1.3 percent over the last six months, less than half as fast as wage growth during 2007 and the first six months of 2008.

"It's an implosion of wage growth far beyond what you would expect" in an ordinary recession, said EPI's Larry Mishel, co-author of the report, in a conference call with reporters. Average wages rose 6 cents in August, according to the Department of Labor.

Other economic indicators this week brought better news. Retail sales fell 2 percent in August from a year earlier, the smallest drop since September 2008. And the Washington Post on Monday reported positive signs in the Men's Underwear Index, the metric reportedly favored by former Federal Reserve Chairman Alan Greenspan. (The MUI outlook was less positive in April.)

Asked for his thoughts on the MUI, Mishel scoffed. "If Alan Greenspan were so wise, we wouldn't be in this mess," he said.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #126 on: 2009-09-08 18:59:46 » |

|

Swiss topple U.S. as most competitive economy: WEF

Source: Reuters

Authors: Not Credited

Dated: 2009-09-08

Refer Also: The Global Competitiveness Report 2009-2010

Switzerland knocked the United States off the position as the world's most competitive economy as the crash of the U.S. banking system left it more exposed to some long-standing weaknesses, a report said on Tuesday.

The World Economic Forum's global competitiveness report 2009/2010 showed economies with a large focus on financial services such as the U.S., Britain or Iceland were the losers of the crisis.

The U.S. as the world's largest economy lost last year's strong lead, slipping to number two for the first time since the introduction of the index in its current form in 2004.

"We have been expecting for some time that it may lose its top-position. There are a number of imbalances that have been building up," said Jennifer Blanke, Head of the WEF's Global Competitiveness Network.

"There are problems on the financial market that we were not aware of before. These countries (like the U.S. and Britain) are getting penalized now," she said.

Trust in Swiss banks also declined. But in the assessment of banks' soundness, the Alpine country still ranked 44th. U.S. banks fell to 108 -- right behind Tanzania -- and British banks to 126 in the ranking, now topped by Canada's banks. [ Hermit : Again I say, if you live in the USA, please keep at least enough money to live on for a month at hand. It looks more and more as if there will be a crash in the very near future (September 29 anyone?) and Bernanke, being a student of 1929, is almost certain to declare a 30 day bank holiday when it happens. ]

The WEF bases its assessment on a range of factors, key for any country to prosper. The index includes economic data such as growth but also health data or the number of internet users.

The study also factors in a survey among business leaders, assessing for example the government's efficiency or the flexibility of the labor market.

The WEF applauded Switzerland for its capacity to innovate, sophisticated business culture, effective public services, excellent infrastructure and well-functioning goods markets.

The Swiss economy dipped into recession last year, too and had to bail out its largest bank UBS. But its economy is holding up better than many peers and most banks are relatively unscathed by the crisis, which drove U.S. banks into bankruptcy.

The WEF said the U.S. economy was still extremely productive [ Hermit : This is outdated. 60% of the US manufacturing capacity is now idle. ] but a number of escalating weaknesses were taking its toll.

Concerns were growing about the government's ability to maintain distance to the private sector and doubts rose about the quality of firms' auditing and reporting standards, it said.

BRAZIL LEAPS

Leading emerging markets Brazil, India and China improved their competitiveness despite the crisis, the report showed.

But Russia saw one of the steepest declines among the 133 countries assessed, falling back 12 places to 63, as worries about government efficiency and judicial independence rose, the WEF said.

After years of rapid improvement, which took it to place 29, China now had to tackle shortcomings in areas such as financial markets, technological readiness and education as it could no longer rely on cheap labor alone to generate growth.

India, ranked 49th, was in turn well positioned in complex fields such as innovation but had still to catch up on basics such as health or infrastructure, the WEF said.

Brazil leapt by 8 ranks to 56th, as measures to improve fiscal sustainability and to liberalize and open the economy showed effects, the report said.

Among the top-ten, Singapore moved up to third from fifth, swapping positions with Denmark, which fell behind fellow-Nordic country Sweden. Finland as 6th and Germany as 7th stayed put while Japan and Canada overtook the Netherlands.

The WEF study named African countries Zimbabwe and Burundi as the world's least competitive economies.

