Author

Author

|

Topic: The Oil Drought (Read 6468 times) |

|

Hermit

Archon

Posts: 4287

Reputation: 8.94

Rate Hermit

Prime example of a practically perfect person

|

|

The Oil Drought

« on: 2008-03-19 18:51:43 » |

|

Our "black Monday" for oil

The record high price of crude that was hit this month reflects the new reality of global energy consumption -- and may presage dark times for America.

Source: TomDispatch.org

Authors: Michael T. Klare

Dated: 2008-03-17

Michael Klare is the author of Rising Powers, Shrinking Planet: The New Geopolitics of Energy

On Monday, March 3, the price of crude oil reached $103.95 per barrel on the New York Mercantile Exchange, surpassing the record set nearly 30 years ago during another moment of chaos in the Middle East. Will that new mark prove distinctive in the annals of world history or will it be forgotten as energy prices drop, just as they did following their April 1980 peak?

When oil costs are plotted over time, the 1980 oil crisis -- prompted by Ayatollah Khomeini's Iranian revolution -- stands out as a sharp spike on that price curve. Both before and after that moment, however, oil supplies proved largely sufficient to meet rising global demand, in part because the Saudis and other major producers were capable of compensating for declining Iranian production. They simply increased their output substantially, dumping a surplus of oil onto the global market. Aided by the development of new fields in Alaska and the North Sea, prices dropped precipitously and stayed low through the 1990s (except for a brief spike following the Iraqi invasion of Kuwait in August 1990).

Nothing similar is likely to happen now. For the present surge in prices -- crude oil costs have risen by 74 percent over the past year -- no easy solution is in sight. To begin with, we face not a sudden spike, but the results of a steady, relentless climb that began in 2002 and shows no signs of abating; nor can this rise be attributed to a single, chaos-causing factor in the energy business or in global politics. It is instead the product of multiple factors endemic to energy production and characteristic of the current era. There is no prospect of their vanishing anytime soon.

Three factors, in particular, are responsible for the current surge: intensifying competition for oil between the older industrial powers and rising economic dynamos like China and India; the inability of the global energy industry to expand supplies to keep pace with growing demand; and intensifying instability in the major oil-producing areas.

The crucial role of the developing economic dynamos in Asia on the global energy market was already evident as this century dawned. With their phenomenal rates of growth, these countries must have more oil (and other forms of energy) to power their expanding industries, fuel their new cars and trucks, and satisfy the aspirations of their burgeoning middle classes. According to the U.S. Department of Energy, combined oil demand from China and India, already at 8.9 million barrels per day in 2004, is expected to hit 12.1 million barrels by 2010 and 15.5 million barrels by 2020. These are staggering rises. If you include anticipated consumption by Brazil, Mexico, South Korea and other rapidly industrializing nations, demand from the developing world is expected truly to soar.

To this tsunami of new energy needs must be added an already high level of consumption by the mature industrial powers led by the United States, the European Union and Japan. This shows little sign of lessening, which means we face an unprecedented surge in the total demand for oil. According to the Department of Energy, combined world oil consumption, which reached 83.7 million barrels per day in 2006, is projected to hit 90.7 million barrels in 2010 and 103.7 million in 2020. We're talking about an increase of 20 million barrels per day in just 15 years. To achieve this would require a mammoth, unbelievably costly effort on the part of the world's giant oil companies (and their lenders and government backers) -- and even then it might not be possible.

American consumers, facing painful prices at the gas pump, are, at the moment, being further punished by the fact that most global oil transactions are denominated in dollars. Given the declining value of the dollar relative to other currencies, we wind up paying more per barrel than competitors who can convert their euros, yen or other strong currencies into dollars before bidding against us on the international energy market. Global investors, sensing the trend, are dumping the dollar for these other currencies or buying oil futures, only adding to the slide of the U.S. currency and the rising price of crude.

Lurking behind soaring demand is another crisis entirely -- a crisis of production. The energy industry is now in the difficult process of transitioning from a world of easily tapped oil supplies to one in which mainly tough-oil options prevail. Those "easy-oil" supplies are the ones we've long been familiar with: the giant petroleum reservoirs in friendly, stable countries that provided most of the world's oil during the formative years of the Petroleum Age, stretching from the late 19th century until the Arab oil embargo of 1973.

These mammoth reservoirs include Ghawar in Saudi Arabia, Burgan in Kuwait, and Cantarell in Mexico -- monster fields that produce hundreds of thousands or even millions of barrels of crude per day. In the last quarter-century, however, discoveries of "elephant" fields like these have been almost nonexistent. The world is, as a result, becoming increasingly dependent on smaller fields, often in remote, unwelcoming locations that require far more expense to develop and bring online. This, too, is adding to the price of oil.

As an illustration of this trend, take Kashagan, a giant oil field discovered in 2000 in Kazakhstan's sector of the Caspian Sea. It represents the single largest discovery worldwide in the past 40 years. Although it does harbor significant reserves of oil and gas, the field poses staggering challenges to the international consortium of energy companies attempting to develop it. It contains, for example, high concentrations of poisonous hydrogen sulfide gas, which makes its development using conventional (and cheaper) production technology impossible. Development costs to bring the field online have already soared from an estimated $57 billion to $135 billion with no end in sight. In the meantime, the projected date for the start-up of production at Kashagan has been continually pushed back. Once expected to come online in 2005, it's now slated for 2011 at the earliest. This, in turn, has led a frustrated Kazakh government to demand that the state-owned KazMunaiGaz energy company be given a larger stake in the field's operating consortium.

Most of the other big discoveries of recent years -- the "Jack" field in the deep waters of the Gulf of Mexico, the Doba field in Chad, fields off Russia's Sakhalin Island, and the Tupi field in the deep Atlantic off Brazil -- exhibit similar characteristics. They are either far offshore and difficult to develop or entail problematic relationships with unreliable governments -- or, worse yet, some combination of the two. You can essentially do the math yourself when it comes to the future cost of oil produced at such sites.

So here's the really bad news at the pump, so to speak: The inability of the global energy industry to keep pace with rising demand is only likely to become more pronounced as, in the years ahead, the world reaches maximum sustainable daily petroleum output and commences what just about all energy experts now agree will be an irreversible decline. No one can be sure when exactly this will occur, but a growing chorus of specialists believes that we are moving ever closer to that moment of "peak" oil output -- with some specialists placing it as soon as 2010-12. [ Hermit : Except that I and the DoD both think that the Hubbert peak, which will only be visible with hindsight, was reached between 2005 and 2007, with the likelihood being high that it was sometime in 2006. ]

Finally, let's not forget that the equivalent of the Iranian Revolution of 1980 remains with us. The oil heartlands of the planet are increasingly in crisis and the price of oil is regularly driven up by that as well. Iraq, with the world's second largest reserves of petroleum, is convulsed by war. Nigeria, a major supplier to the United States and Europe, has experienced a significant reduction in output recently due to ethnic violence in the oil-rich Niger Delta region. Venezuela's production has fallen because many anti-Chavez oil technocrats have been purged from the state-owned oil monopoly PdVSA. Iran's output has suffered as a result of the economic sanctions imposed by the United States. Political violence, corruption and state interference in the energy sector have also led to depressed output in Chad, Mexico, Russia and Sudan.

At one time, the world's major oil producers could compensate for a downturn in output in any area by ramping up production from the "spare" (or reserve) capacity at their disposal. This was critical in 1990, following Iraq's invasion of Kuwait, and again in 2001, following the terrorist attacks of 9/11. Both times, Saudi Arabia simply upped production, adding hundreds of thousands of barrels per day in spare capacity, thereby averting a catastrophic energy crisis in the United States. But the Saudis and the other members of OPEC no longer possess significant spare capacity. They're pumping oil for all they're worth in order to benefit from the current surge in prices. Hence, any sudden loss of production in conflict-torn areas translates quickly into rising prices.

