Author

Author

|

Topic: Is the economy on a pharmaceutical that starts with a V and ends with a smile (Read 50547 times) |

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Is the economy on a pharmaceutical that starts with a V and ends with a smile

« on: 2005-12-30 01:23:09 » |

|

Did I evade your spam filters*? Good. Hopefully the rest will too.

I went to buy some electrical cable that at this time last year cost $109. This year the identical length of the identical product on an identical reel at the identical store costs $238. The cost of copper is responsible for only a small fraction of this difference. This is a "temporary aberration" and so is not included in the PPI or CPI. Of course, if you use copper cable in your products, you would do better to produce them outside the USA. And this is happening. Just ask GE or any transformer producer (and they might answer you honestly if not blaming medical or pension costs for forcing them to move offshore).

Steel, which doubled in price when Bush added illegally added protective tariffs to imports has increased in price now that the tariffs are gone - because the producers are now owned by the Chinese who apparently comprehend capitalist economics rather better than does Washington. This is a "temporary aberration" and so is not included in the PPI or CPI. Of course, if you use steel in your products, you would do better to produce them outside the USA. And this is happening. Just ask a vehicle or machinery producer (and they might answer you honestly if not blaming medical or pension costs for forcing them to move offshore).

Transport makes up 15% of the cost of all goods available in the US. Oil which makes up 70% or more of transport costs is up by a dollar a gallon. This is a "temporary aberration" and so is not included in the PPI or CPI. Of course, if you use oil - or transport to produce your goods, you have to buy the oil anyway - at any price. Which is perhaps why the oil companies are being congratulated by Washington on their record profits.

Roofing (which shares an oleaceous component with transport) which pre Katrina went for $170 a square is now running over $380 a square. Timber too (protected by Bush's present to the timber industry - anti-dumping tariffs levied on Canadian softwoods) is going through the roof as the US timber industry profits in the absence of effective competition. Of course, if you use roofing or timber in your products, as the building industry does, your prices will soar - as they are. Which is why nobody is talking about the value of new housing starts these days. But this is a "temporary aberration" and so is not included in the CPI any longer.

The cost of milk is moving faster than anything less than a Republican in search of illegal campaign contributions. I bought milk in Iowa at $2.70 three months ago. Now the same gallon bottle costs $3.80. In New Orleans it cost a dollar more. But this is a "temporary aberration" and so is not included in the CPI.

House House sales took an unexpected 2.7% dive in November. US 2 and 10 year yield curves are currently inverted. Meanwhile, AFP in a" story about what is described as the movie industry's "most disappointing year in nearly two decades" asserts that Hollywood is "in a deep existential crisis." "Is it the movies? Is it the ticket prices? Is it because home theater and DVD? I think because all this is happening at the same time, it is a combination of facts" whined Paul Dergarabedian of Exhibitor Relations Co's. The article makes it clear that the decline is apparent not only in box-office receipts, but also in the sale and rental of DVDs. Apparently many of the people who have invested large sums in home theater systems prefer to cocoon themselves at home, watching movies in the company of friends, but even this cohort is buying and renting fewer movies. It is probably only a matter of time before this is blamed on emule, limewire, bittorrent and friends (anything to avoid acknowledging that the films on offer were largely pretty crappy), although I notice that had my 1998 suggestion of a "tax" of a few dollars per 64k of broadband connection been adopted (along with "free" public distribution of media by the Library of Congress), that the amount raised by such a tax at the proposed rates in the USA alone, assuming no significant change in broadband adoption, would have exceeded all other income made by the entire entertainment industry this year. But while related, this is a side issue. More centrally, the story claims, "Hollywood [also] faces a major external threat: runaway production costs and the growing trend of movie producers to shoot in places such as Canada, Australia and New Zealand to cash in on much lower staff and production charges." Poor Hollywood! No, not really. Those moving have powerful economic and artistic reasons for the move. Or they once had. Moving abroad isn't as low-a-cost-option as it once was either. While profligate investors, irresponsible producers, and squandering directors all have played a part in ensuring rising production costs, I suggest that the other important variable here is the relentless decline in the purchasing power of the inflated dollar. After all, many directors who have taken production abroad to Canada, Mexico, New Zealand, and other more frugal locations to make their movies still roll up production costs in excess of $100 million (US). Given such up-front costs, a box-office yield of $200 million or more, achieved by only a handful of films, isn't particularly impressive.

I suggest that far from the issues raised by the article, box office takings merely foreshadowed this year's rather sad retail experience. Having had their expectations of strong Thanksgiving sales squished into the slush, having been forced to acknowledge that the pre christmas sales were "below expectations", and now having realised that the "tween" sales postulated by breathless pundits are simply not going to happen, retailers are pinning their hopes on the anticipation of "strong post-Christmas clearance sales" to "salvage" a "very disappointing Holiday".

I think they are in for yet more disappointment. I suspect all the above reflects a perfectly understandable and long predicted development. People are spending less on entertainment simply because, except for those southerners randomly blessed by the insurance industry, people have less money to spend – or to express exactly the same thought in a much scarier way, they've used up all the credit that even the crazy American credit system is prepared to offer. This is evidently seen as good news in some quarters. As reported in the New York Times, those who hurried to file bankruptcy before the new law went into effect in mid-October are already being barraged with new credit card offers - for humanitarian reasons of course. Ellen Schloemer of the Center for Responsible Lending explained how it works, "The whole business model of the credit card industry is built around outstanding debt. This is the only industry that calls people deadbeats when they pay all their bills every month." Unfortunately, this is getting much harder to achieve. As the Economic Policy Institute notes, contrary to the consumptive song of Washington, inflation-adjusted wages are down, living expenses continue to rise, and American households are mired in ever-deepening debt.