In the case of Zimbabwe, the WEF noted the complete absence of property rights, corruption, basic government inefficiency as well as macroeconomic instability as fundamental flaws.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #127 on: 2009-09-08 19:25:44 » |

|

China, Bernanke, and the price of gold

Source: Telegraph.co.uk

Authors: Ambrose Evans-Pritchard

Dated: 2009-09-07

China has issued what amounts to the “Beijing Put” on gold. You can make a lot of money, but you really can’t lose.

I happened to see quite a bit of Cheng Siwei at the Ambrosetti Workshop, a gathering of politicians and global strategists at Lake Como, including a dinner at Villa d’Este last night at which he listened very attentively as a number of American guests tore President Obama’s economic and health policy to shreds.

Mr Cheng was until recently Vice-Chairman of the Communist Party’s Standing Committee, and is now a sort of economic ambassador for China around the world — a charming man, by the way, who left Hong Kong for mainland China in 1950 at the age of 16, as young idealist eager to serve the revolution. Sixty years later, he calls himself simply “a survivior”.

What he said about US monetary policy and gold – this bit on the record – would appear to validate the long-held belief of gold bugs that China has fundamentally lost confidence in the US dollar and is going to shift to a partial gold standard through reserve accumulation.

He played down other metals such as copper, saying that they could not double as a proxy currency or store of wealth.

“Gold is definitely an alternative, but when we buy, the price goes up. We have to do it carefully so as not stimulate the market,” he said.

In other words, China is buying the dips, and will continue to do so as a systematic policy. His comment captures exactly what observation of gold price action suggests is happening. Every time it looks as if the bullion market is going to buckle, some big force steps in from the unknown.

Investors long-suspected that it was China. We later discovered that Beijing had in fact doubled its gold reserves to 1054 tonnes. Fait accompli first. Announcement long after.

Standing back, you can see that the steady rise in gold over the last eight years to $994 an ounce last week – outperforming US equities fourfold, even with reinvested dividends – has roughly tracked the emergence of China as a superpower in foreign reserve holdings (now $2 trillion).

As I have written in today’s paper, Mr Cheng (and Beijing) takes a dim view of Ben Bernanke’s monetary experiments at the Federal Reserve.

“If they keep printing money to buy bonds it will lead to inflation, and after a year or two the dollar will fall hard. Most of our foreign reserves are in US bonds and this is very difficult to change, so we will diversify incremental reserves into euros, yen, and other currencies,” he said.

This line of argument is by now well-known. Less understood is how much trouble the Fed’s QE policies are causing in China itself, where they have vicariously set off a speculative boom on the Shanghai exchange and in property. Mr Cheng said mid-level house prices are now ten times incomes.

“If we raise interest rates, we will be flooded with hot money. We have to wait for them. If they raise, we raise.”

“Credit in China is too loose. We have a bubble in the housing market and in stocks so we have to be very careful, because this could fall down.”

Of course, China cold end this problem by letting the yuan rise to its proper value, but China too is trapped. Wafer-thin profit margins on exports mean that vast chunks of Chinese industry would go bust if the yuan rose enough to close the trade surplus. China’s exports were down 23pc in July from a year before even at the current exchange rate, and exports make up 40pc of GDP. “We have lost 20m jobs in this crisis,” he said.

China’s mercantilist export strategy has led the country into a cul-de-sac. China must continue to run its trade surplus. It must accumulate hundreds of billions more in reserves. Ergo, it must buy a great deal more gold.

Where is the gold going to come from?

[ Hermit : What this really means is that you might make a lot of money buying gold or even more money buying gold futures, but you cannot lose very much on it almost irrespective of your trading strategy. ]

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #128 on: 2009-09-14 21:48:13 » |

|

Coby Lamson’s Monday Market Overview

Source: gainspainscapital.com

Authors: Ron Coby

Dated: 2009-09-14

Is this a Bear Market rally or a new Bull Market?

After this recent 78% move up in the NASDAQ from the March lows, and a 45% rally in the DJIA, this is the question that is on every investor’s mind.

To answer the question, we must look back in history to crashes comparable to the one we just experienced from the October 2007 highs to the March 2009 lows, a fall of over 50% on the DJIA, NASDAQ and the SP500. Similar periods would be the famous 1929 crash, and the crashes of 1973-74 and 1987.