Can we expect the levels of conflict in oil-producing regions to subside sooner or later, bringing prices down? Unfortunately, this is a wholly unrealistic prospect because oil production itself increasingly acts as a goad to conflict. While extracting petroleum generates enormous wealth for privileged elites, it leaves others in many countries, usually of a different ethnic or religious identity, with few benefits from the resource in their midst. Take the Niger Delta area, where ethnic minorities continue to fight to obtain a larger share of oil revenues that historically have been monopolized by elites in the distant national capital, Abuja. The Kurds in Iraq have similarly been struggling to take control over the oil revenues generated by the giant fields in portions of that war-ravaged country they claim. This threatens to turn the oil-producing city of Kirkuk, in particular, into a future battleground.

While no one can predict just where the next conflicts will break out over the allocation of oil revenues or the control of valuable oil fields, it is safe to predict that such conflicts will remain an abiding, price-hiking feature of the global political landscape. Instability is now not only the norm, but spreading in these areas, and high oil prices are an inevitable corollary.

The bottom line: Oil prices are high today, not due to a temporary disruption in the global flow of petroleum as in 1980, but for systemic reasons that are, if anything, becoming more pronounced. This means news headlines with the phrase "record oil price" are likely to be commonplace for a long time to come. The only good news may lie in just how bad the news really is. Sooner or later, ever rising energy costs are likely to push the United States and other oil-consuming nations into deep recession, thus depressing demand and possibly beginning to bring energy prices down. But this is hardly a recipe for lower prices that anyone would voluntarily choose.

What, then, will be the lasting consequences of higher energy costs? For the ordinary American consumer the answer is simple, if grim: A diminished quality of life, as discretionary expenses disappear in the face of higher costs for transportation, home heating, and electricity, not to speak of basics like food (for which, from fertilizers to packaging, oil is a necessity). For the poor and elderly, the implications are dire: In some cases, it will undoubtedly mean choosing among heat in winter, adequate nutrition and medicine.

Finally, there are the implications for the United States as a whole. Because the U.S. relies on petroleum for approximately 40 percent of its total energy supply, and because nearly two-thirds of its crude oil must be imported, this country will be forced to devote an ever-increasing share of its national wealth to energy imports. If oil remains at or above the $100 per barrel mark in 2008, and, as expected, the United States imports some 4.75 billion barrels of the stuff, the net outflow of dollars is likely to be in the range of $475 billion. This will constitute the largest single contribution to America's balance-of-payments deficit and will surely prove a major factor in the continuing erosion of the dollar.

The principal recipients of petro-dollars -- the major oil-producing states of the Persian Gulf, the former Soviet Union and Latin America -- will undoubtedly use their accumulating wealth to purchase big chunks of prime American assets or, as in the case of Hugo Chavez of Venezuela or the Saudi princes, pursue political aims inconsistent with American foreign policy objectives. America's vaunted status as the world's "sole superpower" will prove increasingly ephemeral as new "petro-superpowers" -- a term coined by Sen. Richard Lugar of Indiana -- come to dominate the geopolitical landscape.

So, while March 3 may have only briefly made the headlines here, it may well be remembered as the true "black Monday" of our new century, the moment when energy costs became the decisive factor in the balance of global economic power.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Fritz

Archon

Gender:

Posts: 1746

Reputation: 8.84

Rate Fritz

|

|

Re:The Oil Drought add the Coal crop failure

« Reply #1 on: 2008-03-20 21:53:32 » |

|

[Fritz] If the Oil wasn't enough, doesn't this just add another nail in the abundant energy coffin.

http://www.washingtonpost.com/wp-dyn/content/article/2008/03/19/AR2008031903859.html?hpid=topnews

By Steven Mufson and Blaine Harden

Washington Post Staff Writers

Thursday, March 20, 2008; Page A01

Long considered an abundant, reliable and relatively cheap source of energy, coal is suddenly in short supply and high demand worldwide.

An untimely confluence of bad weather, flawed energy policies, low stockpiles and voracious growth in Asia's appetite has driven international spot prices of coal up by 50 percent or more in the past five months, surpassing the escalation in oil prices.

The signs of a coal crisis have been showing up from mine mouths to factory gates and living rooms: As many as 45 ships were stacked up in Australian ports waiting for coal deliveries slowed by torrential rains. China and Vietnam, which have thrived by sending goods abroad, abruptly banned coal exports, while India's import demands are up. Factory hours have been shortened in parts of China, and blackouts have rippled across South Africa and Indonesia's most populous island, Java.

Meanwhile mining companies are enjoying a windfall. Freight cars in Appalachia are brimming with coal for export, and old coal mines in Japan have been reopened or expanded. European and Japanese coal buyers, worried about future supplies, have begun locking in long-term contracts at high prices, and world steel and concrete prices have risen already, fueling inflation.

In the United States, the boom in coal exports and prices has helped lower the trade deficit, which declined last year for the first time since 2001. The value of coal exports, which account for 2.5 percent of all U.S. exports, grew by 19 percent last year, to $4.1 billion, the National Mining Association said. An even bigger increase is expected this year.

That means that, in a small way, higher revenues for U.S. coal exports indirectly helped the U.S. economy cover the cost of iPods from China, flat-screen TVs from Japan and machinery from Germany. The still-gaping trade deficit of the world's largest industrial power at the dawn of the 21st century was slightly eased by a fuel from the era and pages of Charles Dickens.

Big swings in the prices of coal and other commodities are common. But while the price of coal has slipped slightly in recent weeks, many analysts and companies are wondering whether high prices are here to stay. As increasing numbers of the world's poor join the middle classes, hooking up to electricity grids and buying up more manufactured goods, demand for coal grows. World consumption of coal has grown 30 percent in the past six years, twice as much as any other energy source. About two-thirds of the fuel supplies electricity plants, and just under a third heads to industrial users, mostly steel and concrete makers.

Meeting rising demand will prove difficult. To maintain its role as the world's producer of last resort, the United States will need to make major investments in mines, railways and ports.

"We think the current world markets have legs," said Thomas F. Hoffman, senior vice president of external affairs at Consol Energy, one of the biggest U.S. coal producers. Consol is trying to decide whether to expand output at its Appalachian mines and to add capacity in Baltimore's harbor.

"We're at a point where we're running through the capacity," said David Khani, a coal analyst at Friedman, Billings, Ramsey Group. He compares the coal market to the oil market. For coal, he added, "it is unprecedented."

If high prices last, that would raise the cost of U.S. electricity, half of which is generated by coal-fired powered plants.

Expensive or not, coal is almost always dirtier to burn than are other fossil fuels. Although its use accounts for a quarter of world energy consumption, it generates 39 percent of energy-related carbon dioxide emissions. Climate change concerns could lead to legislation in many countries imposing higher costs on those who burn coal, forcing utilities and factories to become more efficient and curtail its use. Climatologists warn that without technology to capture and store carbon dioxide emissions, burning more coal would be disastrous.

China, the world's largest consumer of coal, is burning through more than the United States, European Union and Japan combined. And its consumption is increasing by about 10 percent a year. In 2006, it installed power plants with more capacity than all of Britain.

China has vast coal resources, but its growing appetite has outstripped production. In January 2007, it imported more coal than it exported for the first time, according to government figures.

Logistics compound China's coal woes. The biggest deposits lie inland and in the north while most of the fast-growing industries are in the south and along the coasts. Transporting all that coal strains the railways, half of which are devoted to coal transport.

When blizzards hit this winter, shipments were held up, reserves dwindled to half their normal levels, and the government suspended exports for two months. On Friday, it issued its first export license of 2008. Because of shortages, electricity was rationed in 17 provinces, most of them in the south.