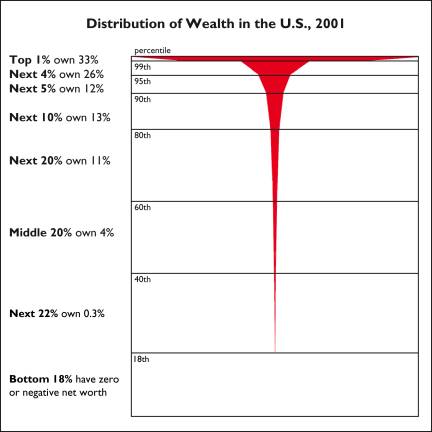

Did I mention "inflation"? Officially annual US inflation at 2.5% is right on target in our booming economy full of record profits. Of course, the inflation rate calculations, like those for the M2 ,have been changed on a moment by moment basis this year (and next year the M2 is to be removed from public view), such that it is impossible to draw any meaningful comparisons of published inflation data with previous numbers - but where we at least know that changes in the price of food and fuel are no longer included in the indices - as they are suffering from "temporary aberrations" in values (which might perhaps more properly be ascribed to the American people that voted for Bush** as they shared their minuscule slice of paradise*** in the graph that deserves a place in prominence in every place where mathematically literate people still comprehend such a presentation).

Source: Inequality.org, Edward N. Wolff, "Changes in Household Wealth in the 1980s and 1990s in the U.S.", Jerome Levy Economics Institute, May, 2004.

Anyway, the critical point I meant to make in all this (inflation data, retail sales, consumer credit crunch, property down turn, US yield curve inversion, etc) is that if you have any market or dollar denominated values that you can move into anything else, the half-day trading on Friday would, I suggest, be a really good time to be moving in to hard assets and currency hedges. Should the indicators prove to be only a market glitch, you might take a cold at worst. Should it be a precursor to worse; as it may well be; you will hopefully avoid pneumonia.

Hermit

*Consider the alluded word which is not a part of the topic or content in order to avoid the beyeing of filters everywhere :-)

**"The larger the mob, the harder the test. In small areas, before small electorates, a first-rate man occasionally fights his way through, carrying even the mob with him by force of his personality. But when the field is nationwide, and the fight must be waged chiefly at second and third hand, and the force of personality cannot so readily make itself felt, then all the odds are on the man who is, intrinsically, the most devious and mediocre — the man who can most easily adeptly disperse the notion that his mind is a virtual vacuum."

"The Presidency tends, year by year, to go to such men. As democracy is perfected, the office represents, more and more closely, the inner soul of the people. We move toward a lofty ideal. On some great and glorious day the plain folks of the land will reach their heart's desire at last, and the White House will be adorned by a downright moron."

HL Mencken originally in "Bayard vs. Lionheart" in the Baltimore Evening Sun, 1920-07-26, reprinted in "On Politics: A Carnival of Buncombe"

***In 2001, according to NYU economist Edward Wolff, the richest five percent of American households controlled over 59 percent of the country’s wealth; the richest 20 percent held 83 percent of the wealth; the bottom 80 percent had 17 percent; and the bottom 40 percent just 0.3 percent.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.06

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:Is the economy on a pharmaceutical that starts with a V and ends with a smile

« Reply #1 on: 2005-12-30 04:12:25 » |

|

Quote from: Hermit on 2005-12-30 01:23:09

Anyway, the critical point I meant to make in all this (inflation data, retail sales, consumer credit crunch, property down turn, US yield curve inversion, etc) is that if you have any market or dollar denominated values that you can move into anything else, the half-day trading on Friday would, I suggest, be a really good time to be moving in to hard assets and currency hedges. Should the indicators prove to be only a market glitch, you might take a cold at worst. Should it be a precursor to worse; as it may well be; you will hopefully avoid pneumonia. |

[Blunderov] What you have described is a recipe for either disaster, revolution or both. And it may be very 'bad'* indeed. Many are wondering how long the greatest scam in history, the greenback, can continue to hold up. 'Not very' is quite probably the answer.

And this time it looks a lot like zugzwang; if the USA goes to war against Iran, or indeed anyone else, it will be catastrophic for the dollar. And if it doesn't gain control over the world oil supply, it will also be catastrophic for the dollar.

Best Regards.

*Depending on your point of view of course. China's equanimity seems likely to remain untroubled should these events unfold. 'You shouldn't send a boy to do a man's job' I suppose is the lesson to be learned. Cold comfort.

http://www.informationclearinghouse.info/article9698.htm

Petrodollar Warfare: Dollars, Euros and the Upcoming Iranian Oil Bourse

"This notion that the United States is getting ready to attack Iran is simply ridiculous...Having said that, all options are on the table."

-- President George W. Bush, February 2005

By William R. Clark

08/08/05 "MM" -- -- Contemporary warfare has traditionally involved underlying conflicts regarding economics and resources. Today these intertwined conflicts also involve international currencies, and thus increased complexity. Current geopolitical tensions between the United States and Iran extend beyond the publicly stated concerns regarding Iran's nuclear intentions, and likely include a proposed Iranian "petroeuro" system for oil trade. Similar to the Iraq war, military operations against Iran relate to the macroeconomics of 'petrodollar recycling' and the unpublicized but real challenge to U.S. dollar supremacy from the euro as an alternative oil transaction currency.

It is now obvious the invasion of Iraq had less to do with any threat from Saddam's long-gone WMD program and certainly less to do to do with fighting International terrorism than it has to do with gaining strategic control over Iraq's hydrocarbon reserves and in doing so maintain the U.S. dollar as the monopoly currency for the critical international oil market. Throughout 2004 information provided by former administration insiders revealed the Bush/Cheney administration entered into office with the intention of toppling Saddam.[1][2] Candidly stated, 'Operation Iraqi Freedom' was a war designed to install a pro-U.S. government in Iraq, establish multiple U.S military bases before the onset of global Peak Oil, and to reconvert Iraq back to petrodollars while hoping to thwart further OPEC momentum towards the euro as an alternative oil transaction currency ( i.e. "petroeuro").[3] However, subsequent geopolitical events have exposed neoconservative strategy as fundamentally flawed, with Iran moving towards a petroeuro system for international oil trades, while Russia evaluates this option with the European Union.

