Author

Author

|

Topic: Alarm - Cover Your Ass! (Read 9912 times) |

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Alarm - Cover Your Ass!

« on: 2006-02-27 17:59:30 » |

|

EUROPE 2020 ALARM / Global Systemic Rupture

March 20-26, 2006:

Iran/USA - Release of global world crisis

Not just the Hermit Anymore

Source: Europe 2020

Dated: 2006-02-27

The Laboratoire européen d’Anticipation Politique Europe 2020 (LEAP/E2020) now estimates to over 80% the probability that the week of March 20-26, 2006 will be the beginning of the most significant political crisis the world has known since the Fall of the Iron Curtain in 1989, together with an economic and financial crisis of a scope comparable with that of 1929. This last week of March 2006 will be the turning-point of a number of critical developments, resulting in an acceleration of all the factors leading to a major crisis, disregard any American or Israeli military intervention against Iran. In case such an intervention is conducted, the probability of a major crisis to start rises up to 100%, according to LEAP/E2020.

An Alarm based on 2 verifiable events

The announcement of this crisis results from the analysis of decisions taken by the two key-actors of the main on-going international crisis, i.e. the United States and Iran:

--> on the one hand there is the Iranian decision of opening the first oil bourse priced in Euros on March 20th, 2006 in Teheran, available to all oil producers of the region ;

--> on the other hand, there is the decision of the American Federal Reserve to stop publishing M3 figures (the most reliable indicator on the amount of dollars circulating in the world) from March 23, 2006 onward [1].

These two decisions constitute altogether the indicators, the causes and the consequences of the historical transition in progress between the order created after World War II and the new international equilibrium in gestation since the collapse of the USSR. Their magnitude as much as their simultaneity will catalyse all the tensions, weaknesses and imbalances accumulated since more than a decade throughout the international system.

A world crisis declined in 7 sector-based crises

LEAP/E2020's researchers and analysts thus identified 7 convergent crises that the American and Iranian decisions coming into effect during the last week of March 2006, will catalyse and turn into a total crisis, affecting the whole planet in the political, economic and financial fields, as well as in the military field most probably too:[1.]Crisis of confidence in the Dollar

[2.] Crisis of US financial imbalances

[3.] Oil crisis

[4.] Crisis of the American leadership

[5.] Crisis of the Arabo-Muslim world

[6.] Global governance crisis

[7.] European governance crisis The entire process of anticipation of this crisis will be described in detail in the coming issues of LEAP/E2020’s confidential letter – the GlobalEurope Anticipation Bulletin, and in particular in the 2nd issue to be released on February 16, 2006. These coming issues will present the detailed analysis of each of the 7 crises, together with a large set of recommendations intended for various categories of players (governments and companies, namely), as well as with a number of operational and strategic advices for the European Union.

Decoding of the event “Creation of the Iranian Oil Bourse priced in Euros”

However, and in order not to limit this information to decision makers solely, LEAP/E2020 has decided to circulate widely this official statement together with the following series of arguments resulting from work conducted.

Iran's opening of an Oil Bourse priced in Euros at the end of March 2006 will be the end of the monopoly of the Dollar on the global oil market. The immediate result is likely to upset the international currency market as producing countries will be able to charge their production in Euros also. In parallel, European countries in particular will be able to buy oil directly in their own currency without going though the Dollar. Concretely speaking, in both cases this means that a lesser number of economic actors will need a lesser number of Dollars [2]. This double development will thus head to the same direction, i.e. a very significant reduction of the importance of the Dollar as the international reserve currency, and therefore a significant and sustainable weakening of the American currency, in particular compared to the Euro. The most conservative evaluations give €1 to $1,30 US Dollar by the end of 2006. But if the crisis reaches the scope anticipated by LEAP/E2020, estimates of €1 for $1,70 in 2007 are no longer unrealistic.

Decoding of the event “End of publication of the M3 macro-economic indicator”

The end of the publication by the American Federal Reserve of the M3 monetary aggregate (and that of other components) [3] , a decision vehemently criticized by the community of economists and financial analysts, will have as a consequence to lose transparency on the evolution of the amount of Dollars in circulation worldwide. For some months already, M3 has significantly increased (indicating that « money printing » has already speeded up in Washington), knowing that the new President of the US Federal Reserve, Ben S. Bernanke, is a self-acknowledged fan of « money printing » [4]. Considering that a strong fall of the Dollar would probably result in a massive sale of the US Treasury Bonds held in Asia, in Europe and in the oil-producing countries, LEAP/E2020 estimates that the American decision to stop publishing M3 aims at hiding as long as possible two US decisions, partly imposed by the political and economic choices made these last years [5]:- the ‘monetarisation’ of the US debt

- the launch of a monetary policy to support US economic activity.

- two policies to be implemented until at least the October 2006 « mid-term » elections, in order to prevent the Republican Party from being sent in reeling.

This M3-related decision also illustrates the incapacity of the US and international monetary and financial authorities put in a situation where they will in the end prefer to remove the indicator rather than try to act on the reality.

Decoding of the aggravating factor “The military intervention against Iran”

Iran holds some significant geo-strategic assets in the current crisis, such as its ability to intervene easily and with a major impact on the oil provisioning of Asia and Europe (by blocking the Strait of Ormuz), on the conflicts in progress in Iraq and Afghanistan, not to mention the possible recourse to international terrorism. But besides these aspects, the growing distrust towards Washington creates a particularly problematic situation. Far from calming both Asian and European fears concerning the accession of Iran to the statute of nuclear power, a military intervention against Iran would result in an quasi-immediate dissociation of the European public opinions [6] which, in a context where Washington has lost its credibility in handling properly this type of case since the invasion of Iraq, will prevent the European governments from making any thing else than follow their public opinions. In parallel, the rising cost of oil which would follow such an intervention will lead Asian countries, China first and foremost, to oppose this option, thus forcing the United States (or Israel) to intervene on their own, without UN guarantee, therefore adding a severe military and diplomatic crisis to the economic and financial crisis.

Relevant factors of the American economic crisis

LEAP/E2020 anticipate that these two non-official decisions will involve the United States and the world in a monetary, financial, and soon economic crisis without precedent on a planetary scale. The ‘monetarisation’ of the US debt is indeed a very technical term describing a catastrophically simple reality: the United States undertake not to refund their debt, or more exactly to refund it in "monkey currency". LEAP/E2020 also anticipate that the process will accelerate at the end of March, in coincidence with the launching of the Iranian Oil Bourse, which can only precipitate the sales of US Treasury Bonds by their non-American holders.

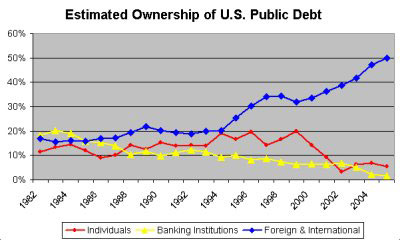

In this perspective, it is useful to contemplate the following information 7: the share of the debt of the US government owned by US banks fell down to 1,7% in 2004, as opposed to 18% in 1982. In parallel, the share of this same debt owned by foreign operators went from 17% in 1982 up to 49% in 2004.

--> Question: How comes that US banks got rid of almost all their share of the US national debt over the last years?

Moreover, in order to try to avoid the explosion of the "real-estate bubble" on which rests the US household consumption, and at a time when the US saving rate has become negative for the first time since 1932 and 1933 (in the middle of the "Great Depression"), the Bush administration, in partnership with the new owner of the US Federal Reserve and a follower of this monetary approach, will flood the US market of liquidities.