Guangdong Taini Cement said it was not allowed to use electricity from 7 a.m. to noon or from 5 p.m. to midnight. "The electricity we were getting at that time was only 60 percent of what we usually get," said Chen Jijing, director of the company's manufacturing department.

Even before the storms, blackouts were common, as a result of China's muddled energy policies.

China has done little to contain demand. Indeed, the government has limited electricity rate increases for years, encouraging greater use. Concerned about climbing inflation, Beijing on Jan. 10 turned once again to Communist-style measures, freezing electricity prices even as coal and oil prices soared.

"The current price policy encourages people and companies to consume electricity because electricity is so cheap. There's no pressure for them to use energy resources efficiently," said Ping Xinqiao, a professor of economics at Beijing University.

Strong coal demand has created incentives for small illegal coal mine operations that are extremely dangerous and highly polluting. The government has shut down 11,155 such mines since 2005, further crimping supplies.

In India, Policy vs. Demand

India also relies on outdated energy policies while trying to keep pace with booming demand. The economy is growing at 8 to 9 percent a year, and by 2012 India expects to add 76,000 megawatts of power, according to Upendra Kumar, a member of the mining committee at the Confederation of Indian Industries.

But 94 percent of India's coal mining is in the hands of government-owned companies. The biggest, Coal India, produces four-fifths of the country's coal. Because the government is worried about social unrest, the prices for coal and electricity are kept low.

"Today our coal prices are about 40 percent lower than international coal prices," said K. Ranganath, Coal India's director of marketing. And, he notes, the "lower the prices, the higher the demand."

That discourages investment, too. Although India's coal reserves are vast, they haven't been fully developed. The government hopes to boost coal production by 50 percent by 2012 and quadruple it by 2030. Yet that would require massive investment. Experts note that India's coal deposits are deep and difficult to mine. The dilapidated rail infrastructure is another obstacle; India's coal has to travel an average of 435 miles to reach plant and industrial users, said D.P. Seth, additional secretary in India's coal ministry.

As a result, India expects to import 51 million tons by 2012, nearly as much as U.S. exports last year. By 2022, imports could climb to 136 million tons, Kumar said.

Developing countries aren't the only ones using more coal. Throughout the 1980s and 1990s, British coal consumption declined as new sources of oil and natural gas were discovered in the North Sea. However, the trend has reversed and coal consumption has climbed steadily over the past six years, including a 9 percent jump from 2005 to 2006. Coal has now surpassed gas once again as the leading fuel for electricity plants.

However, the British mines that George Orwell described 70 years ago as "like my own mental picture of hell" are much smaller than they once were. Mine production capacity declined during the '80s and '90s "dash for gas." Now Britain imports coal from Russia, Australia, Colombia, South Africa and Indonesia.

At the Mercy of Nature

Sometimes it takes an act of nature to uncover human and policy flaws. The fragile balance of coal supplies in Asia has been exposed this winter to flash floods and torrential rains in Asia's top coal-producing nation, Australia. The floods caused six big coal producers in Queensland to declare "force majeure," a contractual option that allows them to miss coal deliveries because of events outside their control. The companies include Rio Tinto, BHP Billiton and Xstrata.

At two major coal ports in Australia, about 45 ships are stacked up, waiting for deliveries from the mines. Loading delays running between 20 and 28 days. The industry is expected to take months to recover. Workers are still draining water and mud that pooled in open pits and repairing machinery and roads.

Australia's problems have contributed to a surge in Asian spot prices, meaning prices for immediate delivery, for coking coal, used for iron and steel production. They are running at three times the current contract price of $98.

South Africa, which might ordinarily have come to Asia's rescue, was wrestling with its own supply problems. The state-owned utility, Eskom, let coal reserves dwindle, and power plants simply ran out. Power outages crippled the country. Heavy rain also dampened coal piles, making it harder to burn the tiny reserves efficiently.

Rolling power outages forced the mining industry to shut down for several days. Amid this political debacle, Eskom vowed to replenish its coal stockpiles, a push that will eat into supplies available for export.

Australia's gridlock also coincides with deep cuts in coal exports by Vietnam, a key supplier to Japan and China. Vietnam will raise tariffs on coal exports to slash them by about a third this year. The goal is to keep coal at home for domestic needs. Last year, Vietnam exported 32.5 million tons of its total production of 41.2 million tons.

Vietnam's Industry Ministry has reportedly recommended to the country's prime minister a total halt in coal exports after 2015.

Prices Squeezing Asia

The consequences of tight supplies are being felt throughout the region and are not limited to developing countries.

Rising coal prices are squeezing Japan and South Korea, which depend largely on imports for energy. Hardest hit, so far, are steel companies. It takes about 1.5 tons of coking coal to make a ton of steel. Steel makers, in turn, are raising prices for carmakers and other manufacturers, who at some point will pass some of the costs on to customers.

Japan's Nippon Steel and JFE Holdings, and South Korea's Posco agreed last month to a 65 percent increase in coal prices, paying Brazilian mining giant Vale $78.90 a ton, up from $47.81. It was the industry's first major deal of the year and could set a global benchmark for material to make steel; a day after the deal was announced, Japanese Industry Minister Akira Amari announced that he was worried about the country's growth.

Japanese steel makers were also buying on the spot market last month, purchasing U.S. coking coal for the first time since 2005, according to Nihon Keizai Shimbun, a Japanese business paper. It reported that mills were paying about $350 a ton for U.S. coal, which is about three times the price of coal purchased from Australia last year.

Nippon Steel has said it plans to raise prices for steel sheet and plate by 10 to 20 percent, reflecting the higher costs of iron ore and coal. Shipbuilders have been passing higher steel costs on to their customers. And in the construction machinery industry, Shin Caterpillar Mitsubishi and Kobelco Construction Machinery raised prices across the board in January, citing higher materials costs.

Jackpot for Mining Firms

For coal mining companies, the coal crisis is a bonanza.

The price hike has revived long-neglected mines in Hokkaido, a region in northern Japan that has been producing coal for more than a century. As global coal prices have more than doubled, the Japanese mines have suddenly become competitive and they are attracting the attention of utilities and companies that use coal for power.

Hokkaido Electric Power Company this year doubled its coal order from the Hokkaido mines, from 500,000 to 1 million tons. The mines cannot produce enough coal to meet new requests.

In the United States, it is getting harder to license and borrow money to build new coal plants. But Peabody Energy's chief executive Gregory H. Boyce says foreign demand will sustain mining output. "Coal is the sustainable fuel best able to close the gap of growing demand vs. scarce and expensive alternatives," he said at a conference last month.

Khani, the FBR analyst, said that "coal use has expanded beyond steam and steel into coal-to-liquids in China and coal-to-chemicals," which he said would link coal prices to oil as well as natural gas. Given recent oil price levels, that could mean higher prices for coal too.

That could slow U.S. and worldwide economic growth and contribute to a renewed bout of stagflation. Rising commodity prices are "producing real limits on the future of economic growth in the U.K. and overseas," said Shaun Chamberlin, a specialist in energy and climate change at the Lean Economy Connection, an research institute in London. "In terms of industry, we're running out of ways of generating energy. We've jumped around from one energy source to another, and now we're running out."

All this is especially bad news for those worried about climate change. Germany, for example, is caught between its pledge to eliminate nuclear power and its pledge to slash carbon emissions. Because nuclear energy accounts for a quarter of the country's electricity needs, utilities have filed applications for permits to build two dozen coal-fired plants over the next few years.

"You reach a point where people say you have to stop burning coal," said Per Nicolai Martens, director of the Institute of Mining Engineering at the Aachen Technical University in Germany. "But when you reach that point, you are forced to ask the question of what happens when you shut it off?"