The Good

In our Clint Eastwood analogy of “The Good, The Bad, and The Ugly”, there are no “good” crashes, only “good” bull markets that eventually follow. On that hopeful note, let’s move on to the bad and ugly.

The Bad

The 1987 crash with its comparatively modest 36% decline, while not good, was the least bad or ugly of those to consider. It was of such short duration and recovered so quickly, that this severe correction is not nearly as good a “comp” to our present market as “the bad” and “the ugly” crashes of 1929, 2000 and 1974.

When we look at today’s powerful 78% rally in the NASDAQ, the DJIA of 1974-75 comes to mind. After the DJIA crashed 44.5% between 1/11/73 and 10/4/74, it rallied a comparable 73.5%.

It would make sense that our current rally in the NASDAQ would be greater than the 1975 DJIA rally, because the current NASDAQ had a much worse collapse of 55.5%. In the past, the DJIA was the proxy for “the marketplace”. Many believe that today’s NASDAQ has assumed that role, and that it is the more accurate representation of today’s overall economy.

If that is so, when the NASDAQ finally ends its current powerful rally, we may very well see a series of corrections and rallies such as those that took place in the DJIA between 1975 and 1982, when a new secular bull market was born.

Indeed, a strong case can be made that the true high of our markets was put in with NASDAQ 2000 bubble high, and the first of the crash and rally intervals took place beginning with the crash of 2000-02. The roller coaster sequence of 2000-02 crash, 2002-07 rally, 2007-09 crash, and the current rally of 2009, may indeed be the proof that we are in such a period. Six more years of crashes and rallies does not bode well for those investors still faithful to the philosophy of “buy and hold”.

The Ugly

When we compare the chart of our current market to that of the 1929 crash, you will see that they are strikingly similar. The 1929 rapid 48% collapse of the DJIA in 1929, although much briefer in duration, produced a similar price pattern to that of the slow motion 49% crash of 2008. Our recent 6-month rally of 45% in the DJIA has been virtually identical to the 5 month, 47% rally which followed the 1929 crash.

What happened after the 1929 rally was simply horrific. The DJIA quickly tanked 26%, and by July of 1932, ultimately collapses by a total of 86%. If our current market continues to follow the 1929-32 pattern, the DJIA should move quickly back to 7000 and finally to a low of 1350 in early 2012. Should this scenario play out, “buy and hold” investors will simply be destroyed. Following the Great Depression, the DJIA did not return to its 1929 highs until 1954. Using history as a guide, today’s “buy and hold” investors who bought in 2007, can look forward to breaking even some time in 2032.

The outlook based on history

Ironically, today’s DJIA seems to be repeating the DJIA 1929-1932 collapse, as the NASDAQ appears to be repeating the movement of the DJIA 1973-82 rollercoaster period. The conclusion to be drawn here is that we are in a bear market similar to both 1930’s and 1970’s; one that will be both “bad” and “ugly”.

We encourage “buy and hold” investors to take full advantage of this bear market rally to protect the gains that have been achieved since the lows of March. We believe that this current rally should be considered a “gift from heaven”, and be sold. Imagine how investors in 1932 must have felt, having held their stock all the way down, they must certainly have looked back at the 1929-30 rally as a great opportunity lost.

Simply stated, for at least several years, it is time to move away from buy and hold investing by buying low and SELLING high. Whether you are a trader or an investor, in light of the magnitude of this current rally, you need to be prepared for a potential downside reversal as we enter the September/October timeframe, historically the worst for the markets.

The bottom line is this… the easy money has been made in this rally. It is now time to “sell high” when this current rally begins to roll over into the next drop.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #129 on: 2009-09-15 11:45:47 » |

|

A year after financial crisis, the consumer economy is dead

Source: McClatchy Newspapers

Authors: Kevin G. Hall

Dated: 2009-09-08

One year after the near collapse of the global financial system, this much is clear: The financial world as we knew it is over, and something new is rising from its ashes.

Historians will look to September 2008 as a watershed for the U.S. economy.

On Sept. 7, the government seized mortgage titans Fannie Mae and Freddie Mac. Eight days later, investment bank Lehman Brothers filed for bankruptcy, sparking a global financial panic that threatened to topple blue-chip financial institutions around the world. In the several months that followed, governments from Washington to Beijing responded with unprecedented intervention into financial markets and across their economies, seeking to stop the wreckage and stem the damage.