Some anticipated effects of this systemic rupture

According to LEAP/E2020, the non-accidental conjunction of the Iranian and American decisions, is a decisive stage in the release of a systemic crisis marking the end of the international order set up after World War II, and will be characterised between the end of March and the end of the year 2006 by a plunge in the dollar (possibly down to 1 Euro = 1,70 US Dollars in 2007) putting an immense upward pressure on the Euro, a significant rise of the oil price (over 100$ per barrel), an aggravation of the American and British military situations in the Middle East, a US budgetary, financial and economic crisis comparable in scope with the 1929 crisis, very serious economic and financial consequences for Asia in particular (namely China) but also for the United Kingdom [8], a sudden stop in the economic process of globalisation, a collapse of the transatlantic axis leading to a general increase of all the domestic and external political dangers all over the world.

For individual dollar-holders, as for trans-national corporations or political and administrative decision makers, the consequences of this last week of March 2006 will be crucial. These consequences require some difficult decisions to be made as soon as possible (crisis anticipation is always a complex process since it relies on a bet) because once the crisis begins, the stampede starts and all those who chose to wait lose.

For private individuals, the choice is clear: the US Dollar no longer is a “refuge” currency. The rising-cost of gold over the last year shows that many people have already anticipated this trend of the US currency.

Anticipating… or being swept away by the winds of history

For companies and governments - European ones in particular - LEAP/E2020 has developed in its confidential letter – the GlobalEurope Anticipation Bulletin -, and in particular in the next issue, a series of strategic and operational recommendations which, if integrated in today's decision-making processes, can contribute to soften significantly the "monetary, financial and economic tsunami" which will break on the planet at the end of next month. To use a simple image – by the way, one used in the political anticipation scenario « USA 2010 » [9] -, the impact of the events of the last week of March 2006 on the “Western World” we have known since 1945 will be comparable to the impact of the Fall of the Iron Curtain in 1989 on the “Soviet Block”.

If this Alarm is so precise, it is that LEAP/E2020’s analyses concluded that all possible scenarios now lead to one single result: we collectively approach a "historical node" which is henceforth inevitable whatever the action of international or national actors. At this stage, only a direct and immediate action on the part of the US administration aimed at preventing a military confrontation with Iran on the one hand, and at giving up the idea to monetarise the US foreign debt on the other hand, could change the course of events. For LEAP/E2020 it is obvious that not only such actions will not be initiated by the current leaders in Washington, but that on the contrary they have already chosen "to force the destiny" by shirking their economic and financial problems at the expense of the rest of the world. European governments in particular should draw very quickly all the conclusions from this fact.

For information, LEAP/E2020's original method of political anticipation has allowed several of its experts to anticipate (and publish) in particular : in 1988, the pproaching end of the Iron Curtain; in 1997, the progressive collapse in capacity of action and democratic legitimacy of the European institutional system; in 2002, the US being stuck in Iraq’s quagmire and above all the sustainable collapse of US international credibility; in 2003, the failure of the referenda on the European Constitution. Its methodology of anticipation of "systemic ruptures" now being well established, it is our duty as researchers and citizens to share it with the citizens and the European decision makers; especially because for individual or collective, private or public players, it is still time to undertake measures in order to reduce significantly the impact of this crisis on their positions whether these are economic, political or financial.

LEAP/E2020's complete analysis, as well as its strategic and operational recommendations intended for the private and public actors, will be detailed in the next issues of the GlobalEurope Anticipation Bulletin, and more particularly in the econd one (issued February 16th, 2006).

1. These decisions were made a few months ago already:

2. By examining Table 13B of the December 2005 Securities Statistics of the Bank for International Settlements entitled International Bonds and Notes (in billions of US dollars), by currency ), one can notice that at the end of 2004 (China not-included), 37.0% of the international financial assets were labelled in USD vs 46,8% in Euros ; while in 2000, the proportion was contrary with 49,6% labelled in USD for 30,1% only in Euros. It indicates that the March 2006 decisions will most probably accelerate the trend of exit-strategy from the dollar.

3. Monetary aggregates (M1, M2, M3, M4) are statistical economic indicators. M0 is the value of all currency - here the dollar - that exists in actual bank notes and coins. M1 is M0 + checking accounts of this currency. M2 is M1 + money market accounts and Certificates of Deposits (CD) under $100,000. M3 is M2 + all larger holdings in the dollar (Eurodollar reserves, larger instruments and most non-European nations' reserve holdings) of $100,000 and more. The key point here is that when the Fed stops reporting M3, the entire world will lose transparency on the value of reserve holdings in dollars by other nations and major financial institutions.

4. See his eloquent speech on these aspects before the National Economists Club, Washington DC, November 21, 2002

(http://www.federalreserve.gov/boarddocs/speeches/2002/20021121/default.htm )

5. It should be noticed that the upward trend of the Dollar in 2005 was mostly the result of an interest rate differential which was favourable for the US Dollar, and of the “tax break on foreign earnings” Law (only valid for 1 year) which brought back to the US over $200 billion in the course of 2005.

(source : CNNmoney.com http://money.cnn.com/2005/10/05/news/economy/jobs_overseas_profits )

6. As regards Europe, LEAP/E2020 wishes to underline that European governments are no longer in line with their opinions concerning the major topics, and in particular concerning the European collective interest. The January 2006 GlobalEurometre clearly highlighted the situation with a Tide-Legitimacy Indicator of 8% (showing that 92% of the panel consider that EU leaders no longer represent their collective interests) and a Tide-Action Indicator of 24% (showing that less than a quarter of the panel thinks EU leaders are capable of translating their own decisions into concrete actions). According to LEAP/E2020, public declarations of support to Washington coming from Paris, Berlin or London, should not hide the fact that the Europeans will quickly dissociate from the US in case of military attack (the GlobalEurometre is a monthly European opinion indicator publishing in the GlobalEurope Anticipation Bulletin 3 figures out of which 2 are public).

7.(source : Bond Market Association, Holders of Treasury Securities: Estimated Ownership of U.S. Public Debt Securities ; http://www.dailykos.com/story/2006/1/28/122315/558 )

8. The United Kingdom indeed owns close to 3,000 billion $ of credits, that is almost three times what countries such as France or Japan hold. (source Bank of International Settlements, Table 9A, Consolidated Claims of Reporting Banks on Individual Countries )

9. Cf. GlobalEurope Anticipation Bulletin N°1 (January 2006)

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #2 on: 2006-02-28 22:44:28 » |

|

No. Not from you, but via an investment management group. I lost track of your limbic site while off-line. Will peek at it from time to time now that I know where it is, but I do you the favor of reading and considering your words, so I should make it conditional on your agreeing to read what I write and not what you think I might have written :-)

Hermit

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

JD

Magister

Gender:

Posts: 542

Reputation: 6.86

Rate JD

|

|

Re:Alarm - Cover Your Ass!

« Reply #3 on: 2006-03-02 07:17:53 » |

|

Quote from: Hermit on 2006-02-28 22:44:28

No. Not from you, but via an investment management group. I lost track of your limbic site while off-line. Will peek at it from time to time now that I know where it is, but I do you the favor of reading and considering your words, so I should make it conditional on your agreeing to read what I write and not what you think I might have written :-) |

Deal :-)

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #4 on: 2006-03-29 08:00:25 » |

|

Standard & Poor's specialists predict global economic Armageddon

Specialists believe that the US will lose almost 45 percent of its [value against the] euro in the near future

This is now old news, but still, of course, applicable. Despite the Iranian Bourse now appearing to be 6 months to a year off, and the urgency of the US war talk somewhat lessened, I continue to suggest sticking with metals in the medium term.