In the developing world, where growth is paramount, there is no thought of shutting off coal, especially when, on average, a person in China emits about one-sixth and an Indian less than one-tenth as many greenhouse gases as an American "Coal will continue to be king in India. There is no way out," said Kumar, of the Confederation of Indian Industries. "The other choice is asking the country to stay poor. . . . The question is, are we going to allow poverty or allow a little bit of pollution?"

Harden reported from Tokyo. Correspondents Ariana Eunjung Cha in Shanghai, Craig Timberg in Johannesburg, Shannon Smiley in Berlin, Jill Colvin in London and Rama Lakshmi in New Delhi contributed to this report.

The Oil Drum http://www.theoildrum.com/node/3755#more has some really interesting post on the Oil industry today

Drink up; tomorrow will be dry ! ... and dark .... or was that tomorrow we will die in glorious battle ... who are we fighting again ?

Fritz

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.90

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:The Oil Drought add the Coal crop failure

« Reply #2 on: 2008-03-21 01:02:52 » |

|

Quote from: Fritz on 2008-03-20 21:53:32

[Fritz] If the Oil wasn't enough, doesn't this just add another nail in the abundant energy coffin. |

[Blunderov] Sad to say I've become innnured to a continuous stream of bad news lately but the implications of this new information ( http://www.washingtonpost.com/wp-dyn/content/article/2008/03/19/AR2008031903859.html?hpid=topnews )are truly appalling in the context of climate change. Not only are we not going to reduce emissions we are going to increase them exponentially. Then, and we are alive to witness it, we will go nuclear on a massive scale.

I wonder how long we've got before the great dying begins?

|

|

|

|

|

Fritz

Archon

Gender:

Posts: 1746

Reputation: 8.84

Rate Fritz

|

|

Re:The Oil Drought

« Reply #3 on: 2008-03-23 20:35:44 » |

|

[blunderov]Then, and we are alive to witness it, we will go nuclear on a massive scale.

[Fritz] Maybe there is hope if Germany is pushing for renewable energy, or so the article suggests. My concerns remains implementation and penetration in Northern climates, as I look out at -12 C and 53 CM of snow at Easter no less; I've had to climb on the roof and dig my panels out 3 times so far. Maybe there is hope if the 'evil doers' of days gone by, are pushing green; if for maybe selfish and business reasons.

My two 30 watt panels on the roof on a bright sunny day in January get me less then 10 watts at high noon; and they are aimed to optimize for the winter sun; but they keep 3 deep cycle 100A batteries charged for emergency sump pump duty and 12v lights, when winter storms take out the power. Heat is still a wood stove when the power goes out.

Still "look'in on the bright side of life" (had to watch "Life of Brian" for Easter since the "Ten Commandments" peppered the TV selection.)

Thx

Fritz

http://ago.mobile.globeandmail.com/generated/archive/RTGAM/html/20080321/wrcover22.html

Breaking News

Friday, March 21

8:48 PM

Lessons from Germany's energy renaissance

ERIC REGULY

From Saturday's Globe and Mail

BERLIN — Solar power will cost next to nothing. The fuel – the sun – is free. The price of the photovoltaic cells used to covert sunlight into electricity will plummet.

Just give it time.

That's the theory of Ian MacLellan, the founder, vice-chairman and chief technology officer of Arise Technologies, a Canadian photovoltaic (PV) cell company. But there's one small hitch: Arise doesn't have time.

PV cells are still expensive. The solar energy market needs priming. Arise shareholders want profits. Mr. MacLellan is 51 and would like to see his company make a buck before he's a senior citizen.

Enter Germany. The ever-so-generous Germans tracked him down and made him an offer he couldn't refuse – free money, and lots of it – as long as Arise promised to build a PV factory on German soil. The German love-fest even came with flowers for Mr. MacLellan's wife, Cathy.

Today, Arise's first factory is about a month away from completion in Bischofswerda, a pretty eastern German town about 35 kilometres east of Dresden, in the state of Saxony. Covering two storeys and 100,000 square feet, the sleek grey metal building will have some 150 employees and produce enough PV cells each year to power the equivalent of 60,000 houses. The value of the annual output, based on today's prices, will be $375-million, or more than three times the company's current value on the Toronto Stock Exchange.

“I couldn't build this in Canada,” Mr. MacLellan said. “Germany is a very high-quality environment for us. I have nothing to worry about.”

Arise couldn't build the plant in Canada because the level of financial incentives, engineering and construction expertise and general awareness of the growth potential of renewable energy simply don't exist there.

Those factors are abundant in Germany and it shows: The country has become the world leader in renewable energy technology, manufacturing, sales and employment. The German map is dotted with hundreds of renewable energy companies. They make PV cells, wind turbines, solar thermal panels, biofuels and technology for biomass plants and geothermal energy.

No PV cells are made in Canada. The Canadian solar industry, lured by money and markets, is jumping across the Atlantic and landing in Germany and a few other European countries with generous incentives.

The German and Saxony governments, with a little help from the European Union, offered Arise about €50-million ($80-million) in financing. The package included a €25-million grant, which is being used to offset half the cost of building the factory and installing the three assembly lines, and €22.5-million of working credit lines and equipment loans at highly attractive rates.

The land was cheap and included a handsome, though abandoned, brick building from 1818 that began life as an army barracks, became a dance hall after the First World War and a Soviet military barracks during the Cold War.

Arise plans to restore the old pile and use it as an office and corporate retreat. “We're turning an old military base into a solar factory – how 21st Century is that?” Mr. MacLellan asked.

Germany has created 240,000 jobs in the renewable energy industry, 140,000 of them since 2001, said Matthias Machnig, State Secretary for the federal Ministry of the Environment. Renewable energy technologies already make up 4 to 5 per cent of Germany's gross domestic product; Mr. Machnig expects the figure to rise to 16 per cent by 2025.

Renewables generated 14 per cent of the country's electricity last year, significantly ahead of the 12.5-per-cent target set for 2010. “We are making a huge investment in the markets of the future,” Mr. Machnig said.

How did Germany turn green technology into a leading industry? And is the aggressive effort to attract renewable energy companies, backed by scads of taxpayers' money, a formula that should be imitated in Canada or its provinces? Mr. MacLellan thinks so. “I think Ontario is in a leading position to clone Germany,” he said.

GERMANY'S VAST renewable energy industry is a careful and deliberate blend of industrial, political and green policies. Wind power has been leading the charge. Germany is a windy country and the ubiquitous wind farms generated 7.4 per cent of Germany's electricity last year.

With onshore wind energy growth starting to level off – offshore wind probably will take off once favourable regulations are in place – the Germans are injecting the photovoltaic industry with growth hormones. “In a few years, the PV industry could be bigger than the German car industry,” said Thomas Grigoleit, senior manager for renewable energy for Invest In Germany, a government investment agency.

It should come as little surprise that Germany has become green energy's focal point. The country is a natural resources desert. It lacks oil and natural gas and its coal production, which is heavily subsidized, is falling. The country has a moratorium on nuclear energy development. Renewable energy is more than just a feel-good exercise; Germany sees it as securing its energy future in a world of disappearing fossil fuels.

There's more to it than energy security. Germany is both latching onto, and propelling, an industrial trend. It wants to do to renewables what it did to the car industry; that is, create a jobs and export juggernaut. “We are at the beginning of the third industrial revolution,” said Mr. Machnig, referring to the growth potential for renewable energy.

Germany is using its political might to ensure it benefits mightily from the green revolution. The country is Europe's biggest economy and the continent's (and the world's) biggest exporter. As the economic heavyweight, it has a lot of political influence over its neighbours, said Paul Dubois, Canada's ambassador to Germany. “This is the key country,” he said.

Nineteen of the European Union's 27 countries count Germany as their main trading partner, he noted. The figure for France is only three (Germany, Spain and Malta) and only one (Ireland) for the United Kingdom.