In 2003 the global community witnessed a combination of petrodollar warfare and oil depletion warfare. The majority of the world's governments – especially the E.U., Russia and China – were not amused – and neither are the U.S. soldiers who are currently stationed inside a hostile Iraq. In 2002 I wrote an award-winning online essay that asserted Saddam Hussein sealed his fate when he announced on September 2000 that Iraq was no longer going to accept dollars for oil being sold under the UN's Oil-for-Food program, and decided to switch to the euro as Iraq's oil export currency.[4] Indeed, my original pre-war hypothesis was validated in a Financial Times article dated June 5, 2003, which confirmed Iraqi oil sales returning to the international markets were once again denominated in U.S. dollars – not euros.

The tender, for which bids are due by June 10, switches the transaction back to dollars -- the international currency of oil sales - despite the greenback's recent fall in value. Saddam Hussein in 2000 insisted Iraq's oil be sold for euros, a political move, but one that improved Iraq's recent earnings thanks to the rise in the value of the euro against the dollar. [5]

The Bush administration implemented this currency transition despite the adverse impact on profits from Iraqi's export oil sales.[6] (In mid-2003 the euro was valued approx. 13% higher than the dollar, and thus significantly impacted the ability of future oil proceeds to rebuild Iraq's infrastructure). Not surprisingly, this detail has never been mentioned in the five U.S. major media conglomerates who control 90% of information flow in the U.S., but confirmation of this vital fact provides insight into one of the crucial – yet overlooked – rationales for 2003 the Iraq war.

Concerning Iran, recent articles have revealed active Pentagon planning for operations against its suspected nuclear facilities. While the publicly stated reasons for any such overt action will be premised as a consequence of Iran's nuclear ambitions, there are again unspoken macroeconomic drivers underlying the second stage of petrodollar warfare – Iran's upcoming oil bourse. (The word bourse refers to a stock exchange for securities trading, and is derived from the French stock exchange in Paris, the Federation Internationale des Bourses de Valeurs.)

In essence, Iran is about to commit a far greater "offense" than Saddam Hussein's conversion to the euro for Iraq's oil exports in the fall of 2000. Beginning in March 2006, the Tehran government has plans to begin competing with New York's NYMEX and London's IPE with respect to international oil trades – using a euro-based international oil-trading mechanism.[7] The proposed Iranian oil bourse signifies that without some sort of US intervention, the euro is going to establish a firm foothold in the international oil trade. Given U.S. debt levels and the stated neoconservative project of U.S. global domination, Tehran's objective constitutes an obvious encroachment on dollar supremacy in the crucial international oil market.

From the autumn of 2004 through August 2005, numerous leaks by concerned Pentagon employees have revealed that the neoconservatives in Washington are quietly – but actively – planning for a possible attack against Iran. In September 2004 Newsweek reported:

Deep in the Pentagon, admirals and generals are updating plans for possible U.S. military action in Syria and Iran. The Defense Department unit responsible for military planning for the two troublesome countries is "busier than ever," an administration official says. Some Bush advisers characterize the work as merely an effort to revise routine plans the Pentagon maintains for all contingencies in light of the Iraq war. More skittish bureaucrats say the updates are accompanied by a revived campaign by administration conservatives and neocons for more hard-line U.S. policies toward the countries…'

…administration hawks are pinning their hopes on regime change in Tehran – by covert means, preferably, but by force of arms if necessary. Papers on the idea have circulated inside the administration, mostly labeled "draft" or "working draft" to evade congressional subpoena powers and the Freedom of Information Act. Informed sources say the memos echo the administration's abortive Iraq strategy: oust the existing regime, swiftly install a pro-U.S. government in its place (extracting the new regime's promise to renounce any nuclear ambitions) and get out. This daredevil scheme horrifies U.S. military leaders, and there's no evidence that it has won any backers at the cabinet level. [8]

Indeed, there are good reasons for U.S. military commanders to be 'horrified' at the prospects of attacking Iran. In the December 2004 issue of the Atlantic Monthly, James Fallows reported that numerous high-level war-gaming sessions had recently been completed by Sam Gardiner, a retired Air Force colonel who has run war games at the National War College for the past two decades.[9] Col. Gardiner summarized the outcome of these war games with this statement, "After all this effort, I am left with two simple sentences for policymakers: You have no military solution for the issues of Iran. And you have to make diplomacy work." Despite Col. Gardiner's warnings, yet another story appeared in early 2005 that reiterated this administration's intentions towards Iran. Investigative reporter Seymour Hersh's article in The New Yorker included interviews with various high-level U.S. intelligence sources. Hersh wrote:

In my interviews [with former high-level intelligence officials], I was repeatedly told that the next strategic target was Iran. Everyone is saying, 'You can't be serious about targeting Iran. Look at Iraq,' the former [CIA] intelligence official told me. But the [Bush administration officials] say, 'We've got some lessons learned – not militarily, but how we did it politically. We're not going to rely on agency pissants.' No loose ends, and that's why the C.I.A. is out of there. [10]

The most recent, and by far the most troubling, was an article in The American Conservative by intelligence analyst Philip Giraldi. His article, "In Case of Emergency, Nuke Iran," suggested the resurrection of active U.S. military planning against Iran – but with the shocking disclosure that in the event of another 9/11-type terrorist attack on U.S. soil, Vice President Dick Cheney's office wants the Pentagon to be prepared to launch a potential tactical nuclear attack on Iran – even if the Iranian government was not involved with any such terrorist attack against the U.S.:

