Author

Author

|

Topic: We're Fucked - The Coming Economic Crisis (Read 164896 times) |

|

Fox

Magister

Gender:

Posts: 122

Reputation: 6.69

Rate Fox

Never underestimate the odds.

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #105 on: 2009-06-23 03:57:31 » |

|

A sign of real recovery?

According to Bloomberg consumer spendings are up by 0.3% for the first time in 3 months. House sales are up by 3% for older houses and 2.3% for new houses. Particularly the latter is a good sign of the economy being in recovery, as house sales is what got the US recession train rollin' in the first place. These aren't official figures yet though, but probably relatively accurate still.

Not denying that things are looking bleak, but saying that we are truly fucked when there are plenty of signs of improvement in the economy amounts to wistful thinking by teh bloggers. Of course "less bad" does not necessarily mean "good", but it doesn't mean "going straight to hell" either.

Source: Bloomberg

Spending, Home Sales Probably Increased: U.S. Economy Preview

Consumer spending in the U.S. probably rose in May for the first time in three months and home sales increased as Americans became more confident the recession will end this year, economists said before reports this week.

Purchases advanced 0.3 percent, according to the median of 58 estimates in a Bloomberg News survey ahead of Commerce Department figures due June 26. Combined sales of new and existing homes likely improved to 5.18 million, capping the first back-to-back increase since 2006, the survey showed.

“There’s more optimism as we get further away from last year’s financial-market chaos,” said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York. “Spending on the part of consumers seems to be picking up after a soft patch. It looks like housing has bottomed.”

Government efforts to restore the flow of credit and prop up incomes are allowing households to take advantage of retailer discounts even as unemployment soars. Federal Reserve policy makers, meeting this week, may try to reassure investors that interest rates will stay low for the foreseeable future and acknowledge the economy has improved since their last gathering.

The Commerce Department’s spending report may also show incomes increased 0.3 percent in May after gaining 0.5 percent the prior month, mainly reflecting the tax cuts and transfers linked to the administration’s stimulus plan, economists said.

Home Sales

Sales of existing homes climbed 3 percent to an annual pace of 4.82 million, the highest level since October, when the economy was in the throes of the financial crisis, according to the survey median. Foreclosure-driven declines in property values are helping to reduce the glut of unsold houses. The National Association of Realtors’ report is due June 23.

The next day, Commerce data may show purchases of new homes rose 2.3 percent in May to an annual pace of 360,000.

In another sign of the improving economic outlook, the Reuters/University of Michigan final index of consumer sentiment probably rose to 69 in June, the highest level in nine months, from 68.7 in May, economists’ forecasts show. The figures are due on June 26.

Business in Las Vegas has “clearly bottomed out,” said Jim Murren, chief executive officer of casino company MGM Mirage. “It’s just a matter of how long we’re going to be on the bottom, and that is what we’re debating internally,” Murren said in a telephone interview last week. “The business trends are no longer deteriorating.”

More Upbeat

Fed officials on June 24, at the conclusion of their two- day meeting, may say the U.S. is showing signs of emerging from the worst recession in a half century. Following their last meeting in April, policy makers said the economy will “remain weak for a time.” The central bankers will also keep the benchmark interest rate in the range of zero to 0.25 percent, economists said.

“The Fed is likely to sound more upbeat on growth prospects,” Dean Maki, chief U.S. economist at Barclays Capital in New York, said in a note to clients. At the same time, the central bank may “aim to convince investors that tightening is not imminent,” he said.

Such an announcement may be an attempt by policy makers to prevent borrowing costs from climbing even more, undermining tentative signs of recovery. The yield on the benchmark 10-year note reached as high as 3.95 percent at the close on June 10, after being as low as 2.54 percent on March 18, the day the Fed announced it would buy Treasury securities in a bid to push borrowing costs down.

Some parts of the economy are lagging. A Commerce report due June 24 may show bookings for goods meant to last several years slid 0.8 percent in May, the survey showed. Durable-goods orders excluding transportation equipment may have also fallen.

Gross domestic product shrank at a 5.7 percent pace in the first quarter, the same as estimated in May, revised figures from Commerce may show. Following a 6.3 percent pace of contraction in the last three months of 2008, the drop capped the worst six-month performance in five decades. The figures are due on June 25.