The upshot: If Germany builds green technology such as wind turbines and solar panels, its friendly neighbours will be sure to buy them, or so the German government believes. That translates into the things politicians and economists like – jobs, export earnings, trade surpluses, international prestige.

There's more. As Europe's most influential country, Germany can pretty much guarantee that renewable energies will be the growth machine of the future. How? By insisting on aggressive, EU-wide carbon reduction targets, care of Angela Merkel, the German Chancellor who is no doubt the greenest European leader.

In February, the EU vowed to reduce greenhouse gas emissions by 20 per cent by 2020 and said it would try to raise the target to 30 per cent. “If you take climate change seriously, we have to reduce carbon dioxide emissions by 60 to 80 per cent by 2050,” Mr. Machnig said. “This is the biggest industrial change ever. This means reducing emissions [in Germany] from 10 tonnes per capita to two to four tonnes per capita.”

Germany doesn't think the reductions are possible without a broad effort that includes renewable energy, the EU emissions trading system and, of course, a fortune in subsidies to kick-start the green technologies and guarantee them a market for many years. The main subsidy for renewable energy generation is the “feed-in tariff,” which was established in 2000 under the Renewable Energy Sources Act.

As far as subsidies go, this one is a beauty. The feed-in tariff for solar electricity is about 50 euro cents per kilowatt-hour, or almost 10 times higher than the market price for conventionally produced electricity (the subsidy for wind energy is considerably less, though still well above the market rate).

German utilities must by law buy the renewable electricity. The cost, in turn, is passed on to the consumer and is buried in his electricity bill. “The feed-in tariff has put Germany on the world [renewable energy] map,” said Mikael Nielsen, the central European vice-president of sales for Vestas, the Danish wind turbine company that makes turbine blades in Germany. “If it weren't for the tariff, you wouldn't have a market like this.”

The subsidy for all forms of green energy, largely wind, with solar just starting to come on strong, costs the government about €3.5-billion a year. The figure is expected to rise to €6-billion by 2015, and then will slowly decline. No wonder the renewable energy industry is on fire in Germany.

But Germany's lunge into renewable energy is not without its critics. The solar industry in particular is sucking up tens of billions of euros of grants and the question is whether taxpayers are getting value for money. “The construction of a solar power plant is currently an almost riskless investment,” the German newspaper Berliner Zeitung said in November.

RWI Essen, a German economic research institute, published a paper earlier this month [March] called “Germany's Solar Cell Promotion: Dark Clouds on the Horizon,” which concluded the feed-in tariff has not accomplished two of the government's most cherished goals – job creation and carbon reduction.

The subsidies for German solar energy probably rank as the highest in the world, thanks to the feed-in tariff and other subsidies. RWI estimated the total subsidies per job created in the PV industry (based on the subsidies and direct PV employment in 2006) at an astounding €205,000.

The tariff has created more demand than the German PV market can satisfy. In fact, most of the PV cells have been imported, creating jobs abroad, not in Germany (though this may change as Germany attracts manufacturers like Arise). RWI argues that billions of euros in subsidies have crowded out investment in other, perhaps more promising, technologies and has probably made the PV industry less efficient that it might otherwise be.

RWI said “the subsidized market penetration of non-competitive technologies in their early stages of development diminishes the incentives to invest in the research and development necessary to achieve competitiveness.”

Finally, RWI says the feed-in tariff “does not imply any additional emission reductions beyond those already achieved” by the EU emissions trading system. Its argument is that reductions under the cap-and-trade system would be made whether or not the feed-in tariff existed.

The indictment is dismissed by the German Environment Ministry and by the PV industry. Mr. MacLellan notes that every form of energy is subsidized to some degree and that the PV subsidies will help Arise's German factory become profitable quickly, allowing the business to pay income taxes within two years. “This is not charity,” he said.

For his part, Mr. Machnig said the subsidies will help establish an export market – three-quarters of the wind turbines made in Germany are exported, for example – as the number of technology manufacturers expands. Furthermore, he said, renewable energy can only make Germany more competitive as the price of fossil fuels rises. By 2020, renewables will provide 27 per cent of Germany's electricity production.

ARISE TECHNOLOGIES was launched in 1996 by Ian MacLellan, an amiable motormouth and Ryerson electrical engineering graduate who calls himself a “solar geek with a spread sheet.” Five years later, it formed a partnership with the University of Toronto to develop a high-efficiency “thin-film-on-silicon-wafer” solar cell.

The company, whose headquarters are in Waterloo, Ont., went public in 2003 in Toronto (it's also listed in Frankfurt) and at times came close to running out of money. Its fortunes reversed in the past couple of years as energy prices soared and Arise displayed a remarkable talent for snagging government freebies. The feds' Sustainable Technology Development Canada fund handed the company $6.4-million in 2006. The general enthusiasm for clean energy technologies allowed Arise to raise $34.5-million in a bought deal last October.

The company's biggest break came entirely by accident. In March, 2006, a German PV magazine called Photon International carried a story on Arise. Two months later, Mr. MacLellan was in Hawaii for the World Photovoltaic Conference. “A guy from Invest In Germany tracked me down,” he said. “We met and he said: ‘We're very interested in your company and we want all the best companies to build in Germany. We'll give you half the money.' ”

Invest In Germany has offices around the world (though not in Canada) and its 80 employees, most of them young, multilingual and highly educated, are considered superb salesmen and women. Its goal is to convince foreign companies to build plants and create employment in Germany and the appeal is quick, one-stop-shopping.

The team offers everything from assistance in site selection and construction engineering to German financing and incentives from the European Union. Boozing even features into the sales pitch. In the “Quality of Life” section of the promotional literature, the agency cheerily notes the country is home to “1,250 breweries with more than 5,000 different kinds of beer” (a statistic not lost on Mr. MacLellan, who loves German beer).

The agency has had particular success in attracting renewable energy companies. Some of the industry's best-known players – among them Shell Solar, EverQ, First Solar, Nanosolar and Signet Solar – have built factories in Germany and created thousands of jobs. “We work hard to find suitable companies,” said Mr. Grigoleit of Invest In Germany. “We go to conferences and trade fairs. We open up kiosks and we have offices in Chicago, Boston, Shanghai, Tokyo and other cities. What we can offer is speed of entry into the German market.”

Mr. MacLellan was impressed by Invest in Germany's efficiency. Within months of the Hawaii meeting, the financial and engineering machinery for the German plant were in place. The funding package, including the €25-million grant, was approved in December, 2006, only seven months after the Hawaii encounter. Construction of the factory started last August and the first cells will roll off the assembly by the end of April. “This is amazing,” he said. “We've gone from the first meeting to production in less than two years.”

He optimistically predicts PV cells made by Arise and other companies “will hit a wall of infinite demand” and he's evidently not alone. At last count about 55 solar companies had set up in Germany. The majority are in the former East Germany, where the incentives are fatter because the employment rate is lower than in the industrialized western half of the country.

There are a similar number of wind energy companies. More of both are coming. The German government's “GreenTech” environmental technology atlas, which describes the technologies and lists companies that develop and build them, runs 500 pages.

In July, a Quebec company called 5N Plus will open a plant in Eisenhuttenstadt, a town on the German-Polish border southeast of Berlin. The plant, its first foreign operation , will employ 45 and make high-purity metals for thin-film PV panels. Jacques L'Ecuyer, the CEO, said he built there because of the incentives – Germany provided about one-third of the plant's €9.5-million cost – and because he wanted guaranteed access to the European market. “If we have a presence in Germany, it will be easier for us to do business in Germany and in Europe,” he said.

CANADA SEEMS to have taken notice of the German example. Make that parts of Canada.

The West is still obsessed with oil. Quebec has few incentives for wind and solar power, probably because it has so much cheap (and renewable) hydro power, Mr. L'Ecuyer said.