The Pentagon, acting under instructions from Vice President Dick Cheney's office, has tasked the United States Strategic Command (STRATCOM) with drawing up a contingency plan to be employed in response to another 9/11-type terrorist attack on the United States. The plan includes a large-scale air assault on Iran employing both conventional and tactical nuclear weapons. Within Iran there are more than 450 major strategic targets, including numerous suspected nuclear-weapons-program development sites. Many of the targets are hardened or are deep underground and could not be taken out by conventional weapons, hence the nuclear option. As in the case of Iraq, the response is not conditional on Iran actually being involved in the act of terrorism directed against the United States. Several senior Air Force officers involved in the planning are reportedly appalled at the implications of what they are doing – that Iran is being set up for an unprovoked nuclear attack – but no one is prepared to damage his career by posing any objections. [11]

Why would the Vice President instruct the U.S. military to prepare plans for what could likely be an unprovoked nuclear attack against Iran? Setting aside the grave moral implications for a moment, it is remarkable to note that during the same week this "nuke Iran" article appeared, the Washington Post reported that the most recent National Intelligence Estimate (NIE) of Iran's nuclear program revealed that, "Iran is about a decade away from manufacturing the key ingredient for a nuclear weapon, roughly doubling the previous estimate of five years."[12] This article carefully noted this assessment was a "consensus among U.S. intelligence agencies, [and in] contrast with forceful public statements by the White House." The question remains, Why would the Vice President advocate a possible tactical nuclear attack against Iran in the event of another major terrorist attack against the U.S. – even if Tehran was innocent of involvement?

Perhaps one of the answers relates to the same obfuscated reasons why the U.S. launched an unprovoked invasion to topple the Iraq government – macroeconomics and the desperate desire to maintain U.S. economic supremacy. In essence, petrodollar hegemony is eroding, which will ultimately force the U.S. to significantly change its current tax, debt, trade, and energy policies, all of which are severely unbalanced. World oil production is reportedly "flat out," and yet the neoconservatives are apparently willing to undertake huge strategic and tactical risks in the Persian Gulf. Why? Quite simply – their stated goal is U.S. global domination – at any cost.

To date, one of the more difficult technical obstacles concerning a euro-based oil transaction trading system is the lack of a euro-denominated oil pricing standard, or oil 'marker' as it is referred to in the industry. The three current oil markers are U.S. dollar denominated, which include the West Texas Intermediate crude (WTI), Norway Brent crude, and the UAE Dubai crude. However, since the summer of 2003 Iran has required payments in the euro currency for its European and Asian/ACU exports – although the oil pricing these trades was still denominated in the dollar.[13]

Therefore a potentially significant news story was reported in June 2004 announcing Iran's intentions to create of an Iranian oil bourse. This announcement portended competition would arise between the Iranian oil bourse and London's International Petroleum Exchange (IPE), as well as the New York Mercantile Exchange (NYMEX). [Both the IPE and NYMEX are owned by U.S. consortium, and operated by an Atlanta-based corporation, IntercontinentalExchange, Inc.]

The macroeconomic implications of a successful Iranian bourse are noteworthy. Considering that in mid-2003 Iran switched its oil payments from E.U. and ACU customers to the euro, and thus it is logical to assume the proposed Iranian bourse will usher in a fourth crude oil marker – denominated in the euro currency. This event would remove the main technical obstacle for a broad-based petroeuro system for international oil trades. From a purely economic and monetary perspective, a petroeuro system is a logical development given that the European Union imports more oil from OPEC producers than does the U.S., and the E.U. accounted for 45% of exports sold to the Middle East. (Following the May 2004 enlargement, this percentage likely increased).

Despite the complete absence of coverage from the five U.S. corporate media conglomerates, these foreign news stories suggest one of the Federal Reserve's nightmares may begin to unfold in the spring of 2006, when it appears that international buyers will have a choice of buying a barrel of oil for $60 dollars on the NYMEX and IPE - or purchase a barrel of oil for €45 - €50 euros via the Iranian Bourse. This assumes the euro maintains its current 20-25% appreciated value relative to the dollar – and assumes that some sort of US "intervention" is not launched against Iran. The upcoming bourse will introduce petrodollar versus petroeuro currency hedging, and fundamentally new dynamics to the biggest market in the world - global oil and gas trades. In essence, the U.S. will no longer be able to effortlessly expand credit via U.S. Treasury bills, and the dollar's demand/liquidity value will fall.

It is unclear at the time of writing if this project will be successful, or could it prompt overt or covert U.S. interventions – thereby signaling the second phase of petrodollar warfare in the Middle East. Regardless of the potential U.S. response to an Iranian petroeuro system, the emergence of an oil exchange market in the Middle East is not entirely surprising given the domestic peaking and decline of oil exports in the U.S. and U.K, in comparison to the remaining oil reserves in Iran, Iraq and Saudi Arabia. What we are witnessing is a battle for oil currency supremacy. If Iran's oil bourse becomes a successful alternative for international oil trades, it would challenge the hegemony currently enjoyed by the financial centers in both London (IPE) and New York (NYMEX), a factor not overlooked in the following (UK) Guardian article:

Iran is to launch an oil trading market for Middle East and Opec producers that could threaten the supremacy of London's International Petroleum Exchange.

