Author

Author

|

Topic: The Impoverishment of Americans (Read 1159 times) |

|

Hermit

Archon

Posts: 4287

Reputation: 8.94

Rate Hermit

Prime example of a practically perfect person

|

|

The Impoverishment of Americans

« on: 2007-10-16 10:24:45 » |

|

Life is harder now, some experts say

Generation gap: After paying the bills, middle-class pockets are emptier

Source: MSNBC

Authors: Bob Sullivan (MSNBC Technology Correspondent)

Dated: 2007-10-16

Shopping malls are packed every weekend. Restaurants can't open fast enough. Everyone seems to be wearing designer shoes, jackets and jeans and sipping $4 lattes. Credit card commercials constantly advocate splurging and, it seems, U.S. consumers are all too ready to comply.

So what's the problem? Why do so many middle class Americans with so much stuff say they feel so squeezed? If they are dogged by debt, isn’t it their own fault?

Perhaps, some experts say, things are not as they appear.

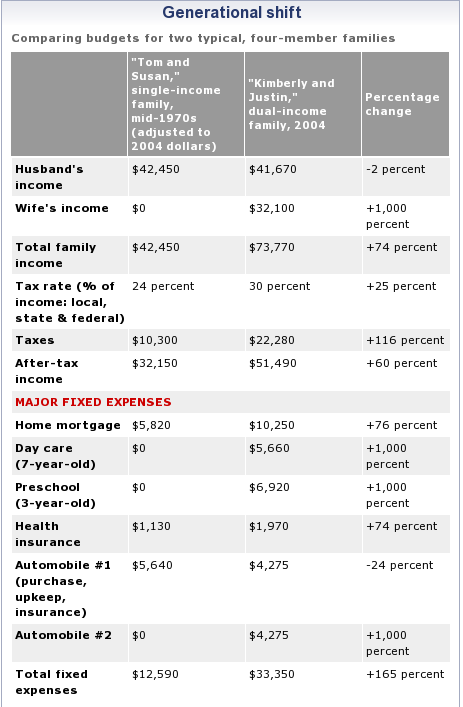

Bankruptcy law expert and Harvard University Professor Elizabeth Warren spent a lot of time crunching consumer spending numbers for her popular books, "The Fragile Middle Class,” and “The Two-Income Trap.” In both, she makes this point: Despite all those $200 sneakers you hear about and the long lines at Starbucks, consumers are actually spending less of their income — much less — on discretionary items like clothing, entertainment and food than their parents did. In fact, after taking care of essentials like housing and health care, today’s middle class has about half as much spending money as their parents did in the early 1970s, Warren says.

The basics, according to Warren, now take up close to three-fourths of every family's spending power (it was about 50 percent in 1973), leaving precious little left over at the end of the month — and leaving many families with no cushion in case of a job loss or health crisis. [ Hermit: And note that whereas the man of the house was working an average of 40 hours a week in the 1970s, that man and woman are now working an average of approximately 96 hours per week - whereas the Europeans have reduced the hours put in by both man and woman from 40 hours per week to 36 hours per week ].

Source: Elizabeth Warren, co-author with Amelia Warren Tyagi of "The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke"

Warren's theories fly in the face of conventional wisdom and those crowded malls. But the premise is simple: Even though household incomes have risen about 75 percent from 1970, most of that is the result of a second earner — generally a woman — joining the work force. And that added income has been swallowed by rising fixed expenses, such as child care and housing costs, Warren argues. The average family pays at least twice as much for housing compared to its counterpart in the 1970s, Warren says, and in some competitive areas with good schools, housing costs have risen by as much as 600 percent.

Without savings, at risk of job loss

Now consider these factors: 4 in 10 Americans don't have even one month's worth of savings for use in case of an emergency, according to a survey by HSBC Bank published in 2006. And with two incomes built into the family budget, the odds of a household getting hit by a layoff have doubled in the last generation. This combination – high housing debt, rising health care costs, lack of savings and greater exposure to unemployment — leaves many families in a precarious financial position.