But Ontario, battered by manufacturing job losses and the high dollar, has made renewable energy part of its industrial salvation plane. The province now has its own feed-in tariff for renewable energy and recently announced a five-year $1.15-billion program, called the Next Generation of Jobs Fund, to help finance everything from “green” auto research to pharmaceuticals manufacturing. Arise may tap into the jobs fund to expand in the Waterloo area, where it is building a plant to refine silicon for PV cells.

Ontario's new incentives, Mr. MacLellan said, “are not as attractive as Germany's but they're getting close.” With Germany still on top, Arise is already making plans to add a second, and possibly third, PV factory, in Bischofswerda, next to the one opening in April. Arise has more than enough available land and the town, one of eastern Germany's Cold War victims, would welcome the jobs.

More foreign companies are bound to rush to Germany while the financial goodies last. Mr. Grigoleit said Invest In Germany is targeting other Canadian renewable energy companies. He won't say how close they are snagging them but seems confident they will be unable to resist what he calls the “magnet” effect.

Even if Canada decides it wants a renewable energy industry of its own, it will face formidable competition from Germany.

http://www.arisetech.com/

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Archon

Gender:

Posts: 1746

Reputation: 8.84

Rate Fritz

|

|

Re:The Oil Drought

« Reply #4 on: 2008-04-01 13:35:23 » |

|

I noticed the story first in a February issue of the Economist I was leafing through in the reading room. I then starting asking around and in general there was little knowledge of the find; so I starting snooping the net and yanked this together. Seems worth watching to see how it will unfold. It has that ENRONesque smell and feel to it to me or, the corporate kids are just behaving as usual.

Fritz

PS: thanks, as usual to all the great posts in the other threads !!

http://www.reuters.com/article/rbssEnergyNews/idUSN2040718320080221

MACAE, Brazil, Feb 20 (Reuters) - Equipment stolen from Brazil's state-run energy giant Petrobras (PETR4.SA: Quote, Profile, Research) (PBR.N: Quote, Profile, Research) could contain data of a major natural gas deposit struck by the company in January, a police source said on Wednesday.

Petrobras confirmed last week that four laptops and two RAM memory chips were stolen in late January from a transport container owned by the U.S. oil-field service company Halliburton (HAL.N: Quote, Profile, Research), a Petrobras business partner.

The equipment came from a drilling ship that had drilled the Jupiter field of natural gas and condensates in the offshore Santos basin, the source said.

Drilling ship NS-21, known as Ocean Clipper, is one of two in Brazil capable of drilling the subsalt cluster deep under the ocean floor, where both Jupiter and giant Tupi oil field are located, said another source close to the investigation.

Jupiter field is expected to help Brazil achieve self-sufficiency in natural gas within a few years and give it a better negotiating position in talks with Bolivia on gas prices.

The area Jupiter field covers is similar to Tupi, which has light oil and gas recoverable reserves estimated by Petrobras at between 5 billion and 8 billion barrels.

Petrobras has not specified the nature of the stolen data.

Halliburton has declined to comment on the case.

Federal police questioned about 20 people who had been in contact with the stolen equipment. In Macae, a main center for Brazil's oil industry, three Petrobras security workers, three Halliburton employees and one worker from transport company Transmagno were interviewed on Wednesday.

Police said they were treating the theft as a case of industrial espionage.

This was not the first case of data robbery from Petrobras. The company reported similar cases to police about a year ago but said they did not involve important information. (Reporting by Mauricio Savarese, Writing by Inae Riveras; Editing by Gary Hill)

http://www.upstreamonline.com/live/article149027.ece

Petrobras data theft 'industrial espionage'

By Upstream staff

Brazilian police said today they were treating the theft of strategic data from state-run energy giant Petrobras as a case of industrial espionage.

Petrobras confirmed last week that four laptops and two RAM memory chips were stolen in late January from a transport container owned by the US oilfield service company Halliburton, a longtime Petrobras business partner.

The data came from a drillship in the Santos basin, which hosts the massive Tupi sub-salt find, a discovery which could catapault Brazil into the ranks of teh world's major oil producers.

"There was in the container office equipment and laptops. They didn't take all the equipment, which leads us to think it was not a common crime," Reuters quoted federal police superintendent Valdinho Jacinto Caetano telling a news conference today.

"Whoever was looking for hard drives was not carrying out a common crime. There was a specific interest in a definite subject."

Caetano confirmed it was not the first case of data robbery from Petrobras. The company reported similar cases to police about a year ago but said they did not involve important information.

He faulted the security system in place for the theft.

"There's no doubt the security system for this material was weak, a lot of people had access. It was inadequate for important information," he said.

Petrobras, headed by Jose Sergio Gabrielli, has not specified the exact nature of the data that was stolen. Halliburton has declined to comment on the case.

The investigation would determine if the fault lay with Petrobras or with Halliburton and transport company Transmagno, Caetano said.

Police had questioned nine people and would talk to 15 more. In Macae, police sources told the news agency that they were interviewing a Halliburton employee and two Transmagno workers.

19 February 2008 18:17 GMT

http://goliath.ecnext.com/coms2/gi_0199-240538/Halliburton-Petrobras-Settle-Dispute-on.html#abstract

Publication: The Oil Daily

Publication Date: 20-APR-04

Format: Online - approximately 545 words

Delivery: Immediate Online Access

Author:

Company: Halliburton Co.

Article Excerpt

WASHINGTON -- Halliburton and Brazil's state-owned giant Petrobras have reached a preliminary agreement to resolve an ongoing legal battle over development of the huge deepwater Barracuda-Caratinga project, both companies announced Monday.

As a result, Halliburton will take a charge against earnings of approximately $62 million, or 14cents per share, in the first quarter for its participation in the $2.5 billion project to develop a production complex in Brazil's oil-rich Campos Basin.

"The additional charges follow a thorough review of the project indicating higher cost...

http://findarticles.com/p/articles/mi_qn4158/is_20070814/ai_n19468348

Halliburton signs deal with Petrobras

Independent, The (London), Aug 14, 2007

Halliburton, the world's second-largest oil services company, has signed a four-year deal worth more than $270m ([pound]134m) with Brazil's state oil company Petrobras. Halliburton said it will work with Expro International to provide exploration and development testing services throughout Brazil.

-------------------------------------------------------------------

http://www.bloomberg.com/apps/news?pid=20601086&sid=aiLH0d1qHJfE&refer=latin_america

Petrobras Makes Oil Discovery Off Brazil Coast, Estado Reports

By Guillermo Parra-Bernal

March 29 (Bloomberg) -- Petroleo Brasileiro SA, also known as Petrobras, found oil and natural gas off the coast of Brazil, Estado de S. Paulo reported, citing unidentified people.

The BM-S-8 offshore basin is south of the Tupi field, which may hold 8 billion barrels of oil, the Brazilian newspaper said. A Petrobras spokesman who declined to be identified declined to comment on the story, Estado reported.

Miriam Guaraciaba, a spokeswoman for Petrobras in Rio de Janeiro, didn't immediately return calls to her office and mobile phones outside of business hours.

Petrobras, Royal Dutch Shell Plc and Portugal's Galp Energia SGPS SA are searching together for oil in the Santos Basin region, off the coast of Brazil's Sao Paulo and Rio de Janeiro states, Estado said.

To contact the reporter on this story: Guillermo Parra-Bernal in Sao Paulo at at gparra@bloomberg.net

Last Updated: March 29, 2008 14:13 EDT

http://www.bloomberg.com/apps/quote?ticker=PETR4%3ABS

-------------------------------------------------------------------

http://news.bbc.co.uk/2/hi/business/7086264.stm

Brazil announces new oil reserves

By Gary Duffy

BBC News, Sao Paulo

The Brazilian government says huge new oil reserves discovered off its coast could turn the country into one of the biggest oil producers in the world.