Bloomberg Survey

================================================================

Release Period Prior Median

Indicator Date Value Forecast

================================================================

Exist Homes Mlns 6/23 May 4.68 4.82

Exist Homes MOM% 6/23 May 2.9% 3.0%

Durables Orders MOM% 6/24 May 1.7% -0.8%

Durables Ex-Trans MOM% 6/24 May 0.4% -0.4%

New Home Sales ,000’s 6/24 May 352 360

New Home Sales MOM% 6/24 May 0.3% 2.3%

GDP Annual QOQ% 6/25 1Q F -5.7% -5.7%

Personal Consump. QOQ% 6/25 1Q F 1.5% 1.5%

GDP Prices QOQ% 6/25 1Q F 2.8% 2.8%

Core PCE Prices QOQ% 6/25 1Q F 1.5% 1.5%

Initial Claims ,000’s 6/25 13-Jun 608 600

Cont. Claims ,000’s 6/25 6-Jun 6687 6707

Pers Inc MOM% 6/26 May 0.5% 0.3%

Pers Spend MOM% 6/26 May -0.1% 0.3%

PCE Deflator YOY% 6/26 May 0.4% 0.1%

Core PCE Prices MOM% 6/26 May 0.3% 0.1%

Core PCE Prices YOY% 6/26 May 1.9% 1.8%

U of Mich Conf. Index 6/26 June F 69.0 69.0

================================================================

|

I've never expected a miracle. I will get things done myself. - Gatsu

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.08

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #106 on: 2009-06-23 06:12:33 » |

|

[Blunderov] Let me say first off that I'm not a trained economist. So I must (usually) defer to those more expert than I. That said, from my armchair, this recovery looks suspiciously like a mere papering over of the cracks - almost literally. These green shoots have been engineered by the frantic expedient of printing so much money that it beggars the imagination. It looks to me that this must result in a huge devaluation of the dollar. (Probably the best than can be managed is that the decline of the dollar is carefully managed to prevent an actual run. )

Meanwhile back on Main St where "we" metaphorically live, we the taxpayer get to give away a huge sum of valuable dollars and "we" will be re payed, if ever, with dollars that are worth a lot less than they were than when they were "lent". (The same applies to America's creditors like China and Japan except that they too can print as much money as they need unlike us.) In the case of "we", we will nonetheless have to work just as hard, if not much harder, in order to earn the valueless dollars required to pay off both national and personal debt. If that's not getting fucked then I don't know what is.

Then there's the derivative bubble...

http://www.smarterearth.org/?q=node/751

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #107 on: 2009-06-23 14:56:09 » |

|

[Fox] A sign of real recovery?

<snip>

You might also have mentioned that some of the larger financial institutions which have survived are having their best year ever. Unfortunately, despite having borrowed and spent the equivalent of the entire GDP of 2008 in stimulants the economy has not yet picked up in any statistically significant way- and of course, military spending continues to extract value from economies much faster than it is created.

No matter what happens in the short term, and hopefully it will be better rather than worse, the structural problems have not been addressed. Until they are, while there are likely going to be brief upticks, the overall trend is towards an inevitable meeting between a global economy designed to require infinite growth and the sad reality that there are constraints to growth.

It isn't as if this is not known. The Club of Rome investigated this in the 1960s and early 1970s and suggested not only that this would happen, but provided the key insight that recognizing when it had happened would likely be determined in hindsight. Rand Corporation confirmed the Malthusian path the collapse would probably follow and established that rapid reductions in population levels rather than slow attrition would maximize the possibility that survivors might be able to re-establish some form of civilization.

I see nothing to assume that these projections have been invalidated by anything subsequently, many factors suggesting that the collapse is happening rather earlier than previously predicted, and vast amounts of evidence supporting the idea that the US and other governments are in fact preparing for it and not bothering to count the cost for the future. This might be seen as sensible considering that the country instigating a first strike will be in a very superior position to anyone else; then again, investing significant effort in attaining military superiority minimises the value that can be invested in attempting to mitigate catastrophe or developing the trust needed to seek effective solutions (all our children would be vastly better off if we could reduce global populations by 2/3 to 9/10 or so).

Forecast of economic collapse backed by data

Source: New Scientist

Authors: Not Credited

Dated: 2008-11-19

WE ARE on track for serious economic collapse that will dwarf our current troubles. That's the conclusion of the real-world analysis of a controversial prediction made 30 years ago that economic growth cannot be sustained.

In 1972, the book Limits to Growth by a group called the Club of Rome predicted that exponential growth would eventually lead to economic and environmental collapse. The group used models that assessed the interaction of rising populations, pollution, industrial production, resource consumption and food production. Most economists rubbished the book, and governments have ignored its recommendations, but a growing band of experts is once again arguing that we need to reshape our economy to make it more sustainable (New Scientist, 16 October 2008, p 40).

Now Graham Turner at the research organisation CSIRO in Australia has compared Limits to Growth's forecast with data from the intervening years. He says changes in industrial production, food production and pollution are all in line with the Club of Rome's predictions, which foresee decreasing resource availability and an escalating cost of extraction that eventually triggers a slowdown of industry - leading to economic collapse some time after 2020 (Global Environmental Change, vol 10, p 397).