Yet before Warren can get policymakers to talk about the middle class squeeze, or at least middle class worry, she often finds she has to beat back the notion that overconsumption is to blame for the rise in consumer debt — and in middle class anxiety.

"A growing number of families are in terrible financial trouble, but no matter how many times the accusation is hurled, Prada and HBO are not the reason," Warren says in her book, “The Two-Income Trap.”

There is no arguing that most Americans have more gadgets in their living rooms and more clothes in their closets than ever before. Consider the explosion of the closet- organizer business.

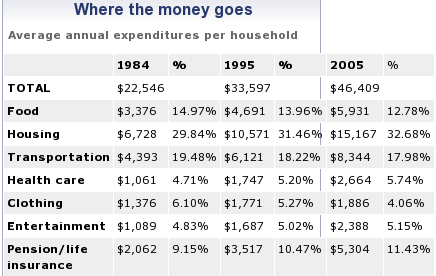

But government spending data paints a different picture. Take the often-cited evidence of culinary extravagance. While it's true that Americans are eating out much more than ever – nearly half of all dollars spent on food now go to dining out — overall food costs have plunged in recent decades. Americans now spent only about 10 percent of their money on food each year, compared to nearly 20 percent in the 1970s, according to data collected by the Bureau of Labor Statistics.

And despite the designer brands they buy, the average family of four spends about 20 percent less on clothes today, according to Warren's analysis. Think about your last trip to Target: Thanks in part to the entry of inexpensive imported textiles from China and other trading partners, it's possible to buy a Friday night outfit for under $40. This shows up in BLS data too: On average, Americans spent nearly 7 percent of their money on clothes in 1973, compared to about 4 percent in 2005.

Two weeks work for a fridge?

In fact, many consumer goods are much cheaper than they were in the 1970s. A look at 1971 Sears catalog offers a glimpse of some plummeting prices. In 1971, a basic Sears refrigerator cost $399. Adjusted for inflation, that would be about $2,000 in 2005 dollars, or nearly 10 times the $297 price of a basic fridge in today’s Sears catalog. Put another way, a fridge costs more than two week’s work for an average earner in 1971, but less than two day’s labor today.

Other household items were similarly expensive in 1971 — an 18-inch TV cost $429 (the equivalent of $2,150 today) and a 24-inch dishwasher cost $249 ($1,200 today).

Lower prices are, of course, a boon for the middle class, which now enjoys many conveniences and luxuries that were formerly reserved for the well-to-do. This is the cornerstone point for those who argue that the middle-class squeeze is a myth.

“I can’t hazard a guess as to why there is such a malaise in this country about current living conditions, but ... we have never had it better,” economist Arthur B. Laffer wrote in response to a question from a Gut Check America reader. Laffer is one of a large group of economists and policy-makers who point to crowded malls and high stock market returns as evidence that middle class America has little to complain about.

But Amelia Warren Tyagi, co-author of “The Two-Income Trap,” and also Warren’s daughter, said weekend shopping trip receipts aren’t the best way to examine the state of the middle class.

"Yes, people are spending more on home electronics, but the dollars just aren't that big," Tyagi said. "Maybe they spend a couple of hundred dollars more on stereo equipment. But they are spending less on tobacco. This is not to say that there's no frivolous spending going on, but as you add it all up, there's no more frivolous spending than there was a generation ago."

The source of the anxiety

With government data showing that Americans are spending much less than they did 35 years ago on clothes, food, and even entertainment, Tyagi says the anxiety they are feeling comes from somewhere else: the exploding costs of housing, health care and education.

Source: U.S. Department of Labor, Bureau of Labor Statistics.

In housing, recent data is most striking. Household incomes have largely stagnated in recent years, even shrinking 2.8 percent from 2000 to 2006. Housing costs skyrocketed 32 percent in that time.