Source: Pravda

Dated: 2006-01-31

Contrast: Pravda

Experts of Standard & Poor's forecast a global economic collapse. The collapse will be caused with the demise of the US dollar rate against the European currency by more than 30 percent. The dollar, specialists say, may lose almost 45 percent of its current value against the euro. However, it is obvious that even a 30 percent reduction will affect the international economy greatly.

Standard & Poor's (SP) ties the possible decline of the American currency with the imminent rise of the European economy and the payment shortage of the USA, which made up 6.4 percent of the nation's GDP last year ($790 billion).

SP analysts emphasize the restricted growth of the USA's GDP, which has been behind the level of ten percent for quite a while. US assets - securities and real estate - successfully compensate the 6.5 percent payment shortage of the GDP at present. The assets enjoy very good demands on the market: the growth of their cost outstrips the growing volume of the payment deficit. SP specialists believe, however, that the cost of the above-mentioned assets has been increasing for a very long time. This process is expected to stop sooner or later, SP analysts say. If it happens, the issue of the US dollar stability will surface immediately. The global economic collapse will follow shortly after that.

The European Central Bank has expressed its concerns with the forecast from Standard & Poor's. European financial specialists say that the demise of the American currency will endanger the global economy on the whole. Alex Weber, a member of the ECB council, stated during the recent Economic Forum in Davos that international investors do not pay enough attention to the risks which the global economy has to face at the moment. The President of the European Central Bank Jean-Claude Trichet agreed with his colleague. According to Trichet, the world will have to pay a huge price for the ongoing increase of the payment deficit in the USA.

The forecast from Standard & Poor's contains several contradictions as well. The US dollar has very strong defenders outside the USA - China and Japan. The two countries acquire the stocks of the US Treasury to support the dollar. The dollar share makes up 70 percent (almost one trillion US dollars) of the Chinese currency reserves despite the continuing process to reduce the dollar constituent in China's reserves. Therefore, China is highly interested in the preservation of the dollar value.

While Standard & Poor's specialists talk about the looming collapse of the American currency, Citigroup analysts predicted the end of the dollar reign in the world economy back in 2005. Nowadays, Citigroup forecasts the fall of the European currency and recommend investors to sell euros.

If the pessimistic forecast from Standard & Poor's is destined to come true, the declining dollar will affect the world economy entirely and lead to unpredictable consequences. The crisis will obviously strike a serious blow on the Russian economy too. The decline of the dollar rate and the growth of the euro may become a positive factor for many Russian producers, though. If the euro grows, the Russian goods exported to Europe will become more competitive.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #5 on: 2006-04-12 19:13:59 » |

|

Politics, philosophy and society

Downsizing dreams

Polly Toynbee is aghast at the fat-cat culture that has overtaken the world as revealed in Barbara Ehrenreich's Bait and Switch and Stewart Lansley's Rich Britain

Source: The Guardian

Authors: Polly Toynbee

Dated: 2006-04-08

Bait and Switch: The Futile Pursuit of the Corporate Dream, by Barbara Ehrenreich (256pp, Granta, £9.99)

Rich Britain: The Rise and Rise of the New Super-wealthy, by Stewart Lansley (265pp, Politico's, £18.99)

How extraordinarily misleading economic statistics can be. Talk of "average" earnings or "per capita" wealth is virtually meaningless as a true description of a nation: if Bill Gates moved to Albania it would soar up the league tables without a single Albanian being a penny better off. This mendacity has never been more grotesque than in the US right now. The myth of America the thriving, booming, prospering envy of the world is most chillingly exposed in the writings of Barbara Ehrenreich. How she strips away the varnish to reveal the lives of the slaves toiling beneath the surface to prop up a curiously hollowed-out empire.

In her most celebrated book, Nickel and Dimed, she took jobs among minimum wage workers, living in a caravan and a motel, failing to survive on $7 an hour. It left the British reader aghast at a far more brutal capitalism, redder in tooth and claw with no safety nets, no health care, no social security. Only charity food parcels stave off starvation for people doing America's essential work, sometimes two or three jobs at once in the richest nation the world has ever known.

Now, Ehrenreich turns her razor-sharp reporting skills on the corporate world. She sets out with suit and briefcase to join business America, the offices of middle management to which most graduates aspire. Unfortunately she doesn't make the grade in the white collar world. As a reporter, this might have been a failed enterprise, a dead story. After all, she is not a good prospect. She is in her 50s, has never worked in business before and aspires to become a PR in the pharmaceutical sector. Even with a good deal of lying and friends to proffer references, frankly, it looks from the start like a doomed enterprise. By the end she concludes the only way she will get near the management suites is pushing a catering trolley.

But Ehrenreich is the kind of reporter who could be put down just about anywhere and always come up with revelations and perceptions of the society around her, its people, their hopes and fears. So as she surfs the job boards on the net, rewrites her CV over and over, networks her way to follow every improbable lead towards the chance of a job, she finds herself down among the many fallers from corporate America. It is not just those who start out poor and uneducated who are destined to plunge into the abyss: it could be almost anyone.

Downsizing after mergers, the arrival of a new manager or the constant cult of cuts keep managers on their toes. If they are "let go" and don't find another job fast, many, maybe most, are doomed to tumble down the social ladder. She meets them at expensive and futile networking conferences and motivational job search events. But a gap on a resumé - never called unemployed but "in transition" or "consulting" - is CV death. Most job applications receive no acknowledgment. From outside the office citadels become increasingly impregnable. Once hot personal contacts go cold, these fallers have no chance.

But America the entrepreneurial has spotted a market here. These desperate people are preyed on by a whole industry of obnoxious (and themselves pretty desperate) career-coaches, "professional mentors" and trainers offering excruciating pop-psychology: reinvent yourself; smile. The psycho-babble of business spills into a kind of bullying, yet these frantic job-seekers shell out a fortune to receive it: it's their fault, their future is in their hands, there is nothing wrong the system, the only failings are all their own. Tragically, most sink into exactly the despair the career coaches say makes them unemployable. Many end up taking minimum wage jobs. Europe could do that tomorrow, if we abandoned social security to starve people into sub-subsistence jobs.

The American dream is so powerful that even those living the nightmare still believe it. Ehrenreich often uncovers this depressing phenomenon in her rich portfolio of reporting America. She picks away at a brain-washed multitude clinging to a false idol. Without political leadership to suggest that the dream is all but dead and aspirational social mobility stuck in cement, the millions at the sharp end ignore the evidence of their own experience to believe still that anyone can make it. Those who don't are just failures.

Only Ehrenreich's acid wit and caustic political intelligence makes this an enjoyable as well as a horrible read. But if you are in the mood for dark humourless mirth, then Rich Britain makes a good accompaniment. Stewart Lansley charts the progress of inequality at the top. The super rich are a new phenomenon whose fortunes took off in the 1980s and kept soaring. The late 70s were the most equal period Britain has ever known, a time when the onward march of social progress and fairer shares was taught in every classroom as if it were historical inevitability, from factory acts and boys up chimneys to universal education and health. What went wrong?

This is a journalistic book, with more cuttings than original research, but it does the business. Well written and well analysed, it revolts and disgusts with tales of squalid greed at the top. All the statistics and the hard facts are there - how it happened, why it happened and how we are destined, unless someone stops it, to watch the pigs in the farmhouse continue to wallow in excess beyond the dreams of a Nero.