One year later, the easy-money system that financed the boom era from the 1980s until a year ago is smashed. Once-ravenous U.S. consumers are saving money and paying down debt. Banks are building reserves and hoarding cash. And governments are fashioning a new global financial order.

Congress and the Obama administration have lost faith in self-regulated markets. Together, they're writing the most sweeping new regulations over finance since the Great Depression. And in this ever-more-connected global economy, Washington is working with its partners through the G-20 group of nations to develop worldwide rules to govern finance.

"Our objective is to design an economic framework where we're going to have a more balanced pattern of growth globally, less reliant on a buildup of unsustainable borrowing . . . and not just here, but around the world," said Treasury Secretary Timothy Geithner.

The first faint signs that the U.S. economy may be clawing its way back from the worst recession since the Great Depression are only now starting to appear, a year after the panic began. Similar indications are sprouting in Europe, China and Japan.

Still, economists concur that a quarter-century of economic growth fueled by cheap credit is over. Many analysts also think that an extended period of slow job growth and suppressed wage growth will keep consumers — and the businesses that sell to them — in the dumps for years.

"Those things are likely to be subpar for a long period of time," said Martin Regalia, the chief economist for the U.S. Chamber of Commerce. "I think it means that we probably see potential rates of growth that are in the 2-2.5 (percent) range, or maybe . . . 1.8-1.9 (percent)." A growth rate of 3 percent to 3.5 percent is considered average.

The unemployment rate rose to 9.7 percent in August and is expected to peak above 10 percent in the months ahead. It's already there in at least 15 states. Regalia thinks that it could be five years before the U.S. economy generates enough jobs to overcome those lost and to employ the new workers entering the labor force.

All this is likely to keep consumers on the sidelines.

"I think this financial panic and Great Recession is an inflection point for the financial system and the economy," said Mark Zandi, the chief economist for forecaster Moody's Economy.com. "It means much less risk-taking, at least for a number of years to come — a decade or two. That will be evident in less credit and more costly credit. If you are a household or a business, it will cost you more, and it will be more difficult to get that credit."

The numbers bear him out. The Fed's most recent release of credit data showed that consumer credit decreased at an annual rate of 5.2 percent from April to June, after falling by a 3.6 percent annual rate from January to March. Revolving lines of credit, which include credit cards, fell by an annualized 8.9 percent in the first quarter, followed by an 8.2 percent drop in the second quarter.

That's a sea change. For much of the past two decades, strong U.S. growth has come largely through expanding credit. The global economy fed off this trend.

China became a manufacturing hub by selling attractively priced exports to U.S. consumers who were living beyond their means. China's Asian neighbors sent it components for final assembly; Africa and Latin America sold China their raw materials. All fed off U.S. consumers' bottomless appetite for more, bought on credit.

"That's over. Consumers can do their part — spend at a rate consistent with their income growth, but not much beyond that," Zandi said.

If U.S. consumers no longer drive the global economy, then consumers in big emerging economies such as China and Brazil will have to take up some of the slack. Trade among nations will take on greater importance.

In the emerging "new normal," U.S. companies will have to be more competitive. They must sell into big developing markets; yet as the recent Cash for Clunkers effort underscored, the competitive hurdles are high: Foreign-owned automakers, led by Toyota, reaped the most benefit from the U.S. tax breaks for new car purchases, not GM and Chrysler.

Need a loan? Tough luck: Many U.S. banks are in no condition to lend. Around 416 banks are now on a "problem list" and at risk of insolvency. Regulators already have shuttered 81 banks and thrifts this year.

The Federal Deposit Insurance Corp. reported on Aug. 27 that rising loan losses are depleting bank capital. The ratio of bank reserves to bad loans was 63.5 percent from April to June, the lowest it's been since the savings-and-loan crisis in 1991.

For all that, the U.S. economy does seem to be rising off its sickbed. The latest manufacturing data for August point to a return to growth, and home sales are rising. Indeed, there are many encouraging signs emerging in the global economy.