Even more striking is the amount of income most families are paying to stay in their homes. Banks have long had a standard that said mortgages should not be approved unless the monthly payment was 25 percent or less of the buyer’s income. That limitation clearly is long gone. The U.S. Census Bureau defines “house poor” as spending more than 30 percent of income on housing expenses. In 1999, 26.7 percent of U.S. households were considered house poor. By 2006, the number had jumped to 34.5 percent.

Because of difference in government data collection methods, it's hard to reach back to the 1970s for a precise comparison point. But the rise in house-poor mortgage holders is striking by any measure. A 1975 Census report showed that only 8.9 percent of mortgage holders spent 35 percent or more of their income — including insurance, property taxes, and utilities — on housing.

The number of households spending half their income on housing — an amount that for most would be fiscal suicide — also has dramatically increased, from 10 percent in 2000 to 14 percent in 2006.

The cost of education has similarly spiked. Pre-school was largely non-existent in the 1970s, but today many families pencil in $1,000 a month for child care and early childhood education. On the other end, college costs have easily outpaced the cost of inflation. For example, the average bill for attending a four-year public college rose 52 percent from 2001 to 2007. [ Hermit : Or as I have repeatedly shown, inflation is far higher than reported and in fact colleges, having to respond to the public, have raised their prices less than the effective inflation rate. ]

Health care costs have climbed steadily as well. According to the BLS, the average household spent 4.7 percent of its income on health care in 1984, and 5.7 percent in 2005. [ Hermit : As we have seen in our recent threads on "socialized medicine", this estimate is significantly distorted. ]

In the end, the portion of an average family’s budget spent on fixed costs like housing has risen much faster than wages and inflation, while spending on discretionary items has declined. [attribution?] That means mortgages, more than lattes, are the source of middle-class anxiety, says economist Jared Bernstein of the Economic Policy Institute, a generally liberal think tank that focuses on the interests of low- and middle-income Americans.

‘They feel squeezed because they are squeezed’

"Consumers are asking, ‘If the economy is doing so well why am I feeling so squeezed?’” he said. “Well, they feel squeezed because they are squeezed." [ Hermit : In fact, the consumers have been lied to. The economy is not doing well at all, with a much smaller percentage of the total population working, with most people working longer hours for lower per hour rates, and with vastly higher government waste particularly on "security" and war, than in 2000. In addition, US inflation rates are no longer coupled to consumer expenses and are currently at the high end of in the 12% to 20% range if the same basket is used to calculate it as was used in 2000. In comparison with Europe which has inflated the Euro M1 by 16% to maintain close coupling with to the dollar, the dollar has still lost a third of its value. ]

Identifying the source of the squeeze requires more than simply comparing overall inflation to overall wage growth, Bernstein said.

"You have to look at a basket of key goods,” he said, like housing and college costs. “If you compare income growth to growth in prices of key goods, that stuff is growing 10 percent faster than income. ... Perhaps (consumers) are beating overall inflation but are they beating inflation in key components of their market basket? No."

More to the point, Bernstein said, rising housing costs have quietly broken a social contract with consumers that promised that a good job with a good income would guarantee a good place to live. While that may have been true in the 1970s, it is often not true today, he said.

"Lodged in the minds of those who come from the middle class is the idea that the middle class is a safe haven. It's not," he said.

That notion is changing. People no longer feel certain they will be better off than their parents, for example. "What really messes with your economic mind is when your expectations and aspirations are violated, Bernstein said. “You think, my parents died in a much better home than they grew up in. Will I?"

Generational trade-offs

Bernstein is not as pessimistic as Tyagi in his interpretation of the data. A comparison of then vs. now needs to be a little more subtle, he said. Clearly, middle class Americans are better off in some ways: larger homes and availability of what were once luxury items, like air conditioning, for instance.