"For the first 30 years of the model, the world has been tracking along an unsustainable trajectory," Turner concludes. Herman Daly of the University of Maryland says these results show that we "must get off the growth path of business as usual, and move to a steady state economy", stopping population growth, resource depletion, and pollution.

For 30 years, the world has been tracking along an unsustainable trajectory

Turner is not suggesting that disaster is inevitable, and says his numbers show that a sustainable economy is attainable. "We wouldn't have to go back to the caves," he says.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #108 on: 2009-06-24 01:33:18 » |

|

[Fox] A sign of real recovery?

<snip>

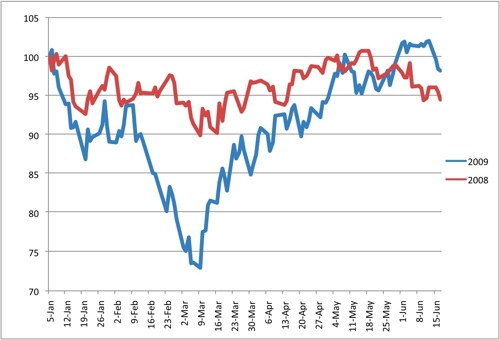

As you can see from the attached graph, financials look very much the same this year as they did last year, only more volatile. Just as it did at this time last year, the Fed says it has taken steps to cut interest rates and has pumped trillions into the market to lower volatility and return stocks to "normal" trading action. Just as last year, financial indicators show that their activity has been a complete and utter failure. The financial market's critical issues of system solvency, asset valuation, debt obligations and accounting standards have not been addressed. Until they are, nobody sane will rely on their own valuations of their future - no matter how glowing.

Retail sales are the worst seen in the post–WWII period. The rate of collapse has begun to slow, but getting worse more slowly doesn't mean that anything is getting better. The indisputable fact that unemployment continues to grow means that retail sales cannot hope to improve in real terms. That means reduced income. Commodities, especially energy, have continued to soar, in dollar and in real terms, meaning that costs are not being reduced. Together these guarantee that earnings, Income - Expenses, will continue their precipitous trend to zero. While sentiment and trading patterns might drive short term market prices, fundamentals can't be ignored - and the fundamentals are simply following the ever diminishing earnings down the tubes. This is why I am not alone in predicting a further and even more catastrophic market collapse in the fall.

Here are some parallels observed on by Graham Summers of the Private Wealth Advisory:- A Crisis/ Market low in March (Bear Stearns & March collapse to 666)

- A Government/ Federal Intervention (Bear Stearns & Stimulus Package)

- Gold testing/ breaching $1,000 in the first quarter (March & February)

- Stocks rallying into the summer on worsening fundamentals

- Stocks rallying close to their beginning of the year highs in May/ June

- Commodities rallying into the Summer on the China story/ inflation concerns

- Various government figures using the rally to claim that the “worst is over”

- Stocks rolling over in earnest in June as fundamentals take hold

I haven't seen a list of differences anywhere that "I can believe in".

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #109 on: 2009-06-24 01:39:01 » |

|

[Blunderov] Let me say first off that I'm not a trained economist.

[Hermit] That may well place you at an advantage. I sometimes suspect that economists are merely the soothsayers, astrologers and other readers of portents displaced by the age of reason returned to haunt us in another guise.

Kindest Regards

Hermit & Co

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #110 on: 2009-06-26 03:49:27 » |

|

A Lost Decade for Jobs

Source:Business Week

Credits: Michael Mandel

Dated: 2009-06-23

Michael Mandel, BW's award-winning chief economist, provides his unique perspective on the hot economic issues of the day. From globalization to the future of work to the ups and downs of the financial markets, Mandel-named 2006 economic journalist of the year by the World Leadership Forum-offers cutting edge analysis and commentary.

Private sector job growth was almost non-existent over the past ten years. Take a look at this horrifying chart:

Between May 1999 and May 2009, employment in the private sector sector only rose by 1.1%, by far the lowest 10-year increase in the post-depression period.

It’s impossible to overstate how bad this is. Basically speaking, the private sector job machine has almost completely stalled over the past ten years. Take a look at this chart:

Over the past 10 years, the private sector has generated roughly 1.1 million additional jobs, or about 100K per year. The public sector created about 2.4 million jobs.

But even that gives the private sector too much credit. Remember that the private sector includes health care, social assistance, and education, all areas which receive a lot of government support. I’ve been talking about the HealthEdGov sector. Take a look at this table:

| 10-year Job Growth: HealthEdGov Sector Dominates | | Industry | Change, May 1999-2009

(thousands of jobs)* | | Private healthcare | 2898 | | Food and drinking places | 1567 | | Gov educ | 1390 | | Professional and business services | 885 | | Gov except health and ed | 843 | | Social assistance | 796 | | Private education | 772 | | Arts, entertainment, and recreation | 188 | | Gov health | 148 | | Mining | 133 | | Financial activities | 130 | | Utilities | -40 | | Transportation and warehousing | -43 | | Retail | -91 | | Accomodations | -119 | | Wholesale | -166 | | Construction | -238 | | Information | -525 | | Manufacturing | -5372 |

*Gov health and gov educ based on April 2009 estimates

Data: BLS

Most of the industries which had positive job growth over the past ten years were in the HealthEdGov sector. In fact, financial job growth was nearly nonexistent once we take out the health insurers.