The stratosphere of the boardrooms, where the likes of Lord Browne of BP now earn £6.5m a year, has moved as far from the life of the average citizen as the addict in a blanket under Waterloo bridge. They no longer inhabit the same planet as the rest of us, hermetically sealed in smoke-windowed limo, private jet, private island, private everything. Yet they are more driven by the politics of envy than any mere socialist. They are driven on and on by that gross desire to be top dog, with top dollar, bigger bonuses than the boardroom next door, fatter jet and more richly bejewelled arm candy. Read this, keep it, store up some of its more pungent statistics and keep asking Labour what it's there for, if never to say enough is enough?

· Polly Toynbee's Hard Work is published by Bloomsbury

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #6 on: 2006-06-02 20:09:05 » |

|

Jobs data underline Fed stagflation dilemma

Source: Reuters

Authors: Ros Krasny

Dated: 2006-06-02

[Hermit: Emphasis below is mine.

Stagflation anyone? Friday's surprisingly weak U.S. May payrolls report suggested the Federal Reserve should seriously consider pausing this month after 17 consecutive interest rate rises in the past two years, but that begs the question of what to do about inflation.

The U.S. looks like it may be facing a slowing economy this year along with higher inflation, raising the possibility of "stagflation", or a period characterized by high inflation combined with economic stagnation, such as last occurred in the 1970s.

Economists this week have mulled the extent to which the Fed's options have narrowed as the economy slows at the same time cyclical inflation still seems to be rising.

The weak U.S. payrolls data on Friday may have been a tiebreaker in the debate over whether to raise interest rates again or not at the Fed's meeting on June 28-29.

Only 75,000 U.S. non-farm jobs were created in May, according to the Labor Department on Friday, far short of Wall Street expectations and the lowest monthly number since October last year.

The number of jobs created in March and April was revised down as well, and the six-month average job creation rate is now 145,833, down more than 50,000 from the average reported last month.

"We think this is the start of the end of the cycle. The Fed should stop before it does more damage," said Ian Shepherdson, chief U.S. economist at High Frequency Economics in Valhalla, New York.

Average hourly earnings in May crept up by just 0.1 percent, short of forecasts for a 0.3 percent gain, and dramatically below April's 0.6 percent advance.

That might calm worries about wage inflation, although the U.S. jobless rate is now just 4.6 percent, its lowest in almost five years, and has been below 5 percent for the past six months.

On the Chicago Board of Trade futures prices for federal funds contracts showed chances that the Fed will raise the federal funds rate for a 17th consecutive time, to 5.25 percent in June, fell as low as 42 percent after Friday's jobs data.

Chances of a June rise in the fed funds rate peaked at 80 percent this week on the market's reading of minutes from the May 10 Federal Open Market Committee (FOMC) meeting.

"Overall, based on today's report we feel more comfortable with our belief that the Fed will pause at the June 28-29 FOMC meeting," said Glenn Haberbush, economist at Mizuho Securities in New York.

Dealers said some of the power of Friday's move reflected a delayed response to weak data on factory output, pending home sales, and weekly jobless claims on Thursday, which was largely brushed aside in the pre-payrolls data vigil.

"A bevy of economic data was released (Thursday) all pointing to less economic activity in nearly every sector of the economy," said Brian Fabbri, chief economist, North America, at BNP Paribas.

"The latest payroll data reflected a substantial slowdown in economic momentum ... it now looks as though the economy is headed for much slower growth in months ahead."

Because inflation is a lagging indicator, the central bank has sometimes felt empowered to end a monetary policy tightening campaign even while inflation pressure is still rising.

Such a move now seems be in the cards for 2006, even though Fed officials such as Chicago Fed President Michael Moskow on Tuesday have fretted about the need to not let the damaging inflation horse gallop out of the barn.

"The economy is slowing, fast, and it is to be hoped Mr. Bernanke will be able to use these data to face down those FOMC members who doubt the slowdown story and are obsessing over backward-looking inflation data," Shepherdson said.

The major data input for the June 28-29 FOMC meeting will be May inflation data, notably the consumer price index due on June 14.

Alas, the Fed's favorite inflation reading, the core personal consumption expenditures (PCE) price index, is not due until June 30, a day after policy-makers roll the dice.

"The employment data give the Fed a little wiggle room not to tighten in June, if core May consumer price index comes in at 0.2 percent or less," said Alan Ruskin, chief international strategist at Greenwich Capital Markets in Greenwich, Connecticut.

"If core CPI comes in at 0.3 percent they will still likely feel compelled to tighten, and the market would then flirt with a hard-landing," Ruskin said.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #7 on: 2006-09-01 00:35:26 » |

|

The US housing bubble has popped - what now?

Source: Money Week

Authors: John Stepek

Dated: 2006-08-30

US consumers are now the most pessimistic they’ve been since November last year.

That might not sound like a long time, but it’s important to remember that in November 2005, the US south coast had just been ravaged by a string of lethal hurricanes - so it‘s not surprising Americans were feeling downbeat.

This year, there’s not much sign of hurricanes - though it’s early in the season yet. But consumers have good reason to be worried. Oil prices are nearly as high as they were after Katrina had just blown herself out, while fears of a US house price crash are hitting front pages across the developed world.

And yet while there’s hope that there will be no further interest rate hikes, stock markets are clinging onto gains. But the optimists on Wall Street should be just as worried as everyone else…

Things aren’t looking good for the US economy. Even The Times’s generally optimistic American columnist Gerald Baker declared the US house price bubble well and truly over yesterday. And other commentators have been far more negative.

New York university economics professor Nouriel Roubini goes as far as to say that: “Every possible indicator of the housing sector that has been coming out in the last few weeks…suggests that the housing market is in free fall.” He reckons that “this may end up being the biggest housing bust in the last 75 years” - in other words, since the Great Depression.

US consumers have been relying on the housing market to fund their debt-fuelled spending. A housing bust of these proportions would be “enough to trigger a US recession…expect the great recession of 2007 to be much nastier, deeper and more protracted than the 2001 recession.”

But stock markets are still hoping against hope that the Federal Reserve will pull a rabbit out of its hat, just as Alan Greenspan always seemed to do. Although the consumer confidence data battered US markets in early trading yesterday, the Dow and the S&P 500 both closed higher. The mood swing came after minutes from this month’s Fed meeting showed that the bankers decided to keep rates on hold because they expect US economic growth to slow down.

The trouble is that the way Greenspan kept the US economy afloat after the tech bubble burst was by inflating a newer, bigger bubble, the US housing bubble. But now that the US housing bubble is bursting, it’s hard to see how you could find another, bigger bubble to cushion the impact - after all, there are few other assets that are owned by such a significant portion of the population.

Besides, the US is now facing rising inflation, which makes the interest rate decision a much tougher call than in Greenspan’s day. The Fed minutes also indicated that the bankers are keeping their options open, and many still believe further rate hikes will be needed. In fact, Mr Bernanke’s fellow central bankers are among those who think that the Fed is going too soft on inflation.

The Bank of England’s own Charles Bean had a dig at US monetary policy at the central bankers’ annual trip to Jackson Hole in the States over the weekend. He argued - much as we do here at Money Week - that using core inflation, which excludes fuel and food costs, makes no sense and understates the real rise in living costs. The Fed of course is fond of this core measure for that very reason.

But Mr Bean points out that high oil prices are at least in part due to rising demand from China. One of the reasons that Chinese demand is rising is because the Chinese are building so many factories, which then produce cheap goods, which they then ship back to the West, and the US in particular.