“If a person is arguing that middle class families are worse off in every way, that person hasn't spent enough time at the mall,” he said. “But these are things you don't see at the mall: housing, health care, child care, saving and saving for college. The price of those (are) rising more quickly than inflation in general, rising more quickly than family income. And they are largely responsible for the squeeze that families report feeling."

Middle-class squeeze skeptics often point to rising credit card debt as evidence that consumers have themselves, and their spending habits, to blame for any economic anxiety. But there’s a problem with that theory too – it’s an exaggeration, says Liz Pulliam Weston, author of “Deal With Your Debt” and an MSN Money columnist. The majority of American consumers carry no credit card debt from month to month and very few carry large balances, she notes.

Last year, Americans held about $900 billion in credit card debt, leaving the average household with a bill of about $9,300, according to Federal Reserve data. That sounds like a lot, but a few consumers with very large debts can skew the average. The median balance is – the point at which half of consumers have more debt, and half have less – is a better indicator. The median credit card balance is $2,200, a fairly manageable amount. Only 8.3 percent of households owe more than $9,000 on their credit cards. Meanwhile, one-quarter of all Americans don’t even have credit cards, and another 30 percent pay them off in full every month.

Notion of heavy credit card debt called overblown

“Our national discussions about consumer indebtedness and bankruptcy are being distorted by the idea that we're waddling around with four- and five-figure credit card debts,” Weston wrote recently. “That makes us sound like spendthrifts, when that's not the norm."

Nevertheless, overconsumption and excessive credit card spending persist as explanations for middle-class debt angst. Tyagi has a theory why.

“Frivolous spending is visible, and it’s easy to pass judgment on, she said. “There is a comforting notion that if you are not spending wildly you are safe. If you are deeply invested in the belief that if everyone can solve their problems on their own, then there's no systematic problem, it would be important to think that if anyone is in trouble financially it’s because they did something stupid.”

It might be something their parents would never have done, such as taking out a negative-amortization mortgage or taking out a $100,000 home equity loan to pay for a child’s college, or spent as much money on child care as food.

But you can’t blame that on extravagant living, Warren said.

“Perhaps the most important thing we can do is persuade people that it's not about the lattes,” she said. “I think the "latte factor" is a way to distract people from real changes in the economy. Those who shake their fingers over lattes can feel good about themselves, both for their own economic prosperity and for the fact that those who are in trouble are there because of their own personal failings.”

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Walter Watts

Archon

Gender:

Posts: 1571

Reputation: 8.89

Rate Walter Watts

Just when I thought I was out-they pull me back in

|

|

Re:The Impoverishment of Americans

« Reply #1 on: 2007-10-17 16:15:07 » |

|

Quote from: Hermit on 2007-10-16 10:24:45

Life is harder now, some experts say

Generation gap: After paying the bills, middle-class pockets are emptier

Source: MSNBC

Authors: Bob Sullivan (MSNBC Technology Correspondent)

Dated: 2007-10-16

<snip>

|

Outstanding Hermit.

Thanks for this.

Best to you and yours.

Walter

|

Walter Watts

Tulsa Network Solutions, Inc.

No one gets to see the Wizard! Not nobody! Not no how!

|

|

|

Hermit

Archon

Posts: 4287

Reputation: 8.94

Rate Hermit

Prime example of a practically perfect person

|

|

Re:The Impoverishment of Americans

« Reply #2 on: 2008-05-03 19:47:53 » |

|

Rich/Poor Income Gap Widening To Chasm

Evidence Shows Impact On Those At Lower End Of Wage Scale Continues To Grow

Source: CBS News

Authors: Not Credited

Dated: 2008-05-03

There have always been "haves" and "have-nots" in the United States, but over the past three decades, the gap between them has gotten a lot wider, statistics from congressional numbers crunchers show.

According to the non-partisan Congressional Budget Office, income for the bottom half of American households rose six percent since 1979 but, through 2005, the income of the top one percent skyrocketed - by 228 percent.