…Some industry experts have warned the Iranians and other OPEC producers that western exchanges are controlled by big financial and oil corporations, which have a vested interest in market volatility. [emphasis added]

The IPE, bought in 2001 by a consortium that includes BP, Goldman Sachs and Morgan Stanley, was unwilling to discuss the Iranian move yesterday. "We would not have any comment to make on it at this stage," said an IPE spokeswoman. [14]

During an important speech in April 2002, Mr. Javad Yarjani, an OPEC executive, described three pivotal events that would facilitate an OPEC transition to euros.[15] He stated this would be based on (1) if and when Norway's Brent crude is re-dominated in euros, (2) if and when the U.K. adopts the euro, and (3) whether or not the euro gains parity valuation relative to the dollar, and the EU's proposed expansion plans were successful. Notably, both of the later two criteria have transpired: the euro's valuation has been above the dollar since late 2002, and the euro-based E.U. enlarged in May 2004 from 12 to 22 countries. Despite recent "no" votes by French and Dutch voters regarding a common E.U. Constitution, from a macroeconomic perspective, these domestic disagreements do no reduce the euro currency's trajectory in the global financial markets – and from Russia and OPEC's perspective – do not adversely impact momentum towards a petroeuro. In the meantime, the U.K. remains uncomfortably juxtaposed between the financial interests of the U.S. banking nexus (New York/Washington) and the E.U. financial centers (Paris/Frankfurt).

The most recent news reports indicate the oil bourse will start trading on March 20, 2006, coinciding with the Iranian New Year.[16] The implementation of the proposed Iranian oil Bourse – if successful in utilizing the euro as its oil transaction currency standard – essentially negates the previous two criteria as described by Mr. Yarjani regarding the solidification of a petroeuro system for international oil trades. It should also be noted that throughout 2003-2004 both Russia and China significantly increased their central bank holdings of the euro, which appears to be a coordinated move to facilitate the anticipated ascendance of the euro as a second World Reserve Currency. [17] [18] China's announcement in July 2005 that is was re-valuing the yuan/RNB was not nearly as important as its decision to divorce itself form a U.S. dollar peg by moving towards a "basket of currencies" – likely to include the yen, euro, and dollar.[19] Additionally, the Chinese re-valuation immediately lowered their monthly imported "oil bill" by 2%, given that oil trades are still priced in dollars, but it is unclear how much longer this monopoly arrangement will last.

Furthermore, the geopolitical stakes for the Bush administration were raised dramatically on October 28, 2004, when Iran and China signed a huge oil and gas trade agreement (valued between $70 - $100 billion dollars.) [20] It should also be noted that China currently receives 13% of its oil imports from Iran. In the aftermath of the Iraq invasion, the U.S.-administered Coalition Provisional Authority (CPA) nullified previous oil lease contracts from 1997-2002 that France, Russia, China and other nations had established under the Saddam regime. The nullification of these contracts worth a reported $1.1 trillion created political tensions between the U.S and the European Union, Russia and China. The Chinese government may fear the same fate awaits their oil investments in Iran if the U.S. were able to attack and topple the Tehran government. Despite U.S. desires to enforce petrodollar hegemony, the geopolitical risks of an attack on Iran's nuclear facilities would surely create a serious crisis between Washington and Beijing.

It is increasingly clear that a confrontation and possible war with Iran may transpire during the second Bush term. Clearly, there are numerous tactical risks regarding neoconservative strategy towards Iran. First, unlike Iraq, Iran has a robust military capability. Secondly, a repeat of any "Shock and Awe" tactics is not advisable given that Iran has installed sophisticated anti-ship missiles on the Island of Abu Musa, and therefore controls the critical Strait of Hormuz – where all of the Persian Gulf bound oil tankers must pass.[22] The immediate question for Americans? Will the neoconservatives attempt to intervene covertly and/or overtly in Iran during 2005 or 2006 in a desperate effort to prevent the initiation of euro-denominated international crude oil sales? Commentators in India are quite correct in their assessment that a U.S. intervention in Iran is likely to prove disastrous for the United States, making matters much worse regarding international terrorism, not to the mention potential effects on the U.S. economy.

…If it [ U.S.] intervenes again, it is absolutely certain it will not be able to improve the situation…There is a better way, as the constructive engagement of Libya's Colonel Muammar Gaddafi has shown...Iran is obviously a more complex case than Libya, because power resides in the clergy, and Iran has not been entirely transparent about its nuclear programme, but the sensible way is to take it gently, and nudge it to moderation. Regime change will only worsen global Islamist terror, and in any case, Saudi Arabia is a fitter case for democratic intervention, if at all. [21]

A successful Iranian bourse will solidify the petroeuro as an alternative oil transaction currency, and thereby end the petrodollar's hegemonic status as the monopoly oil currency. Therefore, a graduated approach is needed to avoid precipitous U.S. economic dislocations. Multilateral compromise with the EU and OPEC regarding oil currency is certainly preferable to an 'Operation Iranian Freedom,' or perhaps another CIA-backed coup such as operation "Ajax" from 1953. Despite the impressive power of the U.S. military, and the ability of our intelligence agencies to facilitate 'interventions,' it would be perilous and possibly ruinous for the U.S. to intervene in Iran given the dire situation in Iraq. The Monterey Institute of International Studies warned of the possible consequences of a preemptive attack on Iran's nuclear facilities:

An attack on Iranian nuclear facilities…could have various adverse effects on U.S. interests in the Middle East and the world. Most important, in the absence of evidence of an Iranian illegal nuclear program, an attack on Iran's nuclear facilities by the U.S. or Israel would be likely to strengthen Iran's international stature and reduce the threat of international sanctions against Iran. [23]

Synopsis:

It is not yet clear if a U.S. military expedition will occur in a desperate attempt to maintain petrodollar supremacy. Regardless of the recent National Intelligence Estimate that down-played Iran's potential nuclear weapons program, it appears increasingly likely the Bush administration may use the specter of nuclear weapon proliferation as a pretext for an intervention, similar to the fears invoked in the previous WMD campaign regarding Iraq. If recent stories are correct regarding Cheney's plan to possibly use a another 9/11 terrorist attack as the pretext or casus belli for a U.S. aerial attack against Iran, this would confirm the Bush administration is prepared to undertake a desperate military strategy to thwart Iran's nuclear ambitions, while simultaneously attempting to prevent the Iranian oil Bourse from initiating a euro-based system for oil trades.