On the one hand, these cheap goods push down inflation. On the other hand, Chinese demand is pushing up fuel costs. One goes hand in hand with the other. But the ‘core’ inflation measure conveniently ignores the higher fuel prices, but includes the lower consumer goods prices, giving a measure of inflation that is ‘lop-sided’, as Martin Hutchinson puts it on Breakingviews.com. And that means interest rates are set too low. This is obvious when you look at real interest rates, which are adjusted for inflation. US real rates are sitting at just 0.5% in the States, if you use the headline inflation rate of 4.8% rather than the core rate of 3.1%. That compares to 2.35% in the UK.

It’s not surprising that Mr Bean is annoyed. According to Credit Suisse, the US is responsible for the pick-up in global inflation since 2002. “US domestic price pressures are threatening to put an end to a global disinflationary process that has been a constant trend in the global economy since the ‘90s.”

In other words, by going easy on the rate hikes, the US is making other central bankers‘ jobs harder. “An overly accommodative Fed has flooded the world with dollars,” adds Martin Hutchison. “That makes it more difficult for other central bankers to control inflation; interest rates have to rise further and economic activity is choked off.”

With the inflation threat much greater now, it will be far harder for the US to justify cutting interest rates to see off recession, without foreign holders of US dollars concluding that the country is just trying to inflate its way out of its debts.

To be fair to Mr Bernanke, it’s not entirely his fault - he‘s in trouble whatever he does with interest rates. The seeds for the 2007 recession were sown a long time ago, under his predecessor, the man some called the ‘Maestro‘. We reckon that posterity will come up with a few more, less flattering names for Mr Greenspan once the housing bubble has detonated.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.06

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:Alarm - Cover Your Ass!

« Reply #8 on: 2006-09-03 13:31:04 » |

|

"This is the way the world ends

This is the way the world ends

This is the way the world ends

Not with a bang but a whimper."

~T.S. Eliot - The Hollow Men.

http://www.smirkingchimp.com/article.php?sid=27539

Mike Whitney: 'Pop goes the bubble! The Great Housing Crash of '07'

Posted on Thursday, August 31 @ 10:01:43 EDT

This article has been read 6708 times.

--------------------------------------------------------------------------------

Mike Whitney

This month's figures prove that the so-called "housing bubble" is not only real, but that its cratering faster than anyone had realized. As the UK Guardian reported just yesterday, "the orderly housing slowdown predicted by the Federal Reserve will (soon) become a full-blown crash".

All the indicators are now pointing in the wrong direction. Consumer confidence is down, inventory is at a 10 year high, and the number of homes sold in July was 22% lower than last year. As Paul Ashworth, chief economist at Capital Economics said, "Things seem to be getting worse very quickly. Freefall is a strong word, but I think it's the right one to use here." (UK Guardian)

The housing bubble is a $10 trillion equity balloon that will explode sometime in 2007 when more than $1 trillion in no-interest, no down payment, adjustable-rate mortgages (ARMs) reset; setting the stage for massive home devaluation, foreclosures and unemployment. ("By some estimates housing activity has accounted for 40% of all the jobs created since 2001". Times Online) July's plunging sales are just the first sign of a major slowdown. The worst is yet to come.

The blame for this rapidly-approaching meltdown lies entirely with the Federal Reserve, the privately-owned collection of 10 central banks who cooked up a way to shift wealth from one class to another through low interest rates.

Sound crazy?

Well, just as high interest rates cause the economy to slow down; low interest rates have the exact opposite effect by stimulating the economy through increased spending. It's all pretty clear-cut.

When the stock market nose-dived in 2000 the Fed lowered rates 17 times to an unbelievable 1% to keep the economy sputtering-along while the Bush administration dragged the country to war, gave away $450 billion a year in tax cuts, and awarded zillions in no bid contracts to their friends in big business. All tolled, the Bush-handouts amounted to roughly $3 trillion dollars, the largest heist in history, and it was carried out under the nose of the snoozing American public.

At the same time, America's debts and deficits have continued to mushroom behind the smokescreen of low interest rates.

Rather than face the recession which should have followed stock market crash, the Fed chose to increase the money supply (which doubled in the last 7 years) and lower the qualifications for getting mortgages. (I read recently that 90% of first time home buyers not only lie on their mortgage applications, but that 50% of them say that they earn TWICE as much as they really do. The applications are not cross-checked with IRS statements) Now, tens of thousands of Americans live in $400,000 and $500,000 homes without a penny of equity in them and with loans that are timed to increase dramatically in 2007. (Many of the monthly payments will double)

So, how can we blame the Fed for the reckless and irresponsible behavior of the average homeowner?

Well, because they knew the effects of their "cheap money" policy every step of the way.

First of all, the Fed knew exactly where the money was going. Greenspan endorsed the shabby new lending-regime which put hundreds of billions of dollars in the hands of people who never should have qualified for mortgages. They were set up to fail just like the victims in the stock market scam who kept dumping their life savings in the NASDAQ when PE's were shooting through the stratosphere.

Secondly, the Fed knew that wages had actually regressed (2.3%) since Bush took office, so they knew that the soaring value of real estate was entirely predicated on debt not real wealth. In other words, home values increased because of the availability of cheap money which inevitably creates a buying-frenzy. It had nothing to do with real demand or growth in wages.

And, thirdly, according to the Fed's own figures, "the total amount of residential housing wealth in the US just about doubled between 1999 and 2006"up from $10.4 trillion to $20.4 trillion". Times Online.

UP $10 TRILLION IN 7 YEARS! That is the very definition of a humongous, economy-killing equity monster. In other words, the Fed knew the ACTUAL SIZE OF THE BUBBLE and chose to steer it towards the nearest iceberg without warning the public.

This is what Greenspan called "a little froth".

There is no real growth in the American economy. Figure it out. Last year Americans saved less than 0% of their net earnings while they borrowed a whopping $600 billion from their home equity to piss-away on a consumer spending-spree. Once home prices begin to retreat, that $600 billion will evaporate, real GDP will shrivel, and the economy will begin flat-lining. (Consumer spending is 70% of GDP)

The Federal Reserve's plan is so simple; we shouldn't dignify it by calling it a conspiracy. It's merely a matter of hypnotizing the masses with low interest rates while trillions of dollars of real wealth is diverted to corporate big-wigs and American plutocrats.

It might not be rocket science, but it worked like a charm.

Now, the trap-door has been sprung; the country is dead-broke and all the levers are in place for a police state. As the housing-balloon slowly limps towards earth, the new Halliburton detention centers are up and running, the National Guard is in Rummy's control, the Feds are able to listen-in on every phone call we make.

The noose is beginning to tighten.

New Orleans was just a dress rehearsal for the new world order; 300,000 million Americans reduced to grinding poverty while the economy explodes into sheets of flames.

Mike Whitney lives in Washington state. He can be reached at: fergiewhitney@msn.com.

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #9 on: 2006-10-30 07:17:19 » |

|

GAO chief warns economic disaster looms

Source: Seattle PI

Dated: Matt Crenson (AP National Writer)

Dated: 2006-10-28

David M. Walker sure talks like he's running for office. "This is about the future of our country, our kids and grandkids," the comptroller general of the United States warns a packed hall at Austin's historic Driskill Hotel. "We the people have to rise up to make sure things get changed."

But Walker doesn't want, or need, your vote this November. He already has a job as head of the Government Accountability Office, an investigative arm of Congress that audits and evaluates the performance of the federal government.