And, correspondent Benno Schmidt reported in The Early Show's "Early Wake-Up Call" Saturday, the impact of the growing disparity on the "have-nots," and even on small businesspeople, is being felt more and more.

Schmidt visited Adam Rames who, after 35 years, is saying goodbye to the only way of life he's known - his formerly thriving meatpacking business in New York City.

"I used to feed a lot of families," Rames told Schmidt. "I feel like I took care of the entire East Coast (with meat)!. I used to move 100,000 pounds a week. It's all gone."

Rames says he couldn't pay the rent when it tripled, couldn't pay pensions and retirement for the 15 workers he had to let go, couldn't keep up with gas and fuel prices, and couldn't afford supplies.

"In the past 16 months, I lost 40 percent of my business," he laments.

Now, he's headed for the unemployment line - and he's not alone.

This, while an upscale hotel goes up in his business' neighborhood.

Generations of working-class Americans came to that area of lower Manhattan to realize their dreams, Schmidt points out, and the meatpacking district is still thriving, but in a very different way.

Trendy boutiques hawk $7,000 jackets and $400 jeans made to look worn and old. Apartments trade for millions of dollars. Record oil profits and record Wall Street bonuses have driven out many who wonder where their tax breaks are.

A hard-hatted worker remarked to Schmidt that his money doesn't go very far in today's economy, and he lives paycheck-to-paycheck.

Many, Schmidt observes, can't understand the two economies: one for them, another for the super-wealthy or conglomerates.

Things are certainly "out of whack, out of balance for a lot of workers," New York Times reporter Steven Greenhouse, author of "The Big Squeeze: Tough Times for the American Worker [pdf excerpt] ," told Susan Koeppen on The Early Show Saturday.

"A lot of people think it's just them," he continued, "just you suffering from stagnant wages, but it's happening to millions of workers. It's happening for many reasons.

"One is globalization. Companies can move operations overseas, which helps them increase profits. Yet it also helps hold down wages for American workers. A second thing is there's pressure by Wall Street for companies to get their stock prices and their profits up, and that often causes them to push down wages.

"A third factor is that unions have become much weaker, and they don't have as much leverage on companies to increase those wages quickly. Another factor is health costs are soaring, and they're eating up part of the money that would normally go to wage increases."

"Many companies and investors on Wall Street," he explained, "want CEOs to maximize profits, maximize share prices, and that often translates into laying off people, downsizing, trying to reduce wages, trying to reduce benefits. So, unfortunately, too often the interests of Main Street and Wall Street are opposed."

About 70 percent of the economy is based on consumer spending, and that's presenting another problem, Greenhouse say: "What we're seeing now is gas prices soaring and debt levels soaring - a lot of Americans are not going out and buying so-called discretionary items like cars and flat-screen TVs, because people have to concentrate on buying food for their families and paying for health insurance and paying for utilities. So, right now, a lot of retail stores are hurting, and in turn, that's hurting a lot of American manufacturers.

"It's not unique to the United States because right now, worldwide, fuel prices are soaring. So, in Europe, in Japan, and the United States, consumers are feeling the squeeze. I think there's more inequality in the United States between the top and the bottom. It's not nearly as bad as in Europe, but I think the people on the bottom and even in the middle here in the United States are being squeezed worse than in many other countries."

What can be done about it?

Possible remedies, Greenhouse says, include enrolling more low income students in college, increasing pay for lower-wage union workers, and revitalizing the manufacturing base.

"A little-known secret is that, over the past seven years, the United States has lost one in five manufacturing jobs," he said. "Those are usually jobs that pay good wages, middle-class wages, usually provide middle-class benefits on health and pensions, and the United States seems not to be paying attention to this huge problem that has lost 3.5 million manufacturing jobs, and I think the government and industry have to work together to figure out how to preserve jobs."

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

|