It's all growth from a low starting point, however, and many economists think that there'll be a lower baseline for U.S. and global growth if the new financial order means less risk-taking by lenders and less indebtedness by companies and consumers.

That seems evident now in the U.S. personal savings rate. It fell steadily from 9.59 percent in the 1970s to 2.68 percent in the easy-money era from 2000 to 2008; from 2005 to 2007, it averaged 1.83 percent.

Today, that trend is in reverse. From April to June, Americans' personal savings rate was 5 percent, and it could go higher if the unemployment rate keeps rising. Almost 15 million Americans are unemployed — and countless others are underemployed or uncertain about their job security, so they're spending less and saving more.

A few years ago, banks fell all over themselves to offer cheap home equity loans and lines of consumer credit. No more. Even billions in government bailout dollars to spur lending haven't changed that.

"The strategy that was stated at the beginning of the year — which is that you would sustain the banking system in order that it would resume lending — hasn't worked, and it isn't going to work," said James K. Galbraith, an economist at the University of Texas at Austin.

Over the course of 2008, the nation's five largest banks reduced their consumer loans by 79 percent, real estate loans by 66 percent and commercial loans by 19 percent, according to FDIC data. A wide range of credit measures, including recent FDIC data, show that lending remains depressed.

Why? The foundation of U.S. credit expansion for the past 20 years is in ruin. Since the 1980s, banks haven't kept loans on their balance sheets; instead, they sold them into a secondary market, where they were pooled for sale to investors as securities. The process, called securitization, fueled a rapid expansion of credit to consumers and businesses. By passing their loans on to investors, banks were freed to lend more.

Today, securitization is all but dead. Investors have little appetite for risky securities. Few buyers want a security based on pools of mortgages, car loans, student loans and the like.

"The basis of revival of the system along the line of what previously existed doesn't exist. The foundation that was supposed to be there for the revival (of the economy) . . . got washed away," Galbraith said.

Unless and until securitization rebounds, it will be hard for banks to resume robust lending because they're stuck with loans on their books.

"We've just been scared," said Robert C. Pozen, the chairman of Boston-based MFS Investment Management. He thinks that the freeze in securitization reflects a lack of trust in Wall Street and its products and remains a huge obstacle to the resumption of lending that's vital to an economic recovery.

Enter the Federal Reserve. It now props up the secondary market for pooled loans that are vital to the functioning of the U.S. financial system. The Fed is lending money to investors who're willing to buy the safest pools of loans, called asset-backed securities.

Through Sept. 3, the Fed had funded purchases of $817.6 billion in mortgage-backed securities. These securities were pooled mostly by mortgage finance giants Fannie Mae, Freddie Mac and Ginnie Mae. In recent months, the Fed also has moved aggressively to lend for purchase of pools of other consumer-based loans.

Today, there's little private-sector demand for new loan-based securities; government is virtually the only game in town. That's why on Aug. 17, the Fed announced that it would extend its program to finance the purchase of pools of loans until mid-2010. That suggests there's still a long way to go before a functioning securitization market — the backbone of consumer lending — returns to a semblance of normalcy.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.16

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #130 on: 2009-09-18 23:16:06 » |

|

"Option" mortgages to explode, officials warn

Source: Reuters

Authors: Lisa Lambert (Reporting), Julie Haviv (Additional Reporting), Padraic Cassidy (Editing)

: 2009-09-17

The federal government and states are girding themselves for the next foreclosure crisis in the country's housing downturn: payment option adjustable rate mortgages that are beginning to reset.

"Payment option ARMs are about to explode," Iowa Attorney General Tom Miller said after a Thursday meeting with members of President Barack Obama's administration to discuss ways to combat mortgage scams.

"That's the next round of potential foreclosures in our country," he said.

Option-ARMs are now considered among the riskiest offered during the recent housing boom and have left many borrowers owing more than their homes are worth. These "underwater" mortgages have been a driving force behind rising defaults and mounting foreclosures.

In Arizona, 128,000 of those mortgages will reset over the the next year and many have started to adjust this month, the state's attorney general, Terry Goddard, told Reuters after the meeting.

"It's the other shoe," he said. "I can't say it's waiting to drop. It's dropping now." [ Hermit : Just as some of the wide-eyed claimed it was safe to go back in the water. And of course, "It wasn't possible to predict this. ]