Basically, that makes Walker the nation's accountant-in-chief. And the accountant-in-chief's professional opinion is that the American public needs to tell Washington it's time to steer the nation off the path to financial ruin.

From the hustings and the airwaves this campaign season, America's political class can be heard debating Capitol Hill sex scandals, the wisdom of the war in Iraq and which party is tougher on terror. Democrats and Republicans talk of cutting taxes to make life easier for the American people.

What they don't talk about is a dirty little secret everyone in Washington knows, or at least should. The vast majority of economists and budget analysts agree: The ship of state is on a disastrous course, and will founder on the reefs of economic disaster if nothing is done to correct it.

There's a good reason politicians don't like to talk about the nation's long-term fiscal prospects. The subject is short on political theatrics and long on complicated economics, scary graphs and very big numbers. It reveals serious problems and offers no easy solutions. Anybody who wanted to deal with it seriously would have to talk about raising taxes and cutting benefits, nasty nostrums that might doom any candidate who prescribed them.

"There's no sexiness to it," laments Leita Hart-Fanta, an accountant who has just heard Walker's pitch. She suggests recruiting a trusted celebrity - maybe Oprah - to sell fiscal responsibility to the American people.

Walker doesn't want to make balancing the federal government's books sexy - he just wants to make it politically palatable. He has committed to touring the nation through the 2008 elections, talking to anybody who will listen about the fiscal black hole Washington has dug itself, the "demographic tsunami" that will come when the baby boom generation begins retiring and the recklessness of borrowing money from foreign lenders to pay for the operation of the U.S. government.

"He can speak forthrightly and independently because his job is not in jeopardy if he tells the truth," said Isabel V. Sawhill, a senior fellow in economic studies at the Brookings Institution.

Walker can talk in public about the nation's impending fiscal crisis because he has one of the most secure jobs in Washington. As comptroller general of the United States - basically, the government's chief accountant - he is serving a 15-year term that runs through 2013.

This year Walker has spoken to the Union League Club of Chicago and the Rotary Club of Atlanta, the Sons of the American Revolution and the World Future Society. But the backbone of his campaign has been the Fiscal Wake-up Tour, a traveling roadshow of economists and budget analysts who share Walker's concern for the nation's budgetary future.

"You can't solve a problem until the majority of the people believe you have a problem that needs to be solved," Walker says.

Polls suggest that Americans have only a vague sense of their government's long-term fiscal prospects. When pollsters ask Americans to name the most important problem facing America today - as a CBS News/New York Times poll of 1,131 Americans did in September - issues such as the war in Iraq, terrorism, jobs and the economy are most frequently mentioned. The deficit doesn't even crack the top 10.

Yet on the rare occasions that pollsters ask directly about the deficit, at least some people appear to recognize it as a problem. In a survey of 807 Americans last year by the Pew Center for the People and the Press, 42 percent of respondents said reducing the deficit should be a top priority; another 38 percent said it was important but a lower priority.

So the majority of the public appears to agree with Walker that the deficit is a serious problem, but only when they're made to think about it. Walker's challenge is to get people not just to think about it, but to pressure politicians to make the hard choices that are needed to keep the situation from spiraling out of control.

To show that the looming fiscal crisis is not a partisan issue, he brings along economists and budget analysts from across the political spectrum. In Austin, he's accompanied by Diane Lim Rogers, a liberal economist from the Brookings Institution, and Alison Acosta Fraser, director of the Roe Institute for Economic Policy Studies at the Heritage Foundation, a conservative think tank.

"We all agree on what the choices are and what the numbers are," Fraser says.

Their basic message is this: If the United States government conducts business as usual over the next few decades, a national debt that is already $8.5 trillion could reach $46 trillion or more, adjusted for inflation. That's almost as much as the total net worth of every person in America - Bill Gates, Warren Buffett and those Google guys included.

A hole that big could paralyze the U.S. economy; according to some projections, just the interest payments on a debt that big would be as much as all the taxes the government collects today.

And every year that nothing is done about it, Walker says, the problem grows by $2 trillion to $3 trillion.

People who remember Ross Perot's rants in the 1992 presidential election may think of the federal debt as a problem of the past. But it never really went away after Perot made it an issue, it only took a breather. The federal government actually produced a surplus for a few years during the 1990s, thanks to a booming economy and fiscal restraint imposed by laws that were passed early in the decade. And though the federal debt has grown in dollar terms since 2001, it hasn't grown dramatically relative to the size of the economy.[Hermit: More to the point, when measured against a commodities basket (which is no longer "made in America), the value of the dollar has plummeted since 2000. The only thing disguising the extent of the plunge is that the rest of the world has carefully printed money at about the same rate as the US has. But even though about 45% of our purchases return to the US as borrowings (nice accounting trick that), the value of commodities clearly reflects the decreased purchasing power of the dollar (and why they are no longer included in the CPI and PPI which are, if the same basis as was used in the 1990s is applied, running in excess of 10%).]

But that's about to change, thanks to the country's three big entitlement programs - Social Security, Medicaid and especially Medicare. Medicaid and Medicare have grown progressively more expensive as the cost of health care has dramatically outpaced inflation over the past 30 years, a trend that is expected to continue for at least another decade or two.

And with the first baby boomers becoming eligible for Social Security in 2008 and for Medicare in 2011, the expenses of those two programs are about to increase dramatically due to demographic pressures. People are also living longer, which makes any program that provides benefits to retirees more expensive.

Medicare already costs four times as much as it did in 1970, measured as a percentage of the nation's gross domestic product. It currently comprises 13 percent of federal spending; by 2030, the Congressional Budget Office projects it will consume nearly a quarter of the budget.[Hermit: Perhaps we should ask Fidel Castro for help. After all, we have adopted and exceeded most of Cuba's more horrible practices (no habeas corpus, torture, detention at the pleasure of the president, massive financial manipulation of the market, politicians wearing military uniforms, etc.), we might as well try to adopt a couple of their effective practices too!]

Economists Jagadeesh Gokhale of the American Enterprise Institute and Kent Smetters of the University of Pennsylvania have an even scarier way of looking at Medicare. Their method calculates the program's long-term fiscal shortfall - the annual difference between its dedicated revenues and costs - over time.

By 2030 they calculate Medicare will be about $5 trillion in the hole, measured in 2004 dollars. By 2080, the fiscal imbalance will have risen to $25 trillion. And when you project the gap out to an infinite time horizon, it reaches $60 trillion.[Hermit: I don't expect the USA to last that long anyway. More to the point, there isn't enough wealth to support lending us that amount, even if we were deemed creditworthy and had invented some mechanism to eventually repay it. So this number is pure mental masturbation.]

Medicare so dominates the nation's fiscal future that some economists believe health care reform, rather than budget measures, is the best way to attack the problem.

"Obviously health care is a mess," says Dean Baker, a liberal economist at the Center for Economic and Policy Research, a Washington think tank. "No one's been willing to touch it, but that's what I see as front and center."

Social Security is a much less serious problem. The program currently pays for itself with a 12.4 percent payroll tax, and even produces a surplus that the government raids every year to pay other bills. But Social Security will begin to run deficits during the next century, and ultimately would need an infusion of $8 trillion if the government planned to keep its promises to every beneficiary.

Calculations by Boston University economist Lawrence Kotlikoff indicate that closing those gaps - $8 trillion for Social Security, many times that for Medicare - and paying off the existing deficit would require either an immediate doubling of personal and corporate income taxes, a two-thirds cut in Social Security and Medicare benefits, or some combination of the two.