However, as members of the U.N. Security Council; China, Russia and E.U. nations such as France and Germany would likely veto any U.S.-sponsored U.N. Security Resolution calling the use of force without solid proof of Iranian culpability in a major terrorist attack. A unilateral U.S. military strike on Iran would isolate the U.S. government in the eyes of the world community, and it is conceivable that such an overt action could provoke other industrialized nations to strategically abandon the dollar en masse. Indeed, such an event would create pressure for OPEC or Russia to move towards a petroeuro system in an effort to cripple the U.S. economy and its global military presence. I refer to this in my book as the "rogue nation hypothesis."

While central bankers throughout the world community would be extremely reluctant to 'dump the dollar,' the reasons for any such drastic reaction are likely straightforward from their perspective – the global community is dependent on the oil and gas energy supplies found in the Persian Gulf. Hence, industrialized nations would likely move in tandem on the currency exchange markets in an effort to thwart the neoconservatives from pursuing their desperate strategy of dominating the world's largest hydrocarbon energy supply. Any such efforts that resulted in a dollar currency crisis would be undertaken – not to cripple the U.S. dollar and economy as punishment towards the American people per se – but rather to thwart further unilateral warfare and its potentially destructive effects on the critical oil production and shipping infrastructure in the Persian Gulf. Barring a U.S. attack, it appears imminent that Iran's euro-denominated oil bourse will open in March 2006. Logically, the most appropriate U.S. strategy is compromise with the E.U. and OPEC towards a dual-currency system for international oil trades.

Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes...known instruments for bringing the many under the domination of the few…No nation could preserve its freedom in the midst of continual warfare.

-- James Madison, Political Observations, 1795

Footnotes:

[1]. Ron Suskind, The Price of Loyalty: George W. Bush, the White House, and the Education of Paul O' Neill, Simon & Schuster publishers (2004)

[2]. Richard A. Clarke, Against All Enemies: Inside America's War on Terror, Free Press (2004)

[3]. William Clark, "Revisited - The Real Reasons for the Upcoming War with Iraq: A Macroeconomic and Geostrategic Analysis of the Unspoken Truth," January 2003 (updated January 2004)

http://www.ratical.org/ratville/CAH/RRiraqWar.html

[4]. Peter Philips, Censored 2004, The Top 25 Censored News Stories, Seven Stories Press, (2003) General website for Project Censored: http://www.projectcensored.org/

Story #19: U.S. Dollar vs. the Euro: Another Reason for the Invasion of Iraq

http://www.projectcensored.org/publications/2004/19.html

[5]. Carol Hoyos and Kevin Morrison, "Iraq returns to the international oil market," Financial Times, June 5, 2003

[6]. Faisal Islam, "Iraq nets handsome profit by dumping dollar for euro," [UK] Guardian, February 16, 2003

http://observer.guardian.co.uk/iraq/story/0,12239,896344,00.html

[7]. "Oil bourse closer to reality," IranMania.com, December 28, 2004. Also see: "Iran oil bourse wins authorization," Tehran Times, July 26, 2005

[8]. "War-Gaming the Mullahs: The U.S. weighs the price of a pre-emptive strike," Newsweek, September 27 issue, 2004. http://www.msnbc.msn.com/id/6039135/site/newsweek/

[9]. James Fallows, 'Will Iran be Next?,' Atlantic Monthly, December 2004, pgs. 97 – 110

[10]. Seymour Hersh, "The Coming Wars," The New Yorker, January 24th – 31st issue, 2005, pgs. 40-47 Posted online January 17, 2005. Online: http://www.newyorker.com/fact/content/?050124fa_fact

[11]. Philip Giraldi, "In Case of Emergency, Nuke Iran," American Conservative, August 1, 2005

[12]. Dafina Linzer, "Iran Is Judged 10 Years From Nuclear Bomb U.S. Intelligence Review Contrasts With Administration Statements," Washington Post, August 2, 2005; Page A01

[13]. C. Shivkumar, "Iran offers oil to Asian union on easier terms," The Hindu Business Line (June 16, ` 2003). http://www.thehindubusinessline.com/bline/2003/06/17/stories/

2003061702380500.htm

[14]. Terry Macalister, "Iran takes on west's control of oil trading," The [UK] Guardian, June 16, 2004

http://www.guardian.co.uk/business/story/0,3604,1239644,00.html

[15]. "The Choice of Currency for the Denomination of the Oil Bill," Speech given by Javad Yarjani, Head of OPEC's Petroleum Market Analysis Dept, on The International Role of the Euro (Invited by the Spanish Minister of Economic Affairs during Spain's Presidency of the EU) (April 14, 2002, Oviedo, Spain)

http://www.opec.org/NewsInfo/Speeches/sp2002/spAraqueSpainApr14.htm

[16]. "Iran's oil bourse expects to start by early 2006," Reuters, October 5, 2004 http://www.iranoilgas.com

[17]. "Russia shifts to euro as foreign currency reserves soar," AFP, June 9, 2003

http://www.cdi.org/russia/johnson/7214-3.cfm

[18]. "China to diversify foreign exchange reserves," China Business Weekly, May 8, 2004

http://www.chinadaily.com.cn/english/doc/2004-05/08/content_328744.htm

[19]. Richard S. Appel, "The Repercussions from the Yuan's Revaluation," kitco.com, July 27, 2005

http://www.kitco.com/ind/appel/jul272005.html

[20]. China, Iran sign biggest oil & gas deal,' China Daily, October 31, 2004. Online: Online: http://www.chinadaily.com.cn/english/doc/2004-10/31/content_387140.htm

[21]. "Terror & regime change: Any US invasion of Iran will have terrible consequences," News Insight: Public Affairs Magazine, June 11, 2004 http://www.indiareacts.com/archivedebates/nat2.asp?recno=908&ctg=World

[22]. Analysis of Abu Musa Island, www.globalsecurity.org

http://www.globalsecurity.org/wmd/world/iran/abu-musa.htm

[23]. Sammy Salama and Karen Ruster, "A Preemptive Attack on Iran's Nuclear Facilities: Possible Consequences," Monterry Institute of International Studies, August 12, 2004 (updated September 9, 2004) http://cns.miis.edu/pubs/week/040812.htm

by courtesy & © 2005 William R. Clark

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Is the economy on a pharmaceutical that starts with a V and ends with a smile

« Reply #2 on: 2005-12-30 09:24:10 » |

|

An impressive article indeed. Well punctuated. Yet I suggest that it fails to fully map the terrain in that it does not reassemble the known facts about: altogether-to-sensitive-to-ask-congress-about spy programs authored and authorized by the White House; the known capabilities of Echelon to penetrate almost every communication on a global basis; the ability to use large scale data mining to extract minuscule aberrations and to assemble devastatingly complete analysis on the slightest of evidence. These, with strong suggestions of major irregularities on a global basis in dollar related settlements and markets, and previous history of US Government sponsored irregularities strongly suggest that the above capabilities are being used to drive black operations in the financial markets, possibly to prop up the tottering dollar, and, or, possibly providing clandestine funding of unaccountable operations. Add to this the fact that the US had no compunction over the totally illegal bugging and monitoring of foreign diplomats and UN staff in the run-up to the BushWarTM (Jake 2005). Remember too the strange affair of Airbus vs Boeing and who said what when. Add some data mining to the mix, along with the expertise in economic manipulation developed in the Reagan era as an anti-soviet tool - by the same people running black operations and entire directorates today, together with the extremely strange statistical and economic indicators I have commented on during this year, and I suggest that the probability that the above is very close to the mark approaches near certainty.

Now consider that an elite seldom considers sharing wealth or power as the best way of avoiding a revolution. The ruling class invariably prefers to draw the potential revolutionaries into a "lager" created by external enemies (real or imaginary) where they can be eliminated, marginalized, or otherwise managed on the grounds that the potential revolutionaries are "threatening" the safety of the society that has imprisoned them. Add to this toxic soup the fact that Israel is both the tutor du jour for the US - and a master of this strategy (Our "Good Commandos" are killing "Bad Palestinian Terrorists" in reprisal for their attacks on our civilians - just ask Spielberg) and you have a very bad scenario indeed. One that possesses the dubious virtue of appearing indefinitely plausible to those too simplistic or filled with hubris to realize that one's enemies might evolve countermeasures for simple or even complex repetitions.

Finally, tie in the fact that challenging the economic preeminence of the US is grounds for the US to preemptively nuke you according to our wonderful, published National Security Strategy Report. So the longterm outlook for China (and at the outer limits of conceivability, Europe) looks bright (bright, that is, as in nuclear flare*, not as in optimism).

This may just be the simplest possible answer to a very large number of strangenesses we are seeing in the world today. And terrifyingly, none of it requires a conspiracy to put it into motion. Just a few "great men" and the complaisance of the mass. Machiavelli - or Trotsky - would be proud of their ideological descendants.

Remember, you read it here first.

Hermit

*Although the NeoCon's self-documented interest in genetically targeted organisms might suggest an alternative weapon - at least for use against the Chinese.

This may just be the simplest possible answer to a very large number of strangenesses we are seeing in the world today. And terrifyingly, none of it requires a conspiracy to put it into motion. Just a few "great men" and the complaisance of the mass. Machiavelli - or Trotsky - would be proud of their ideological descendants.

Remember, you read it here first.

Hermit

*Although the NeoCon's self-documented interest in genetically targeted organisms** might suggest an alternative weapon - at least for use against the Chinese.

**Google for "US genetic targeted biological weapons" and if you have a strong stomach, read http://www.army.mil/professionalwriting/volumes/volume3/october_2005/10_05_4.html which will, if nothing else, persuade you that the premis behind Dr. Strangelove was more rational than our current highly offensive defense strategy. Finally, a visit to http://en.wikipedia.org/wiki/National_Security_Study_Memorandum_200 to comprehend why the US has invested vast amounts of money in the weapon systems referenced above might be amusing if you read it while concentrating on the idea that "these are the people who claim to be 'pro-life'".

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Is the economy on a pharmaceutical that starts with a V and ends with a smile

« Reply #3 on: 2006-09-13 08:32:00 » |

|

The Rapidly Increasing "Poverty Gap"

[Hermit: Excerpt only - the balance of the source article, being devoted to the sad phenomenon of black inequity in the USA, is not particularly interesting from an economic perspective. However, the statistics quoted here are, in my opinion, very pertinent to this thread.]

Source: Counterpunch

Authors: Roland Sheppard

Source: 2006-09-05

"The American economy [has been] undergoing an astonishing phenomenon that the mainstream news left largely unreported or actually glamorized in its infrequent references, the largest transfer of the national wealth in American history from a majority of the population to a small percentage of the country's wealthiest families." This process was facilitated by the fact that almost every "tax reform" from Kennedy in 1961, to Bush in 2004, has resulted in the taking of wealth from the working class and giving it to the capitalist class.

And yet, the Congressional Black Caucus echoes the "hype" from the government, the press, and the Republican and Democratic Parties, that things are better today. The economic figures from the bipartisan wage-price freeze in 1972 to today demonstrate that this it is false illusion.

According to info please, Black households median income in 1972 was $21,311 or $97,201.78 in 2005 dollars, while white Households median income in 1972 was $36,510 or $166,526.06 in 2005 dollars. In 2004 Black households had a median income in 2004 was $30,947 in 2005 dollars. White Households had the highest median income at $47,957 in 2005 dollars. Significantly lower than the median incomes for 1972.

These figures show that Black Households median income in 1972 was 58% of white households median income and approximate 64% of white households today. This does not represent progress, it represents that income for workers, Black People and other minorities has decreased since 1972. Black people now have an income of 64% of white households that has not kept up with inflation and has actually decreased by over 50% since 1972. Since the working class and the poor have been suffering an ever-increasing rate of taxation and concurrent cuts in government services, the decline in real wages and their standard of living has been worse.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.17

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Is the economy on a pharmaceutical that starts with a V and ends with a smile

« Reply #4 on: 2006-09-13 09:15:54 » |

|

No Recovery for Workers

Downward Mobility

Source: Counterpunch

Authors: Sharon Smith

Dated: 2006-09-07

While accomplishing little else of substance in this election year, the House of Representatives voted in June, for the eighth consecutive year, to award all members of Congress cost-of-living increases in their annual salaries amounting to a hefty $168,500, not including the many perks they enjoy.

Washington's policymakers have not, however, managed to muster a similar bipartisan resolve to raise the federal minimum wage of $5.15 per hour, unchanged since 1997, leaving a family of three $6,000 below the federal poverty line-the lowest proportion of the median annual wage since the years immediately following World War Two.

The human toll of this heartless government policy was illustrated on this Labor Day weekend, when six Chicago siblings, aged three to fourteen, perished in an apartment fire. The source of the fire proved to be the candles this poor family was using for light because they had been without electricity since May.

The mother escaped with one child, and a neighbor was able to rescue another. But more children appeared at a window screaming, "Help! We're burning!" to helpless bystanders, and arriving firefighters soon found the six dead siblings huddled together in the room where the candle burned.

Downward mobility

This image should shatter media depictions of the U.S. as a predominantly "consumer society." Those in upper income levels have certainly engaged in a spending spree over the last several years. But those in the lower echelons have been struggling to survive. Class stratification has not been this pronounced since the late 1920s.

Since 1997, the last year in which the minimum wage rose, gasoline prices have risen by 140 percent, and home heating oil by 120 percent. Since 2000, health care premiums have gone up by 73 percent.

But all workers' wages have been falling in the current economic expansion-declining roughly $2,000 per household since 2000. This marks the first recovery since World War Two that has failed to offer a sustained rise in workers' wages.

In the first quarter of 2006, wages and salaries accounted for only 45 percent of gross domestic product, falling from nearly 50 percent in the first quarter of 2001 and a record 53.6 percent in the first quarter of 1970, according to the Commerce Department.

New York Times reporters Steven Greenhouse and David Leonhardt commented on August 28, "[W]ages and salaries now make up the lowest share of the nation's gross domestic product since the government began recording the data in 1947, while corporate profits have climbed to their highest share since the 1960s. UBS, the investment bank, recently described the current period as 'the golden era of profitability.'"

Between 2000 and 2005, the real median income of households headed by persons under the age of 65 fell by 5.4 percent, paralleling the nosedive in incomes during the Reagan era. The U.S. Census Bureau reported in August that wages and salaries fell by 1.8% for men and 1.3% for women last year alone.

Roughly one-fourth of all low-income families with a full-time worker has been unable to pay the rent or mortgage at least once during the past year, and the same number report being unable to put enough food on their families' tables.

In 2005, the number of Americans without health insurance increased for the fifth straight year. The number of uninsured Americans rose to 46.6 million in 2005, to 15.9 percent from 14.2 percent in 2000.

Economists at Goldman Sachs accurately noted, "The most important contributor to higher profit margins over the past five years has been a decline in labor's share of national income."

"There are two economies out there," political analyst Charles Cook recently described. "One has been just white hot, going great guns. Those are the people who have benefited from globalization, technology, greater productivity and higher corporate earnings.

"And then there's the working stiffs,'' he added, who "just don't feel like they're getting ahead despite the fact that they're working very hard. And there are a lot more people in that group than the other group."

The bipartisan project

But gaping class inequality cannot be blamed on the Bush administration alone, for this has been a bipartisan project, widening virtually without interruption since the mid-1970s, including during the Clinton-era boom.

As Ezra Klein noted in February's American Prospect, "while electoral defeats help explain why Democrats couldn't implement a comprehensive antipoverty strategy, they don't account for why they couldn't propose one. It's not just that Democrats couldn't bring policies onto the Senate floor. In this case, the backstage was empty too. The Democratic National Committee's issues page never mentions the word 'poverty.' Nor does Harry Reid's, Nancy Pelosi's, the House Democratic Caucus, nor the Senate Democratic Caucus. Not a single one identifies poverty as an issue the Democratic Party cares to solve."

Indeed, Democratic President Bill Clinton ended "welfare as we know it" in 1996, dismantling 60 years of New Deal legislation that obliged the government to assist the poor. It turns out no government agency bothered to follow the subsequent (mis)fortunes of the poorest Americans suddenly released from their "cycle of dependency."

More than likely, former welfare families make up a substantial proportion of the 43 percent of poor American households now surviving on less than half the official poverty level in 2005-just $7,800 for a family of three.

Workers have not shared in the current economic prosperity that has sent corporate profits soaring in recent years. When the economy flat-lines in the coming months as the housing bubble bursts, the silent depression experienced by working families might finally enter the mainstream of public discourse. And the "golden era of profitability" should meet the same fate as the "Roaring Twenties"-in an explosion of class struggle-to finally begin to reverse the balance of class forces.

[Hermit: The resulting torrent of catastrophe, fiendishly exacerbated by the recent amendments to the bankruptcy laws, slightly benefiting banks, card issuers and large scale medical providers at a very high cost to individuals, is likely to make the bitter consequences of the crash of 1893 look mild in comparison. Eventually, and we survive that long, Americans will probably discover what the Europeans have long known. That the many costs to a society of a large "underprivileged" class is far greater than the minor costs involved in engineering a flatter distribution of wealth and income.]

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

|