Let me finish with a final chart.

Without a decade of growing government support from rising health and education spending and soaring budget deficits, the labor market would have been flat on its back.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #111 on: 2009-07-22 05:01:53 » |

|

Watchdog sees huge U.S. bill for banks bailout

Source: Associated Press

Authors: Not Credited (AP)

Dated: 2009-07-20

The federal government has devoted $4.7 trillion to help the financial sector through its crisis, a watchdog report said Monday.

Under the worst of circumstances, the report said, the government's maximum exposure could total nearly $24 trillion, or $80,000 for every American. [ Hermit : In 2009 dollars and excluding interest ]

The figures are part of a tough new quarterly report to Congress from special inspector general Neil Barofsky, who accuses the Treasury Department of repeatedly failing to adopt recommendations aimed at making one component of the government financial rescue effort more accountable and transparent.

The $4.7 trillion commitment to the industry equals about one third of the overall U.S. economy and takes into account about 50 initiatives and programs set up since 2007 by the Bush and Obama administrations as well as by the Federal Reserve. Barofsky oversees one of the initiatives — the $700 billion Troubled Asset Relief Program.

Much of the government assistance is backed by collateral and Barofsky's $23.7 trillion estimate represents the gross, not net, exposure that the government could face. No one has suggested that the full amount will be used. [ Hermit : In fact, going on what seems to have become standard practice, money will be given to the largest banks, not to make loans which has all but stopped, but rather to allow them to create profits through accounting miracles, enabling them to pay their staff appropriate bonuses, and relatively small amounts will be provided to preferred earmarks, and the rest, which might have done some good will not be distributed owing to a lack of appropriate channels. ]

Because of declining participation in short-term loan programs and because some infusions of money have been repaid, the maximum amount actually spent has declined to a current outstanding balance of $3 trillion, Barofsky said.

The agencies and the programs assisting the financial sector include a newly created Federal Housing Finance Agency, increased deposit insurance initiated by the Federal Deposit Insurance Corp., and 18 support programs created by the Fed under the special powers it can deploy to address a systemwide financial crisis.

Banks have cut back on their use of the Fed's emergency lending program as well as other programs to ease credit stresses. Given that, the Fed has reduced the amount it will lend to financial institutions under two programs and it has decided to let a program to support money market mutual funds to expire as currently scheduled at the end of October.

Barofsky's $23.7 trillion estimate represents the maximum exposure that the government would face if all eligible applicants requested the maximum assistance at the same time. It does not account for the fees and other costs that some of these programs charge and for the collateral that many of the programs require that participants provide.

"While quantity and quality of the assets backing all of these programs vary, ignoring that side of these programs misrepresents 'potential exposure' associated with them," Treasury spokesman Andrew Williams said.

In his report, Barofsky says Treasury has accepted some of his recommendations for greater accountability, but says the department has not taken steps to require all TARP recipients to report on their actual use of funds. He said Treasury also should report the values of its investments in banks and other financial institutions, disclose the identity of borrowers under a nonrecourse loan program and disclose trading activity under a public-private investment fund.

Barofsky says Treasury's inaction means taxpayers have not been told what the financial institutions that have received assistance are doing with the money.

Barofsky's conclusion is contained in a quarterly report to Congress and in testimony he is prepared to give Tuesday to the House Oversight and Government Reform Committee.

"The very credibility of TARP (and thus in large measure its chance of success) depends on whether Treasury will commit, in deed as in word, to operate TARP with the highest degree of transparency possible," Barofsky said.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #112 on: 2009-07-22 05:09:28 » |

|

Washington's Dilemma: This Isn't a Recession, It's a Collapse

Source: seekingalpha.com

Authors: Not Credited

Dated: 2009-07-22

Washington is bluffing that it will not bail out California, and every other state suffering from collapsed revenues and massive job losses. If cuts in police and schools don’t force DC off from its current position, then the math will. Because in many states the aggregate revenue losses and looming cuts to state payrolls will largely render the intended effects of federal stimulus as moot. Frankly, unless Washington prints money and bails out every state that needs capital, including California, federal power will decline amidst this severe economic recession, and the process of a soft American devolution will begin. If you think this idea is outrageous, then you’ve still not come to terms with a core reality of our current situation: the structure of this financial crisis is wholly different than any in our post-war era. This isn’t a recession. This is collapse.

In Recession vs. Collapse published in March, this blog explained that in a normal recession existing savings are used to support government debt issuance and that those who remain employed increase their savings to also support government debt issuance. Neither phenomenon is at work today. Yes, the savings rate has soared in the US. But this has not resulted in any actual accrued savings. Because private sector debt came to define the internal structure of the US system, savings currently is little more than debt service. Also, bank purchases of US Treasuries are really just a result of the circularity of monetization. It’s just money from the FED being recycled into Treasuries. There is no privately driven growth of bank deposits, in the aggregate. Americans as a class are broke. What the savings rate more accurately measures is a collapse of consumer spending.

The internal composition of the US economic and financial system when it hit 2007/8 was very different than in previous recessions, even the severe recession of 1980/82. It’s this internal composition that’s now determinative, to the outcome. The sawdust of debt, and the monetization of assets rather than the production of goods, continually came to define the internal composition of the system. The economy cannot, therefore, express the same kind of resilience it has done so often, since WW2.

This is the core problem of this collapse and why the prospect for recovery is dim. Americans can’t actually rebuild the savings that the banking system needs to escape from the current mess. Individually, Americans are trapped by debt and cannot spend. In The Seigniorage Curse, I explain that one of the primary mechanisms for the hollowing out of the American economy over many years was the dollar advantage, which at first was earned. And then, came to be un-earned. By the time the US reached the 21st century, our primary manufactured product was debt, and dollars. Is it any wonder that once that system collapsed, that we quickly gave up 100% of the phantom job growth that had been sitting on top of the debt bubble? The current level of employment in the United States has now returned to the levels of June 2000. Enough said.

Washington apparently has a fresh dilemma on its hands, just inside of 6 months after the new administration came to power. Clearly the economic team, even though they were given almost 18 months to study the nature of the current crisis (starting in the Summer of 2007), incorrectly judged this recession to be of the post-war variety. Is that any surprise?

Nothing in the public record since the year 2000 indicates that Larry Summers, Ben Bernanke, or Tim Geithner understood that we had been building a skyscraper of private sector debt in textbook blow-off style, since the deflation scare of 2001. Now, two years after FED repair operations began on the broken credit system, and over 3 years since US real estate topped in price, major portions of the country are staring at further home price declines in most major markets. Indeed, it appears that the same macro cycle of the last two Autumns is about to repeat, with more waves of foreclosure, more withdrawals from savings and investment to pay for living expenses, and the attendant bailouts of financial institutions that comes around each time.

Washington can’t really take a pass on this situation. If the federal government decides it can wait while “the states rebuild their balance sheets and clean up their payrolls” (as in past recessions) they’ll be waiting forever. None of that is underway.

It’s no surprise therefore that the country is already being prepped for a second stimulus. Sure, Washington would like to act tough and tell the States to clean up their act. This is the moral hectoring version of Ben Bernanke saying in 2006 he doubts US real estate will ever decline year over year, or Treasury Secty Paulson saying that the front-end of the crisis was just a problem contained to sub-prime. We’ve seen this script before. If California issuing IOUs in a state where banks refuse to accept them doesn’t get the message across, nothing will. We are on the front end, not the back end, of a crisis within the States.

Unless Washington prints up dollars and bails out the States, of what use is Washington? Exactly what services can Washington provide, if California is let go? Left on its own, there would no doubt come an initial hooray from rubber-neckers and I-Told-You-So-ers. A newly broken relationship between Washington and the states might also quicken the pulse of anti-federalists, who feel we are long overdue for a tip in the balance of power. Perhaps it would all work out well. For the best, even?

In Washington today the annual budget deficit crossed the one trillion mark. In Sacramento, there is a 26 billion dollar shotgun hole in their budget. (One hopes that CALPERS is marking to market, because if they’re not, that would be a new liability for Sacramento to deal with). Meanwhile, Autumn approaches and whole range of rather nasty choices looms over the school system. Imagine living in a prime area of California and watching your house decline by 40%, your household income knocked for an initial 30%, and the after-school programs and town services get cut. Now throw some fees and tax hikes on top of that mess. For the coup de grace, imagine California voters sitting down each night to another wave of bailouts from Washington to financial corporations. Under those circumstances it seems quite unlikely Washington can say no, to the States.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Mermaid

Adept

Posts: 770

Reputation: 7.35

Rate Mermaid

Bite me!

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #113 on: 2009-07-22 20:08:42 » |

|

(re printing money)like i said elsewhere...we better enjoy this 'recession' while it lasts. it aint going to be pretty when inflation turns up at the party.

|

|

|

|

|

Mylon

Initiate

Posts: 8

Reputation: 5.61

Rate Mylon

I'm a llama!

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #114 on: 2009-07-23 10:09:33 » |

|

I have no doubt that the economy can recover. However, the price may seem really heartless.

This economy cannot support the population we have now. Given the recession, businesses have realized all of these improvements in technology has allowed its workers to be more productive. Thus, it can fire many workers without a significant loss in productivity. If anything, the firings may increase productivity for a short while as people fear being the next one.

The end result is that there is simply less room for workers in the economy. This is why many developed countries have been shrinking in population. It's not because there isn't plenty to go around, but because wealth is so concentrated. There is a finite number of wealthy people in the world, and the number required to support them shrinks every year with technologies that increase productivity.

One easy way to solve the unemployment problem would be to downsize the 40 hour workweek. Moving to a 32 hour workweek would mean employers would have to either pay more money for the same work, or hire 25% more workers. By acknowledging that four people today can do what 5 people could 20-30 years ago, suddenly we'll have a place for all of the people currently without jobs in this rough economy.

Employment would rise once again as businesses work to fill these gaps and suddenly there are more people to spend money all around. The economy can continue.

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #115 on: 2009-07-23 21:41:44 » |

|

The French realized and implemented something like this in the 1980s already.

The troubles in the US are structural and much more substantial. American couples are now working far longer hours for much less disposable income than their parents experienced with only one parent working. Income remains substantially below inflation which is set to become stratospheric.

Unfortunately, outside of the banking sector whose miraculous accounting produced 70% of American GDP last year, and is now as welcome as toxic waste, not much value is being created in the USA, the population has doubled since 1950 and there is no sign that Americans have realized that they are breeding themselves into poverty even as their productivity collapses (bear in mind that you can work 24x356 but if nobody appreciates your work sufficiently to pay for it, then you won't derive any benefit from it). China has used America's (and other countries) willingness to accept cash for mines and the torrents of money flowing to them for work, to buy up resources all over the world. Even if the USA wanted to restart its industrial production it wouldn't be able to, it no longer owns the required resources.

And the end of cheap energy is approaching. China, which has more Internet users than the USA has people, and which still lends $0.50 to Washington for every dollar spent by Washington needs fuel to power and lubricate its economy. By 2014 China's oil imports will exceed those of the USA, and by 2018 to 2022, there will be shortages. When that happens, the USA will see its energy dependent lifestyle come to an abrupt halt - unless it has halted before then.

Meanwhile, the US has established a "smart" economy. Where money money once flowed from storekeeper, to farmer, to farrier, from car dealer, to serviceman to grocer, from banker to hair dresser to doctor, circulating in communities and doing everyone good, now it flows into Walmart tills all over the US to vanish into "efficient" corporate coffers prior to being exported. Now most everybody is smarting and the means to correct this are not very obvious.

By the way, the above is why US cities are collapsing. It was all those proud producers, professionals, service- and middle- men who paid to make the cities attractive. They paid the doctor's bills, which let doctors contribute too. Neither Walmart nor China care about American cities, and given that people ended up unable to afford to see the doctor, small practices closed and the doctors retired to Florida and donated their money to Bernie Madoff. Who possibly epitomised the American investment system which has now done the opposite of the Europeans, socialized the losses and privatized the profits leaving the US on its knees but printing money as if there is no tomorrow. Perhaps in the hope that Jeezuz will arrive and pull them out of the train smash before it becomes too painful. Most Americans haven't realized any of this yet. Other perhaps, than a few in California who are already experiencing a world of hurt, holding IOUs from a State that is apparently not too big to fail, and so nobody wants to accept them. Not even in Iowa.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #116 on: 2009-08-10 04:55:31 » |

|

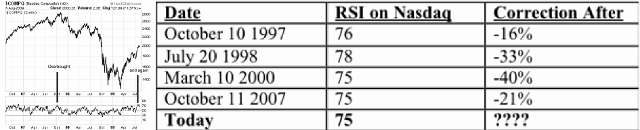

Own stocks? Please pay attention.

Source: http://www.gainspainscapital.com/index.php?option=com_content&view=article&id=112:five-times-out-of-five-stocks-collapsed-after-this

Stocks are overbought.

And by overbought, I mean WAY overbought.

The relative strength index (RSI) is a metric used to measure the velocity and momentum of a given investment by comparing its upward and downward moves from close-to-close. If an investment is moving up strongly, its RSI is higher. Similarly, if an RSI is low, it means the investment is performing weakly.

Historically, RSI’s of 70 or higher mean an investment is overbought while an RSI of 30 means an investment is oversold. In these situations the market is primed for a “revert to the mean” trade, meaning you could see a quick correction or turnaround rally as the market snaps back to a more reasonably RSI.

Well, have a look at the NASDAQ today.

As you can see, the NASDAQ recently hit an RSI of 75. This is the highest reading we’ve seen in nearly two years. In fact, the last time the NASDAQ had an RSI of 75 was October 10, 2007, right before stocks entered their first major leg down in the Financial Crisis, losing 55% in six months.

As soon as I noticed this, I called up Ron Coby, a brilliant portfolio manager based in Medford, Oregon. Ron’s one of the smartest guys I know and when it comes to trading short-term moves, he’s one of the best in the business. What he had to say completely blew me away.

Ron said,“Graham, you won’t believe this, but I went back on the NASDAQ and made a note of every time it hit an RSI of 75. EVERY TIME, the market collapsed soon after. And I don’t mean a “plain vanilla” correction, I mean a full blown CRASH.”

Ron then forwarded me the following chart. Suffice to say, I was floored:

As you can see, the NASDAQ has hit an RSI of 75 or higher five times in the last 12 years. Every time, the market collapsed soon after with an average drop of -22%. In several cases, stocks suffered a full-blown CRASH.

This is a very serious warning for the Bulls. A high RSI doesn’t mean that stocks have to CRASH immediately. But it does indicate that the NASDAQ is more than ready for a serious correction. Again, an RSI of 75 or higher has only been hit FIVE times in the last 12 years. Two of those times were at massive historic bubble peaks. The others were all periods in which stocks were simply far too overbought. And ALL FIVE OF THEM PRECEDED SERIOUS CORRECTIONS. [ Hermit : While he may, as he warns, be overreading the very sparse available data, it matches my fundamentals based analysis that we are in for the mother of all crashes in autumn. I'd take this as the writing on the wall. ]

Be forewarned, if stocks are this overbought, we’re in dangerous territory. If smart money like Ron Coby is worried and shifting to a defensive stance, I’m paying attention.

I suggest you do the same.

Good Investing!

Graham Summers

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.19

Rate Hermit

Prime example of a practically perfect person

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #117 on: 2009-08-12 13:02:25 » |

|

Economists Lead the Way to Calamity

Source: dailyreckoning.com

Authors: Bill Bonner

Dated: 2009-08-07

Since founding Agora Inc. in 1979, Bill Bonner has found success and garnered camaraderie in numerous communities and industries. A man of many talents, his entrepreneurial savvy, unique writings, philanthropic undertakings, and preservationist activities have all been recognized and awarded by some of America’s most respected authorities. Along with Addison Wiggin, his friend and colleague, Bill has written two New York Times best-selling books, Financial Reckoning Day and Empire of Debt. Both works have been critically acclaimed and internationally. With political journalist Lila Rajiva, he wrote his third New York Times best-selling book, Mobs, Messiahs and Markets, which offers concrete advice on how to avoid the public spectacle of modern finance. Since 1999, Bill has been a daily contributor and the driving force behind The Daily Reckoning .

Goldman gets a hidden bailout…Wall Street uses bailout money for bonuses…Cash for Clunkers…nationalizing GM…quantitative easing…Geithner lies to the Chinese…

Crackpot ideas! Corruption! What next?

But the most breathtaking scene is the one no one seems to notice…

Perhaps it is because we have our head in the clouds…so far above the surface of everyday life that we can look down and see what is happening…

…or perhaps because you have to be a connoisseur of absurdity to appreciate it…

…strange…bizarre…almost surreal…even when you see it, you don’t quite believe it…

First, the voters ruined themselves…now it’s the government’s turn!

The US federal government is digging its own grave…bankrupting itself with its eyes wide shut. And it’s not alone…

Look back a little more than 100 years ago, and you’ll see that something similar happened. Europe went to war. No one knew why. No one knew what he stood to gain. But whether he was a kraut, a frog or a Tommy…he kept at it for four years – until every major government of Europe was broke. Most of them collapsed completely. All of them were broke. Germany and Russia, with the added burdens of war reparations on the one hand, and Bolshevism and civil war on the other, forgot their manners. Both were soon butchering their own people.

In the Great War the generals led the way to calamity. Now it is economists…

Some observers think the economy is recovering already. Others think it is not. If it is not recovering, it is because it didn’t get enough stimulus, they say. If it is recovering, it’s because the stimulus has worked.

“Fewer layoffs expected as recession winds down,” says a headline this morning from one of the wire services.

The Dow fell 25 points yesterday…but it’s still in bear market rally mode. With a little luck, it could go to 10,500.

(Of course, it can do whatever it wants…we’re just guessing, based on the experience of other major crash/depression episodes in history.)

Oil trades at just under $72 this morning. Gold is at $960.

It is “business as usual at Goldman,” says a news report. Which is to say, big bonuses for the bankers. The top eight US banks got more than $170 in bailout money last year. They paid about 20% out in bonuses. [ Hermit : And are still not lending money to anyone, using the most interesting technicalities to repeatedly screw borrowers. ]

But now the press and the politicians are on their case. It looks like they might have to ease up on the bonuses…at least until the heat is off.

The news is mixed. German factory orders are up…but the Bank of England says the recession is worse than expected; it says it will continue buying bonds.

Americans are raising chickens in their backyards again…even in places like Brooklyn. But the latest headlines tell us that requests for unemployment benefits are running below expectations.

The housing market is supposed to be stabilizing…but new waves of defaults, resets and foreclosures are coming. Half America’s mortgages will be underwater by 2011, says a Reuters report. And Deutschebank warned that construction loans were starting to go bad too.

But the big story? Stimulus.

Here is the International Herald Tribune on Monday:

“More Stimulus is Needed to Spark a Strong Recovery,” is the headline. According to the IHT, stimulus is working. And it will work even better if there were more of it.

Once underway, the WWI generals used the same sort of logic. If they were winning, it was because they put so many resources into the campaign. If things were going against them, they called for more men…more guns…more ammunition.

Of course, once a war has begun, it is hard not to want to win it. One hundred years later, it seems obvious the combatants should have called the whole thing off. They could have spared themselves a lot of misery.

But that’s not the way history works. She may be absurd, but she rarely does things by half measures. Once called to action, soldiers fought to win…even at the cost of their own lives.

And now the world’s central banks, Treasuries, and legislatures are at war. With economic strategists egging them on, they have declared war on all that they find unholy about capitalism – deflation, bear markets, and the down swing of the business cycle. John Maynard Keynes, that much-revered strategist from the Depression Era, tells them this is a fight they can win. And they believe it!

Of course, these are the same people who saw nothing to worry about in 2006…the same people who have no idea what is going on – and have the track record to prove it!

Can you really fix a debt-saturated economy by pouring on more debt? We know the answer, don’t we? When you borrow money you take something away from the future and bring it into the present. That is not a bad thing…if you are doing it to increase your future output. In that case, you’ll be able to pay back the loan with your extra earnings. But if you borrow from the future only to consume, the future waits for you…like Shylock waiting for his pound of flesh…

The future caught up with American consumers in 2007. But the feds learned nothing…and soon it will be a ton of flesh the future will want.

“Life seemed much more simple when I was growing up,” said mother, reflecting back on her youth during WWII.

“People were so much more modest. I had a job at Bergstrom Air Base in Texas…[she was in the WACs]; we would show movies to the soldiers who were going overseas. Some of the movies reminded them not to talk to people about where they were going… ‘Loose lips sink ships’ was the phrase.

“And there were some awful movies such as ‘Kill or Be Killed’…it showed them that they had to be on-guard…and they couldn’t hesitate. Of course, it is an awful thought – that you had to kill someone before he killed you. And then there were the movies about social diseases…I don’t remember what we called them then…but these were training films that warned the boys that they might catch a disease overseas if they weren’t careful. But we weren’t allowed to show those movies…we weren’t even allowed to see them.

“To tell you the truth, it was so long ago I can’t remember very accurately. And it was such a different world; I can barely believe it existed. It seems unbelievable now…I can barely believe I lived through it.”

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.08

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #118 on: 2009-08-12 14:35:54 » |

|

"...we’re just guessing, based on the experience of other major crash/depression episodes in history."

[Blunderov] Economics. The science of predicting past events. (At least it's a growth industry - not too many of those are left to us.)

|

|

|

|

|

MoEnzyme

Magister

Gender:

Posts: 2256

Reputation: 6.98

Rate MoEnzyme

infidel lab animal

|

|

Re:We're Fucked - The Coming Economic Crisis

« Reply #119 on: 2009-08-12 22:14:11 » |

|

Quote from: Blunderov on 2009-08-12 14:35:54

"...we’re just guessing, based on the experience of other major crash/depression episodes in history."

[Blunderov] Economics. The science of predicting past events. (At least it's a growth industry - not too many of those are left to us.)

|

Thanks for that Blunderov,

I appreciate that we in the Church of the Virus noticed this collapse months or even a year or so before it happened depending on how you measure these things. Just to be honest, I don't really count myself in the "we" forecaster class except that I had nasty feelings of foreboding and I happened to be reading other people who had already focussed on such a probability. However like all economic issues, past realities are no gaurantee of future performance.

Which brings me to a point of cognitive disonnance with the Church of Virus. Historically we proclaim ourselves as transhumanists - a group ideologically wedded to the concept of the technological singularity, something that by its very definition has no precedent in our past economic models. It would seem to me at clear loggerheads with any science of predicting past events.

So what are we? Transhumanists? Economists? Or something we have yet to define? Have the economists among us finally won (even as I applaud them on their recent predictions)? Are we no longer transhumanists? Should we stop talking about the singularity?

-Mo

|

I will fight your gods for food,

Mo Enzyme

(consolidation of handles: Jake Sapiens; memelab; logicnazi; Loki; Every1Hz; and Shadow)

|

|

|

|