Why is America so fiscally unprepared for the next century? Like many of its citizens, the United States has spent the last few years racking up debt instead of saving for the future. Foreign lenders - primarily the central banks of China, Japan and other big U.S. trading partners - have been eager to lend the government money at low interest rates, making the current $8.5-trillion deficit about as painful as a big balance on a zero-percent credit card.

In her part of the fiscal wake-up tour presentation, Rogers tries to explain why that's a bad thing. For one thing, even when rates are low a bigger deficit means a greater portion of each tax dollar goes to interest payments rather than useful programs. And because foreigners now hold so much of the federal government's debt, those interest payments increasingly go overseas rather than to U.S. investors.

More serious is the possibility that foreign lenders might lose their enthusiasm for lending money to the United States. Because treasury bills are sold at auction, that would mean paying higher interest rates in the future. And it wouldn't just be the government's problem. All interest rates would rise, making mortgages, car payments and student loans costlier, too.

A modest rise in interest rates wouldn't necessarily be a bad thing, Rogers said. [Hermit: It would make a lot of creditors happy as effective interest rates to most consumers would soar above 30% as they missed card payments, and the lenders will end up owning most properties due to the collapse of the housing market, meaning that around 60% of the population will be transformed into renters with no rights. The recent changes in bankruptcy law, while completely unneeded in the late 1990s when they were advocated, were put there for a reason by our Republcan Suzerains.] America's consumers have as much of a borrowing problem as their government does, so higher rates could moderate overconsumption and encourage consumer saving. But a big jump in interest rates could cause economic catastrophe. Some economists even predict the government would resort to printing money to pay off its debt, a risky strategy that could lead to runaway inflation.[Hermit: It is already happening, only the money isn't being printed, it is being created by off-balance sheet (since the cessation of publication of the M3 data) loans.].

Macroeconomic meltdown is probably preventable, says Anjan Thakor, a professor of finance at Washington University in St. Louis. But to keep it at bay, he said, the government is essentially going to have to renegotiate some of the promises it has made to its citizens, probably by some combination of tax increases and benefit cuts.[Hermit: This does not take the end of cheap fuel into account. Which is going to happen in the same time frame. As will the impact of global warming.].

But there's no way to avoid what Rogers considers the worst result of racking up a big deficit - the outrage of making our children and grandchildren repay the debts of their elders.

"It's an unfair burden for future generations," she says.

You'd think young people would be riled up over this issue, since they're the ones who will foot the bill when they're out in the working world. But students take more interest in issues like the Iraq war and gay marriage than the federal government's finances, says Emma Vernon, a member of the University of Texas Young Democrats.[Hermit: "They" are already in a majority, and are ultimately going to be destroyed by it. Unfortunately, by my reading, by the time that they "get riled up about it" it will be to late to do anything about it.]

"It's not something that can fire people up," she says.

The current political climate doesn't help. Washington tends to keep its fiscal house in better order when one party controls Congress and the other is in the White House, says Sawhill.

"It's kind of a paradoxical result. Your commonsense logic would tell you if one party is in control of everything they should be able to take action," Sawhill says.

But the last six years of Republican rule have produced tax cuts, record spending increases and a Medicare prescription drug plan that has been widely criticized as fiscally unsound. When President Clinton faced a Republican Congress during the 1990s, spending limits and other legislative tools helped produce a surplus.

So maybe a solution is at hand.

"We're likely to have at least partially divided government again," Sawhill said, referring to predictions that the Democrats will capture the House, and possibly the Senate, in next month's elections.

But Walker isn't optimistic that the government will be able to tackle its fiscal challenges so soon.

"Realistically what we hope to accomplish through the fiscal wake-up tour is ensure that any serious candidate for the presidency in 2008 will be forced to deal with the issue," he says. "The best we're going to get in the next couple of years is to slow the bleeding."

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #10 on: 2006-11-25 16:56:16 » |

|

Why the dollar is falling so fast

Source: BBC News

Authors: Steve Schifferes (Economics reporter)

Dated: 2006-11-25

The US domination of the world economy may be at stake

The US dollar is plunging in world currency markets - and bringing down share prices in its wake.

But why is the dollar under pressure - and what would be the consequences for the US economy if it continues to fall?

Behind the problems of the dollar lies the huge and growing US trade deficit, and the large Federal budget deficit.

A fall in the greenback could hit Asian countries whose governments hold huge foreign currency reserves in dollars

For many years financial markets have worried about the growing size of the US trade deficit - the difference between the amount the US imports from the rest of the world, and the amount it can sell to the rest of the world.

That deficit is now heading above $800bn for 2006, or 7% of the US economy, and shows no signs of diminishing.

At the same time, tax cuts and the war in Iraq have led to a US budget deficit of several hundred billion dollars despite the booming economy.

Asian giants

Much of the trade gap relates to US commerce with East Asian countries such as China, Japan, and Korea, who sell much more to America than they buy.

Together, the East Asian countries have accumulated foreign currency surpluses of nearly $1 trillion, much of it held in US Treasury bonds denominated in dollars.

Thus they are funding both the budget gap and the trade gap.

These huge global imbalances are threatening to derail the world economy, the IMF and other international organisations have warned.

The classic economic view of how to correct such changes is to adjust the exchange rate in order to make US goods cheaper and Asian goods more expensive.

But many Asian currencies - especially the Chinese yuan - do not float freely on international currency markets, and the US has long been pressuring China to revalue its currency.

Now the markets are beginning to take matters into their own hands, by forcing the US dollar down.

In the long run, the fall in the dollar could lead to a cut in the trade deficit and a boost to US exports.

But this process often takes a long time, and in the meantime, it is fraught with dangers.

The fall in the dollar is worrying the IMF, the international organisation charged with surveillance of the world economy.

"A disorderly unwinding of global imbalances would be very damaging," IMF managing director Rodrigo Rato warned at its spring meeting in April.

Run on the dollar

In the first place, a rapid fall in the dollar, if it accelerates, could cause short-term problems for the US economy.

The higher price of imported goods could lead to a hike in domestic inflation, and it could take several years before consumers switch back to buying more US goods.

High inflation, combined with the stronger-than-expected growth of the US economy, could force the US central bank, the Federal Reserve, to keep raising interest rates.

They have already been raised 15 times, and now stand at 5%, partly on fears of a growing housing boom.

But the fears of inflation are also likely to affect the interest rates on long-term bonds, which determine mortgage rates.

The rising mortgage rates, while they may eventually dampen the housing boom, will also give a further boost to inflationary pressures.

International exporters hit

Meanwhile, foreign companies who have derived an increasing proportion of their sales and profits from the US market could also be hit by falling demand for their exports.

The sharp falls in non-US stock markets, especially in Asia, are a response to this fear, with electronics and car companies like Toyota and Sony especially vulnerable.

And that in turn could affect the growth rate of countries like China, who derive much of the growth in their economies from exports.

But the Asian exporters also have another reason to feel vulnerable.

As the value of the dollar falls, their reserves of the currency also reduce in value, as do the yields on the US Treasury bonds held by many of their central banks.

In buying such bonds these governments are, in effect, underwriting the large US Federal budget deficit as well.

This deficit is set to increase as the baby boomer generation faces retirement.

The Asian governments and investors may be tempted to sell many of their dollar holdings in order to protect themselves - but this would have the effect of weakening the dollar further.

And it would force the Fed to raise interest rates even more to protect the dollar.

Countries like China are reluctant to massively revalue their currency - because it would make investing in China much more expensive and could deter valuable foreign investment.