Petrobras, Brazil's national oil company, says it believes the offshore Tupi field has between 5bn and 8bn barrels of recoverable light oil.

A senior minister said Brazilian oil production had the potential to match that of Venezuela and Saudi Arabia.

Petrobras delivered its estimate after analysing test results.

'New reality'

The state-controlled company says the results show high productivity for gas and light oil - the best quality oil - which is more valuable and cheaper to refine.

Petrobras says the find has the potential to move Brazil into a position where it is one of the top ten oil reserves in the world.

Brazil currently has proven oil reserves of 14 billion barrels, over half of which have been discovered in the past five years.

The news, which led to a sharp rise in company shares, was also given an enthusiastic welcome by the government.

The senior minister in charge of the cabinet, Dilma Rousseff, said if the deposits turned out to be as significant as first thought, it would place Brazil in the same league as Venezuela and countries in the Arab world.

With a reserve like this, the country could be transformed into an exporter of petroleum, she said.

"This has changed our reality," she said.

Most of Brazil's oil is heavy and found at great depth but even so its reserves have almost doubled in the last ten years, as has output.

Some analysts say this latest find raises the interesting scenario of offering a new source of supply to the United States, reducing its dependence on Venezuela, a country with which it has such a fraught relationship.

With the Tupi field potentially equal to 40% of all oil ever discovered here, it seems by any standards a significant moment for Brazil.

"If the best-case scenario happens, this discovery would make Petrobras' reserves overcome those of Shell and Chevron," said Felipe Cunha, an analyst with brokers Brascan.

Petrobras controls 65% of the firm which has the exclusive licence to explore and extract oil from the Tupi field in the Santos basin, about 180 miles south of Rio de Janeiro.

British firm BG and Portugal's Galp Energia hold minority stakes in the business.

Reserves have also been found in the more northerly Campos and Espirito Santo basins.

-------------------------------------------------------------------------

http://www.halliburton.com/public/ss/contents/Case_Histories/web/07-SS1-123%20Petrobras%20SIA.pdf

A S P E R R Y D R I L L I N G S E R V I C E S S U C C E S S S T O R Y

Several years ago, state-run Petróleo Brasileiro SA

(Petrobras) discovered the massive Mexilhão gas/

condensate field in the Santos Basin off the coast of Sao

Paulo, at a water depth of roughly 500 meters. According

to Petrobras, the field, which has proven reserves of

approximately 72 billion cubic meters of gas, is scheduled

to begin production during 2008. In coming years,

Mexilhão production will help offset rapidly growing

demand for natural gas among industrial and household

consumers in Brazil.

Solving The Vibration Challenge

Development drilling in the Mexilhão field began in

2005. Due to hard sandstone formations, however, initial

drilling activities were adversely affected by high downhole

vibration, causing repeated failures in directional drilling

and MWD/LWD tools. As a result, Petrobras experienced

considerable nonproductive time (NPT) in rig operations,

which proved very costly. After a string of failures by

another drilling contractor, Petrobras called Halliburton’s

Sperry Drilling Services to ask if they could finish the last

section of the well.

-------------------------------------------------------------------------

http://www.ogs.com.sg/referencelist.html

FPSO P43 Barracuda

– Halliburton Petrobras E&I Commissioning Assistance Yetagun Premier Oil E&I Engineering designer FPSO Brasil Petrobras

– Single Buoy Moorings Inc E&I Commissioning Assistance for Topside Modules FPSO Falcon Petrobras

– – Single Buoy Moorings Inc E&I Commissioning Assistance for Topside Modules

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Hermit

Archon

Posts: 4287

Reputation: 8.94

Rate Hermit

Prime example of a practically perfect person

|

|

Re:The Oil Drought

« Reply #5 on: 2008-04-02 01:29:27 » |

|

Much chicanery indeed. And much nonsense.

This is definitely mixed news

We do know where there is a lot of oil at great depths, this only tells us about some potentially nice oil owned by Brazil. Possibly somewhat good for them and less so for the planet. Only possibly good because, as the Brazilians are discovering, extracting oil from deep bores, especially far from shore, is rapaciously expensive. Not only expensive in dollars, but expensive in energy and of course that energy comes mainly in the form of oil. Which is why this is a near perfect example of the consequences of the inexorable law of diminishing returns. The reason it is bad for the planet is that the vast amounts of oil expended in the acquisition process also have emissions. and the total emissions per barrel are on a steeply rising curve. And to borrow a line from Al Gore, you would need to be a flat earther to think that this might be a good thing.

On a technical note, it is not at all unusual to see 3 different companies and often 3 different rigs to drill a bore, even on dry land, as the nature and methods of the three phases are very different and most drilling companies specialize in one or another. The last bit of drilling and the bore development is also the most risky, even on dry land. Never mind at insane depths where all that can venture is a robot or bathysphere. I don't even want to think about the issues of attempting to manage a safety manifold at such extreme depths.

Kind Regards

Hermit

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Fritz

Archon

Gender:

Posts: 1746

Reputation: 8.84

Rate Fritz

|

|

Re:The Oil Drought

« Reply #6 on: 2013-04-13 21:21:34 » |

|

Look back and were we are.

Cheers

Fritz

The Death of Peak Oil ?

Source: The Oil Drum

Author: Gail the Actuary

Date: 2013.04.07

This is a guest post by James Hamilton, Professor of Economics at the University of California, San Diego. This post originally appeared on the Econbrowser blog here.

"Peak oil is dead," Rob Wile declared last week. Colin Sullivan says it has "gone the way of the Flat Earth Society", writing

Those behind the theory appear to have been dead wrong, at least in terms of when the peak would hit, having not anticipated the rapid shift in technology that led to exploding oil and natural gas production in new plays and areas long since dismissed as dried up.

These comments inspired me to revisit some of the predictions made in 2005 that received a lot of attention at the time, and take a look at what's actually happened since then.

Here's how Boone Pickens saw the world in a speech given May 3, 2005:

"Let me tell you some facts the way I see it," he began. "Global oil (production) is 84 million barrels (a day). I don't believe you can get it any more than 84 million barrels. I don't care what (Saudi Crown Prince) Abdullah, (Russian Premier Vladimir) Putin or anybody else says about oil reserves or production. I think they are on decline in the biggest oil fields in the world today and I know what's it like once you turn the corner and start declining, it's a tread mill that you just can't keep up with....

"Don't let the day-to-day NYMEX (New York Mercantile Exchange) fool you, because it can turn and go the other direction. I may be wrong. Some of the experts say we'll be down to $35 oil by the end of the year. I think it'll be $60 oil by the end of the year. You're going to see $3 gasoline twelve months from today, or some time during that period."

But others, like Daniel Yergin, chairman of Cambridge Energy Research Associates, were not as concerned. Yergin wrote on July 31, 2005:

Prices around $60 a barrel, driven by high demand growth, are fueling the fear of imminent shortage-- that the world is going to begin running out of oil in five or 10 years. This shortage, it is argued, will be amplified by the substantial and growing demand from two giants: China and India.

Yet this fear is not borne out by the fundamentals of supply. Our new, field-by-field analysis of production capacity, led by my colleagues Peter Jackson and Robert Esser, is quite at odds with the current view and leads to a strikingly different conclusion: There will be a large, unprecedented buildup of oil supply in the next few years. Between 2004 and 2010, capacity to produce oil (not actual production) could grow by 16 million barrels a day-- from 85 million barrels per day to 101 million barrels a day-- a 20 percent increase. Such growth over the next few years would relieve the current pressure on supply and demand.

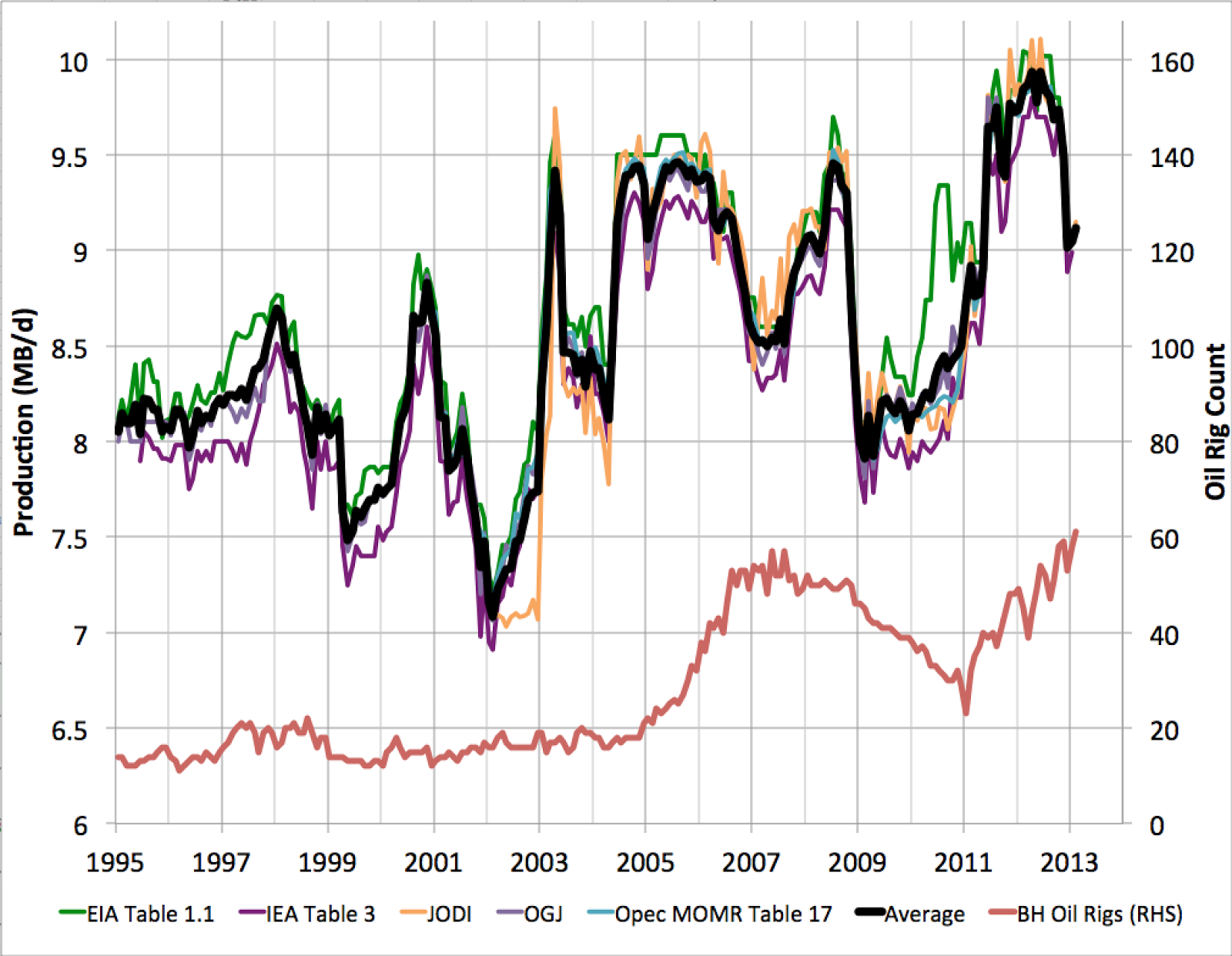

Let's start by taking a look at what happened to global oil production in the years since those two very different views were offered. Total world liquids production as reported by the EIA had reached 85.2 million barrels a day at the time Pickens issued his pronouncement. It briefly passed that level again in June 2006 and June 2008, though mostly was flat or down over 2005-2009 before resuming a modest and erratic climb since then. The most recent number (December 2012) was 89.3 million barrels a day, 4 mb/d higher than where it had been in May 2005, and 12 mb/d below the levels that Yergin had expected we'd be capable of by 2010.

Figure 1. Global liquids production, monthly, Jan 2000 - Dec 2012, in millions of barrels per day. Includes field production of crude oil, crude condensate, natural gas plant liquids, refinery process gain, and other liquids such as biofuels. Vertical line marks May 2005. Data source: EIA

But more than half of that 4 mb/d increase has come in the form of natural gas liquids-- which can't be used to make gasoline for your car-- and biofuels-- which require a significant energy input themselves to produce. If you look at just field production and lease condensate, the increase since May 2005 has only been 1.7 mb/d.

Figure 2. Global production of crude oil (including lease condensate), monthly, Jan 2000 - Dec 2012, in millions of barrels per day. Excludes natural gas plant liquids, refinery process gain, and other liquids such as biofuels. Vertical line marks May 2005. Data source: EIA

Gasoline in the United States reached $3.00 a gallon in July 2006, just as Pickens had predicted it would. Today we'd consider that cheap.

Figure 3. Average U.S. retail gasoline price, all grades and formulations, Jan 2000 - Dec 2012, in dollars per gallon. Vertical line marks May 2005. Data source: EIA

Crude oil only took two months after Pickens' prediction to reach $60/barrel. Brent is almost twice that today.

Figure 4. Price of Brent crude oil, Jan 2000 - Dec 2012, in dollars per barrel. Vertical line marks May 2005.

Data source: EIA

Knowing all the facts today, of the assessments offered in 2005 by Pickens and Yergin, which one would an objective observer characterize as having been closer to the truth? How could anyone come away with the conclusion that those who saw the world as Pickens did were "dead wrong"?

The rush to judgment seems to be based on the remarkable recent success from using horizontal fracturing to extract oil from tighter rock formations. Here for example is a graph of production from the state of Texas, one of the areas experiencing the most dramatic growth in tight oil production. In 2012, Texas produced almost 2 million barrels each day, up 800,000 barrels a day from 2010.

Figure 5. Top panel: Texas field production of crude oil, annual, 1946-2012, in millions of barrels per day, from Hamilton (2012) and EIA. Bottom panel: Price of West Texas Intermediate crude oil in 2012 dollars, calculated as average nominal price over year (from FRED) divided by ratio of end-of-year seasonally unadjusted CPI to Dec 2012 CPI (from FRED).

But Texas production in 2012 was still 1.4 mb/d below the state's peak production in 1970, and I haven't heard anyone suggest that Texas is ever going to get close again to 1970 levels. Production from any individual tight-formation well in Texas has been observed to fall very rapidly over time, as has also been the experience everywhere else.

Figure 6. Type decline curve for Eagle Ford liquids production. Source: Hughes (2013).

Total U.S. production-- including Texas, offshore, and every other state-- is up 1 mb/d since 2012. But interestingly, that's almost the magnitude by which Saudi production (which accounted for 13% of the 2012 total in Figure 2 above) has recently declined.

Figure 7. Alternative estimates of Saudi daily oil production (mb/d, left scale) and Saudi oil rig count (right scale). Source: Stuart Staniford.

Stuart Staniford speculates that the recent Saudi cutback may have been a deliberate response to U.S. production gains in an effort to prevent oil prices from declining. On the other hand, his graph shows that Saudi effort (as measured by active drilling rigs) has ramped up significantly in the last two years.

Perhaps it's the case that Saudi Arabia isn't willing to maintain its previous production levels, or perhaps it's the case that Saudi Arabia isn't able to maintain its previous production levels. But whatever the explanation, this much I'm sure about: those who assured us that Saudi production was going to continue to increase from its levels in 2005 are the ones who so far have proved to be dead wrong.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

|