Managed float

This problem with the dollar has happened before, in the 1980s, when it was Japan rather than China that was seen as the main threat.

At that time, the main industrialised countries worked together for a managed currency float in an agreement called the Plaza Accord.

The coordinated approach led to a managed decline in the value of the dollar, which then stabilised at a more sustainable level, supported by central banks.

However, the current US administration does not favour such an approach, believing that the markets should be left to their own devices.

And given the vast size of foreign currency markets today, it is doubtful that central banks could make such an effective intervention again.

The downside for the US in the 1980s was that it was forced to enter into an international agreement with other governments that reduced its freedom to set its own domestic policy.

But in the absence of such an agreement, it looks like the markets themselves are finally deciding that the US 'twin deficits' are no longer sustainable.

And when the world's largest economy begins to look shaky, it is not surprising that confidence among financial markets is weakened around the world.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Alarm - Cover Your Ass!

« Reply #11 on: 2006-12-03 03:59:45 » |

|

Dollar dips to new low on US fears

Source: The Independent

Authors: Philip Thornton (Economics Correspondent)

Dated: 2006-12-02

The dollar tumbled to new lows against the pound and the euro yesterday after the US manufacturing sector contracted unexpectedly for the first time in almost four years.

Factory activity shrank in November for the first time since April 2003 as new orders, production and employment fell and their raw material bills rose.

The figures were the latest in a string of downbeat data that have fuelled fears that the US economy is set for a hard landing.

Sterling rose as much 1 per cent to $1.9805, putting it within two cents of breaching the two-dollar level. The pound has not been worth two dollars since shortly before the pound's exit from the European exchange rate mechanism.

David Bloom, global economist at HSBC, said: "The dollar is just coming under waves of assault here. It is quite something to see."

The dollar dropped to $1.3323 against the euro and has slumped by 12 per cent so far this year - although it is still some distance from the record low of $1.3666 in December 2004.

Ken Rogoff, a former chief economist at the International Monetary Fund who has forecast a fall in the dollar of between 20 and 40 per cent, said the greenback would hit €1.40 next year. He told The Independent: "As long as the US external position is so vulnerable, the market is right to be nervous every time the dollar starts to drift downwards." But he added: "We still seem to be in a period of generally low volatility across markets, where a precipitous dollar crash is unlikely."

The latest fall was driven by the survey by the Institute for Supply Management, whose index unexpectedly dropped to 49.5 from 51.2 in October - where a number below 50 denotes contraction.

The Commerce Department said construction spending declined 1 per cent in October, adding to a growing pile of evidence that the housing market is cooling.

"Housing and now manufacturing are in serious trouble," said Ken Wattret, European economist at BNP Paribas. "The Federal Reserve's view that 95 per cent of the economy is in fine fettle is increasingly under threat."

Ben Bernanke, the Fed's chairman, passed up an offer to support the dollar at a conference on monetary policy yesterday, deciding not to discuss the economy or the outlook for inflation or interest rates. Earlier this week, Mr Bernanke issued a hawkish statement, warning that inflation was "uncomfortably high", but the markets brushed this aside to continue selling the dollar. Julian Jessop, chief international economist at Capital Economics, said: "The markets are paying more attention to the latest data, which largely contradict what Bernanke was saying."

However, traders in London ignored an unexpectedly weak set of UK manufacturing data. Factory activity grew at its weakest in eight months, a report showed. The survey of 620 factory managers showed its index fell to 52.6 in November from 53.5 in October. Manufacturers cut staffing levels for the first time in six months.

John Butler, European economist at HSBC, said: "Given the rise in trade-weighted sterling and evidence of slower global growth, we would expect this downward trend in output and inflation to persist."

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.06

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:Alarm - Cover Your Ass!

« Reply #12 on: 2006-12-03 07:45:44 » |

|

[Blunderov] Without at all beeing a magi of what Hermit has termed the "black art of economics", it does seem to me that one important factor has not been properly reckoned with, at least not in anything which I have seen. The war spending boom must, ISTM, have artificially buoyed the economy somewhat and the consequences of the drying up of the fundage for this failed venture seems likely further depress the economy.

I hear that a one dollar coin is soon to be introduced. Seems somebody knew this was going to happen.

http://www.iraq-war.ru/tiki-read_article.php?articleId=111012

Plunging dollar will set world markets reeling

By: Heather Stewart on: 03.12.2006 [07:41 ] (88 reads)

Plunging dollar will set world markets reeling

By Heather Stewart, economics correspondent

12/03/06 "The Observer" --- — The slowdown in the US economy, which has sent the dollar into freefall over the past fortnight, will have devastating knock-on effects in markets around the world, analysts warn.

As the US slows, and consumers in the world's biggest economy feel the buying power of the dollar in their pocket declining, global growth will be hit hard, economists say. The greenback took yet another turn for the worse on Friday, after a survey of the US manufacturing sector showed output declining for the first time in more than three years.

Wall Street is now betting that Federal Reserve chairman Ben Bernanke will slash interest rates to stave off a recession. The dollar ended the week at $1.98 against the pound, and $1.32 to the euro, but analysts say there is further weakness to come. 'I think the dollar's going to hell in a handbag,' said David Bloom, currency strategist at HSBC. '

Some analysts have argued that a more balanced global economy, with strong growth in Asia and Europe, means the impact of a US slowdown will be limited; but Stephen Roach, chief economist at Morgan Stanley, believes China - and in turn the rest of Asia - will follow.

'America is China's largest export market, accounting for 21 per cent of its total exports over the past five years,' he said, adding that economies such as Japan, Korea and Taiwan, which export directly to the US but also sell components to China that are assembled before being sent on to the US, will be hit.

Eurozone finance ministers have expressed alarm at the strength of the euro against the dollar, fearing that their exporters will suffer; but the European Central Bank is expected to push up interest rates by another quarter-point on Thursday, as it frets about inflation.

Despite increasing signs of weakening demand in the world's biggest economy, ECB chairman Jean-Claude Trichet has insisted the 12-member single currency zone can shrug off a US slowdown.

'The ECB's in a complete state of denial,' said Paul Mortimer-Lee, global head of market economics at BNP Paribas. 'Quite a lot depends on how Trichet plays it at the ECB press conference next week. They're hankering after raising rates again next year.'

Wall Street will also be watching Bernanke for signals of a change. The Fed has left rates on hold at 5.25 per cent since the summer, after increasing them 17 times over the previous two years as the US economy recovered from the post-dotcom downturn. Bernanke sought to reassure the currency markets last week by stressing that the Fed is still concerned about inflation, but his words failed to stem the sell-off. 'It's as though the markets are saying, "you central bankers are worrying about inflation, we're worrying about the reality of life",' said Bloom.

Mortimer-Lee said the Fed would wait for definitive evidence before making a move. 'At the end of the tightening cycle, you know you've got an inflation problem, and it's only when the evidence is overwhelming that you move.' However, he believes that evidence will come soon: with investment in construction already falling as the housing boom turns to bust, BNP Paribas is predicting that a million jobs will be lost in the building industry alone over the coming 18 months.

Equity markets are already wobbling as investors weigh the cost of a US slowdown. Graham Turner of GFC Economics said a shake-out would raise questions about this year's merger frenzy.

'We have had an absolute monster year in terms of leveraged transactions,' he said. 'A lot of them looked quite dubious in terms of their economic value. Once the market starts to retreat, all the suspect things that went on come out of the woodwork.'

http://www.informationclearinghouse.info/article15798.htm

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit